[ad_1]

It does not sound good ….

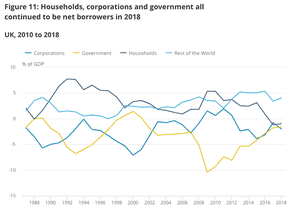

In 2016, households financed their loans through long-term borrowings and disinvestment in mutual funds. More recently, households have sharply reduced the deposits of UK banks, while the net acquisition of long-term loans and disinvestment in mutual funds have continued throughout this period to help finance household net borrowing. .

Economist Rupert Seggins shows how British households moved from net savers to net borrowers after the Brexit vote of 2016 (when the pound sterling started to push up inflation).

Rupert Seggins

(@Rupert_Seggins)The household sector has been a net borrower for just over two years, which is unprecedented since the start of the record highs in 1987. It is also unprecedented that, over the same period, every UK sector has been a net borrower ( give or take a quarter for financial companies). ). pic.twitter.com/vYNJDw9oF4

UK households are net borrowers for ninth consecutive quarter "unprecedented"

Another sign of increasing economic stress is that British households and businesses have more than they have earned in the last three months of 2018.

The UK government was also a net borrower in the fourth quarter, says the ONS.

This means that each domestic sector has been forced to borrow or reduce its savings to finance its expenditures and investments.

The decline in household savings is a particular concern – this suggests that more families were forced to borrow because inflation was eroding their wages.

The Office for National Statistics explains:

Households have always been a net lender. However, in recent times this has not been the case, as households are now net borrowers for the ninth consecutive quarter, an unprecedented period.

Although the first estimates may be subject to revision, the underlying downward trend clearly indicates that households have recently saved less to support their spending in the face of contraction in real incomes. Net household borrowing rose to 0.6% of GDP in the fourth quarter (from October to December) in 2018, an improvement from 1.1% in the previous quarter, under the same conditions. effect of an increase in salaries and wages.

Photography: ONS

Update

British business investment knows the longest decline since 2009

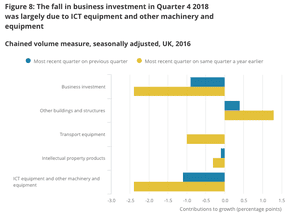

Worryingly, UK business investment fell in the fourth quarter of 2018, for the fourth consecutive quarter.

The growth report released today shows that businesses are spending 0.9% less on IT badets, such as machinery and machines. On an annual basis, business investment decreased by 2.5%.

This is the fourth consecutive quarterly decline in business investment and the first time since the economic slowdown from 2008 to 2009.

Another bad quarter for UK business investment Photo: ONS

This is a new confirmation that British bosses have been prevented from making important investment decisions, until they have more clarity about Brexit.

The Office for National Statistics states:

ICT equipment and other machinery and equipment contributed the most to the 2.5% decline in business investment between the fourth quarter of 2017 and the fourth quarter of 2018, with a decline of 2.4 percentage points.

Transportation equipment and intellectual property products also contributed negative 1.0% and 0.3% respectively. Other buildings and structures contributed the only positive contribution of 1.2 percentage points.

ONS

(@ONS)A 0.9% drop in business investment in the fourth quarter of 2018, mainly due to the decline in "ICT equipment", "other machinery and equipment" and "intellectual property products". Business investment declined each quarter of 2018 https://t.co/VkYTzBHdZ9 pic.twitter.com/1Xhbj6HpDf

Once again, Britain relies on its services sector for growth.

Services grew 0.5% in the last quarter, while production decreased 0.8% and construction fell 0.5%.

UK annual growth rate revised upwards

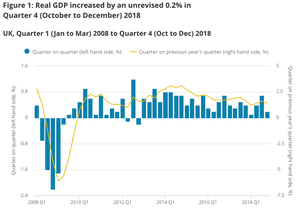

Newsflash: The UK economy grew even faster last summer than expected.

The Office of National Statistics revised its growth forecast for the third quarter of 2018 to + 0.7%, up from + 0.6%.

This is due to the "one-off effects of hot weather and the World Cup," said ONS (which both boosted consumer spending on food, beer, barbecues …)

This pushed the annual growth to 1.4%, against 1.3% previously.

However, the NSO also confirmed its previous estimate that the UK economy grew by only 0.2% in the last three months of 2018.

In the last quarter, growth was driven by the services sector, while the four subsectors of production and construction contributed negatively to GDP growth, the report said.

British GDP picture: ONS

Mike Ashley: Councilors should be jailed

Back in the UK, Sports Direct may be preparing to accept defeat in its pursuit of the Debenhams department store.

He has just announced to the City that it "takes into account" the announcement made yesterday by Debenhams' creditors of its restructuring plan.

This eliminates an obstacle to Debenhams' plan to convert £ 200 million into convertible debt.

Sports Direct had hoped to get the better of this plan with a public offer to buy Debenhams. It already holds nearly 30% of its shares and plans to pay £ 40 million for the rest.

CEO Mike Ashley does not take the imminent defeat very well, suggesting that some Debenhams advisors should do the porridge:

[RCF = Revolving Credit Facility]

Now that the results of the vote are known and that we have also subsequently learned that HSBC, which supports it, is no longer part of Debenhams RCF, I think that if there was justice in the world, the majority of counselors would be put in jail. "

A currency trader is monitoring screens in the foreign exchange trading room at KEB Hana Bank headquarters in Seoul, South Korea, on Friday, March 29. Photo: Ahn Young-joon / AP

Asian markets continued to recover, in the hope that "constructive negotiations" between the US and China would lead to a positive outcome.

Here is the shooting of the AFP:

Shanghai jumped 3.2% and Tokyo 0.8%, while Hong Kong added 1%.

Seoul and Singapore each added 0.6%, Sydney 0.1% and Wellington 0.8%. Taipei, Mumbai and Manila were also significantly higher.

"At-risk badets are currently supported, I believe, by a peaceful Fed, a stabilization of China and a better sense of geopolitical risk," said Frances Donald of Manulife Asset Management at Bloomberg. News.

"It probably gives this rally a little more juice."

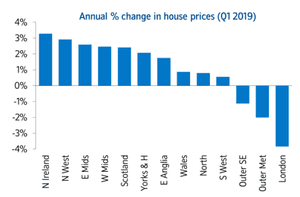

UK housing prices are down

We have new evidence today of the cooling UK real estate market.

Prices in England were down 0.7% in the last quarter compared to last year, the first decrease since 2012.

London once again led the recession, with prices down 3.8%.

UK house prices by region Photography: Nationwide

Overall, UK housing prices have increased – but only 0.7% from one year to the next, while the slowdown continues:

Rupert Seggins

(@Rupert_Seggins)UK average house price growth was 0.7% y / y in March according to Nationwide, with prices apparently falling in London and the south-east of the country. The main housing price indexes all suggest that house price growth continues to weaken. Halifax looks more and more like a strange case. pic.twitter.com/HgJNabTrm0

Here is the complete story:

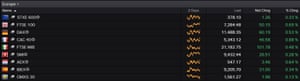

Despite TUI's profit warning, European stock markets are on the rise.

European Stock Exchanges Photo: Refinitiv

TUI shares slip after warning 737 Max profit

Newsflash: The TUI holiday agency warned that the Boeing 737 Max crisis would cost him at least 200 million euros.

In an unplanned announcement, TUI said it had been forced to lease new devices to cover its holiday trips, after the 737 Max had been grounded by aerospace regulators around the world.

It will cost the company 200 million euros, baduming 737 Max is allowed to fly in mid-July.

TUI explains:

This impact is attributable in particular to costs related to aircraft replacement, higher fuel costs, other disruption costs and the anticipated impact on trade.

But if the 737 Max flights do not resume before the end of September, the total cost could amount to 300 million euros.

This reduced his shares by 10% at the beginning of the session:

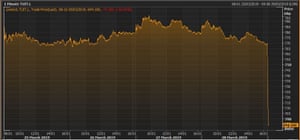

TUI Stock Photo Photo: Refinitiv

The 737 Max had been immobilized earlier this month, days after the crash of Ethiopian Airlines, which killed 157 people.

Boeing now faces claims that the aircraft's automated flight control system was defective and that its anti-stall system could have caused the crash in Ethiopia.

The Wall Street Journal reports today that:

Officials investigating the crash of a Boeing 737 MAX in Ethiopia came to the preliminary conclusion that a suspicious flight control function automatically activated before the aircraft dipped to the ground.

Update

Markets.com's Neil Wilson said Steven Mnuchin's tweet had encouraged investors at the end of the first quarter of 2019:

"The 10-year US Treasury yields are 2.39%, still down, but at historically low levels. The stock markets again show a little more optimism. Mnuchin and Lighthizer arrive in Beijing for more talks – a tweet this morning saying that talks were "constructive", Chinese Vice Premier Liu He is preparing to visit Washington next week "important" talks .

A good excuse to increase the markets on the last day of the quarter, if any.

Mining shares gather in London early in the negotiations, while the optimism sparked by the trade war melts.

Glencore, BHP Billiton, Rio Tinto and Anglo American all gained at least 2%, pushing the FTSE 100 45 points or 0.6% to 7278.

Mike van Dulken

(@Accendo_Mike)FTSE Miners + 2.5% on the optimism of trade talks in China; Copper + 1%

Here are some photos of the US delegation arriving for today's "constructive" talks:

US Treasury Secretary Steven Mnuchin (C) and his team in Beijing today. Photography: Greg Baker / AFP / Getty Images

US Trade Representative Robert Lighthizer (C) and his team Photo: Greg Baker / AFP / Getty Images

Mnuchin: The discussions were constructive

Newsflash: Treasury Secretary Mnuchin tweeted that today's negotiations were over.

He said they were "constructive" and Vice Premier Liu He will return to Washington next week for further talks.

Steven Mnuchin

(@ stevenmnuchin1).@USTradeRep and I have concluded constructive trade negotiations in Beijing. I look forward to welcoming Chinese Vice Premier Liu He for the continuation of these important discussions in Washington next week. #USEmbbadyChina pic.twitter.com/ikfcDZ10IL

Chinese stock market soars

The optimism sparked by a break in the trade war has pushed stocks up in China.

Shanghai's benchmark composite index jumped more than 3 percent, in the hope that Beijing's "unprecedented offer" to address Washington's concerns could put an end to the stalemate.

Jeroen Blokland

(@Jsblokland)Hello stocks! #Chinaof #Shanghai Composite up 3.2%! pic.twitter.com/lW8VsMZcco

David Madden of CMC Markets said:

The sentiment was generally positive after the announcement of improved trade negotiations between the United States and China. It was reported that Beijing had made "unprecedented" proposals to the US regarding technology transfers, and that this was a major step forward, as trade talks were not just about China to buy more American products.

Introduction: US-Chinese trade negotiations resume

Chinese Vice Premier Liu He (c) shakes hands with US Trade Representative Robert Lighthizer (left), while US Treasury Secretary Steven Mnuchin (right) looks at Diaoyutai Guest House. Beijing. Photo: Nicolas Asfouri / AFP / Getty Images

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

The week was turned upside down for the markets, driven by fears of a slowdown in the global economy. However, stocks are stronger at the end of the week, in the hope that Beijing and Washington can finally make progress to end their trade war.

US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin are back in the Chinese capital and hold further talks with Liu He, the largest trade negotiator in Beijing.

It's a bit of an aerial tour – just 24 hours – so we do not really know how much progress they will make.

But investors were encouraged by reports that China is making "unprecedented offers" on issues such as forced technology transfers.

The trade war between the United States and China is a major factor that has weighed on the markets for weeks, pushing nervous investors toward safe haven state bonds, so any sign of a breakthrough would be welcome.

Mnuchin raised his spirits as he left his hotel for talks, telling reporters that:

"We had a very productive working dinner last night and we can not wait to meet today."

Rob Carnell, chief economist and head of research for the Asia-Pacific region at ING Bank, told CNBC's Squawk Box this morning:

"I think that in the end, we will be rewarded with an agreement that both parties will proclaim … as a fantastic victory",

"What we have to keep in mind, is that it's a process … Whatever we withdraw from it, it's nice to say: "agree, agree, we will draw a line below this step, we must now expect all the others things that we have not sorted out".

Also coming today

At 9:30, we have a better idea of the British economy when the third estimate of the GDP of the last quarter of 2018 is published.

Economists fear that this data confirms that business investment continued to contract in the wake of Brexit. They are also likely to confirm that the economy grew only 0.2% in October-December.

L & # 39; s calendar

- 9.30 GMT: UK GDP for Q4 2018 (third estimate)

- 13:30 GMT: Canadian GDP for January

- 12:30 GMT: US personal expenditure figures

Update

[ad_2]

Source link