[ad_1]

Another profit warning! This time, Ferguson, the supplier of plumbing and heating equipment FTSE 100.

Ferguson warned shareholders that market conditions have deteriorated recently, which has had a negative impact on earnings. The benefits will be at the lowest of expectations.

It is now expecting organic growth in its turnover to slow down between 3 and 5 percent, up from 6.8 percent in the last six months.

Ferguson operates in the United States, the United Kingdom and Canada, so it is a good indicator of the economic prospects in these countries ….

Stocks fell nearly 9% this morning, bottom of the FTSE 100 rankings.

The online grocery chain Ocado is overcoming gloom.

Ocado shares jumped 4% after announcing a new international partnership – this time with Australia's Coles.

The agreement will allow Coles to access Ocado's technology platform for grocery delivery. The British company will build and maintain automated warehouses in Australia. It's a big boost for Ocado, just weeks after his warehouse in Hampshire suffered a huge fire.

With little good news this morning, it is not surprising that European stock markets are stable early in the session.

The UK, the FTSE 100, the German DAX and the French CAC are both frightened are investors who question the health of the economy of the euro area.

Photography: Refinitiv

Photography: Jeon Heon-Kyun / EPA

The South Korean tech company Samsung has surprised traders overnight with a warning on its profits, due to lower prices of memory chips.

The world's largest smartphone vendor has warned that it will market its estimates for the first quarter of this year due to falling prices for LCDs and semiconductors.

In a regulatory filing, it revealed:

"The company expects the magnitude of the lower prices of major RAM components to be greater than expected."

The price of chips has been affected by lower than expected sales of new phones such as the iPhone X and by the general economic downturn.

Samsung's earnings warning could therefore be a significant sign that Big Tech is going through a difficult period.

Christophe Barraud?

(@C_Barraud)Warning The profit warning Samsung is the inverse yield curve of Tech – Bloomberg

* A slowdown caused by excess inventories and weakened demand, whose signs were evident in August, could last longer than expected.

* Link: https://t.co/hIzajrOcps pic.twitter.com/IdJphycdPq

The confidence of French manufacturers also decreases

Photography: Kenzo Tribouillard / AFP / Getty Images

Darker gloom of the euro zone! The confidence of French manufacturers has fallen to its lowest level in nearly two and a half years.

The INSEE statistics agency has just reported that its index of monthly industrial confidence fell to 102 points this month, against 103 in February. This is the lowest reading since November 2016.

This is another sign that manufacturers are in the doldrums. More encouragingly, services sector companies are more positive, pushing INSEE to take a broader measure of private sector confidence, from 103 to 104.

Reuters think French companies are dispelling their worries about the "yellow vest":

Business confidence plummeted in December as a result of a series of protests over the high cost of living turned violent, triggering one of the worst riots and vandalism of decades during the peak shopping period before the holidays.

While confidence in the dominant services sector was stable in March, it rebounded in the wholesale trade and remained unchanged in the retail trade.

German consumer confidence falls

Photography: Arnd Wiegmann / Reuters

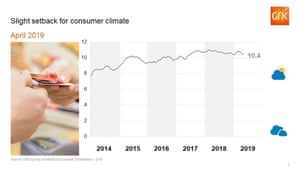

Newsflash: German consumer confidence has taken a hit, adding further to worries that the economy in the Eurozone is in trouble.

The GfK market research group said morale had deteriorated this month as Germans said they were less likely to buy new products.

The survey of about 2,000 Germans showed that the revenue forecast had dropped slightly and that the propensity to buy had hit its lowest level since December 2016.

This resulted in GfK's consumer confidence index at 10.4, below expectations of 10.8 and down from 10.7 a month ago. This will add to the fear that the global economy will run out of steam.

German consumer confidence Photo: GfK

The German economy struggling for several months, its exporters being caught in the trade dispute between America and China and the EU.

GfK researcher Rolf Buerkl explains:

Although consumers certainly do not believe that Germany will fall into recession this year, they are seeing a net slowdown in economic activity.

Buerkl also fears Brexit scares German consumers … and continues to weigh on the economy:

The lack of determination about the nature and timing of the UK's exit from the EU, as well as the growing trade dispute between the EU and the US is creating more and more uncertainty for consumers. Barriers to trade, such as increased tariffs, are creating a burden on German exports.

Introduction: markets always nervous

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

Global stock markets continue to fear heading towards a recession.

After two days of defeat, the city feels a little more nervous today. The actions could grow higher, but there is not much momentum behind any gathering.

DailyFX Team Live

(@ DailyFXTeam)European opening of IG calls:#FTSE 7193 + 0.22%#DAX 11371 + 0.21%#CAC 5269 + 0,15%#MIB 21096 + 0.17%#IBEX 9181 + 0.01%

Asian markets are also rather mixed – the Chinese market Shanghai composite lost 1.5% today, while Japan Nikkei rebounded after the rout of Monday (-3%) with a gain of 2%.

With the slowdown in the euro zone, China is struggling to conclude a trade deal with the United States and the United Kingdom mired in an endless mess about Brexit, investors have little to do.

And the steady decline in government bond yields (as nervous traders push up bond prices) is fueling tensions.

After an influx of money into US Treasury securities, longer-term US debt now offers a lower return than short-term bonds. This suggests that markets expect a marked slowdown or even a recession.

David Madden of CMC Markets said:

Investors are aware that the US economy is in poor health and growth is expected to run out in 2019, but they also do not want to ignore fluctuations in the inversion of the yield curve as it was a reliable indicator of the recession.

ACEMAXX ANALYTICS

(@Acemaxx)Equity and credit investors should rightly be worried. The yield curve in US dollars, measured by the difference between a $ 3 million and a 10-year bill, became negative or reversed for the first time since 2007, chart @michaellachlan @FT https://t.co/DXSd1oKF9X pic.twitter.com/q15m5oJIpV

On the business side, city traders will have drinks in mind as a tonic maker Fever-Tree and brewer Irn-Bru AG Barr report financial results, with United Utilities and evening wear Moss Bros.

We will also have a health check of the US economy, with new data on consumer confidence and housing prices. Do Americans feel more dangerous than their German friends?

L & # 39; s calendar

- 7:45 GMT: French GDP for the 4th quarter of 2018 (final estimate)

- 13:00 GMT: S & P / Case-Shiller index of real estate prices in the United States for January

- 14:00 GMT: US consumer confidence data for March

Update

[ad_2]

Source link