[ad_1]

Bitcoin Cash (BCH) is back in force.

Bitcoin certainly drove the market up, but its 20% jump is insignificant next to the gigantic progress of Bitcoin Cash, 84% better last week at $ 305.

In the same way that badysts and investors find it difficult to find a reason for the timing of the Bitcoin escape, so is the scraping of the head by the Bitcoin Cash price movement, whose the value has almost doubled since April 1.

The successful launch of the simple account book protocol for the creation of tokens on the BCH blockchain was cited as a catalyst, as well as the participation in BCH futures trading on Kraken.

Bitcoin.travel, which now also accepts BCH, in addition to just bitcoin, if you want to book a flight with crypto, was also very helpful.

But that's barely enough to explain BCH's stellar price performance. The bitcoin.travel part is particularly unconvincing, as it has also added five more crypto to its list of accepted crypto currencies – Ethereum, Litecoin, Dogecoin, Ethereum Clbadic and Dash.

Ok, if none of this is convincing enough to explain how the pump works, it may be the only mandatory upgrade roadmap that the BCH developer community has created. Bitcoin Cash is upgraded every six months. The next round of changes is due in May.

Initially, the biannual upgrade of the network upgrades seemed like a gadget or perhaps an ideological tactic to emphasize the ease of upgrading BCH, unlike the slow development observed in the community of bitcoin developers with its notoriously heavy governance.

Schnorr is welcome but not the price booster

But it is unlikely that buyers since Monday 1 April were primarily motivated by the prospect of software changes such as Schnorr's signatures arriving in the BCH blockchain, although this is the case.

Certainly, it should be noted that Schnorr is not as insignificant as some would have thought and that it is certainly another feather of the BCH that contrasts with bitcoin, where Schnorr has been much discussed but has not arrived yet .

Schnorr signatures will free up space like SegWit, but it will also include the ability to make private transaction information. While older ECDSA signatures (elliptic curve digital signature algorithm) required the sender to sign each transaction, Schnorr aggregation is possible, so that only one signature can be used by one group of collaborating senders.

Schnorr is therefore welcome, but in itself does not explain the gain of 84% either.

BCH survives the fork disaster

At the top, we said that Bitcoin Cash was back. Well, it's the return of the whole market, if it's the beginning of a new bull market.

But BCH is also back in a sense perhaps more significant.

Crypto observers will remember the imminent death of BCH in November 2018. Many will remember that date as the time when the hard fork of its blockchain triggered the market crash, pushing bitcoin to less than $ 6,000.

Bitcoin Cash, of course a bitcoin fork, has been split into ABC (now known worldwide as Bitcoin Cash and SV (BSV)). At first, there was a fight between the two to see which channel would attract the most hash power, a clear winner finally emerged.

Despite the efforts of Craig Wright and his nChain team

and the dollar muscle of billionaire Calvin Ayre, the direction of travel since

January was clear: BCHABC is the winner.

The past week has been such that, after leaving BSV empty, it is currently trading at $ 305, against $ 84 for BCH.

Admittedly, BSV still achieved a gain of 30%, a performance superior to that of Bitcoin, but it is far from the appreciation of 83% of the price of the BCH.

For those who are still interested in following these events, the number of nodes on the BSV chain is only 438 out of 821 of BCH.

So taking resolutely ahead of time on BSV is beneficial for BCH, but it was something that, as we have said, was the likely outcome since January, if not before.

Asia still in love with BCH

Then there is the angle of Asia.

Since the birth of Bitcoin Cash, deeply rooted in the internal war that erupted in the struggle for the development of bitcoin on those who advocated the upgrade of SegWit and the belief of the rival camp that radical resizing solutions were needed of any emergency. size – from where the BCH fork.

In the BCH camp, apart from Roger Ver (Bitcoin Jesus), its bitcoin.com site and its mining pool, were Chinese companies such as Bitmain that dominated the mining sector and which, it was claimed, wanted to succeed. BCH at the expense of Bitcoin.

Less political observers have argued that the more advanced mobile payments ecosystem in Asia is driving the creation of BCH. American consumers were lagging behind, still in the habit of handing their cards to a merchant.

For cryptography enthusiasts in high tech countries such as South Korea, the question of scale was more urgent at the time.

The fact that the Bitcoin rally started when the Asian market was awake is significant because Bitcoin Cash has long been one of the favorites. We do not know the finger behind the three transactions of 7,000 algo BTC, but our argument does not matter, although the timing is Asian.

As bitcoin bounced, BCH fans took the opportunity to celebrate and put their winnings, yen and maybe Yuan (or BTC) in their place, helping to propel BCH to fifth place. ranking position to market capitalization.

Excluding Tether and BTC, the Korean won and the Japanese yen are the second and third places on the BCH market.

Small is beautiful – preference for a whole rather than for fractions

All of the above can be mentioned in the history of the BCH

last week, but it's still not enough for this author to explain the

staggering almost doubling in value.

There is something quite more prosaic about work.

In reading the interviews of the British authorities of financial conduct with consumers entering the market in the wild at 20 000 USD, one of its main conclusions is recalled to us: the ignorance of many market players.

To perfect oneself is essential in this space for reasons that we do not need to repeat here.

One of the FCA survey buyers said she did not know you could buy a fraction of bitcoin and so decided to buy parts at a lower unit price.

This trend, motivated by a purchasing psychology that indicates that it is more acceptable to buy a coin at a lower unit price, was found among new consumers who entered the previous bull market. This seems to happen again and BCH is a prime candidate.

Bitcoin Cash has a high profile because it is one of the top 10 cryptobadets and can exploit the halo effect of the Bitcoin brand name.

In conclusion, BCH's driving force may in part be influenced by one or more of the factors already mentioned, but it is the fact that it has the least possible friction for potential buyers, at a price of 167 $, priced at $ 4,150 bitcoin at takeoff.

BCH had fallen from 98% of its absolute record low, compared to the lowest 84% drop in Bitcoin, which further accentuates the risk-reward proposition.

BCH could begin its parabolic rise ahead of the others.

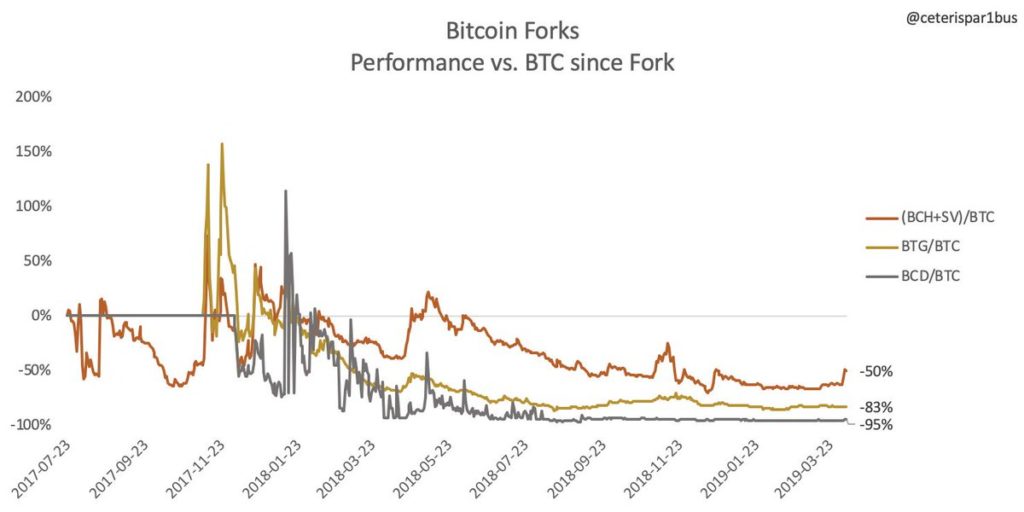

And if you think about how other bitcoin forks work, do not do it.

The argument of the BTC maximalists that there is really only one bitcoin is still valid.

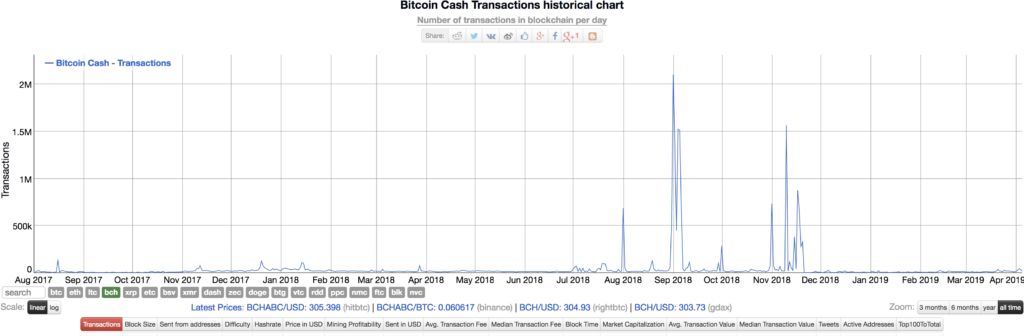

If this is not enough, the transaction table for BCH on bitinfocharts may provide some balance.

Obviously, there is not much happening on the BCH adoption front – it seems like few people buy BCH flights with bitcoin.travel. Roger Ver could of course say the same for Bitcoin.

[ad_2]

Source link