[ad_1]

Sterling Technical Analysis (GBP)

- GBPUSD – The strength of the US dollar puts pressure on 1.3000.

- EURGBP – Stuck in a range.

- GBPNZD – Go higher on the weak dollar kiwi.

Q2 Trading forecasts for a wide range of currencies and commodities, including the pound sterling, with our fundamental technical and medium-term technical perspectives.

How to combine fundamental and technical badysis.

Technical forecast for Sterling (GBP): Neutral

I remain neutral on Sterling global for the week ahead but there are other forces at play that make choosing the right pair more important than Sterling's general direction. Brexit will also be up and running again next week as MPs return from their Easter break. Expect an increase in trading margins and volatility from current low levels.

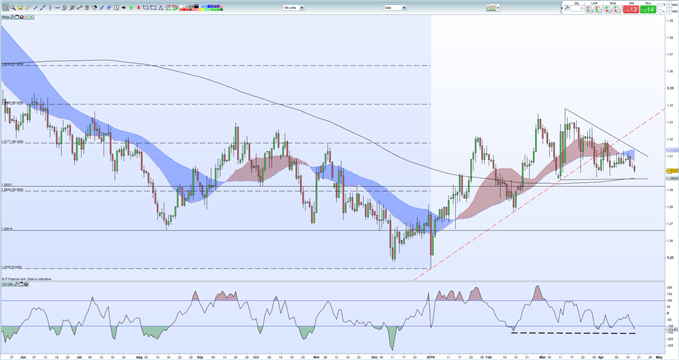

GBPUSD try to stay above 1.3000 but finds it more and more difficult in the face of the recovery of the US dollar. The 1.3000 line in the sand has actually held in recent weeks as market prices, in a mild Brexit. The decreasing wedge pattern above the March 13th peak at 1.3380 continues to dominate the floor around 1.2960, the first real level of support if 1.3000 breaks. This level also crosses the 200-day moving average, which adds credibility and support. A break and a close down here opens the way for a Fibonacci retracement to 23.6% at 1.2894. The ICC indicator at the bottom of the chart indicates that the pair may be oversold in the near term, but that the strength of the US dollar is likely to trigger short-term price action.

GBPUSD – Daily Price Table – April 18, 2019

How central banks impact the Forex market

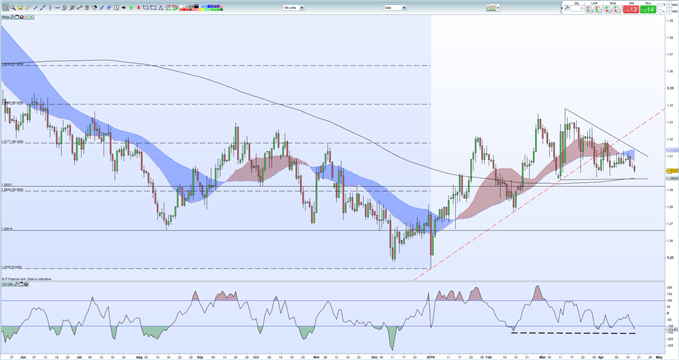

EURGBP has risen slightly over the last week, but is now overturning, while the euro is under pressure, fearing more and more that growth in the eurozone will further slow down. The Fibonacci retracement level of 23.6% at 0.8621 now serves as a support, while the next level of Fibonacci at 0.8718 is likely to be a strong resistance. The CCI indicator is emerging from the overbought territory, which may then involve the 0.8600 – 0.8610 area where the 20 and 50 day moving averages are currently located. Once again, the next movement of couples will be motivated by titles related to Brexit.

EURGBP Daily Price Table – 18 April 2019

Interest Rates and Foreign Exchange Market

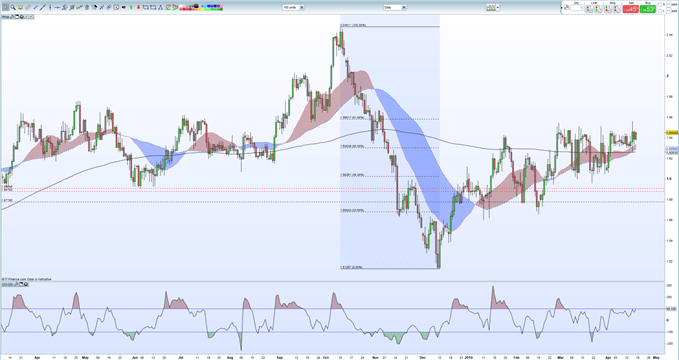

GBPNZD is currently rising and respects the 200-day moving average, while the kiwi dollar weakens. The pair hit a new high in five months on Tuesday but returned to its two-week trading range. GBPNZD is also now trading above its 20- and 50-day moving averages, which should provide initial support in the event of an economic slowdown before the 200-day maturity at 1.9260. On the upside, a break back over the top of this week leaves 61.8% Fibonacci retracement at 1.9582 the first goal. Another weakness of the Kiwi dollar could then lead to GBPNZD's attempt of 2.0000 in the medium term, the short-term rise being slowed by the overbought signal from the CCI indicator.

GBPNZD Daily Price Table – April 18, 2019

DailyFX has many resources to help traders make more informed decisions. These include a complete update Economic calendar, and a lot of updates constantly Educative and Trading Guides

— Written by Nick CawleyAnalyst

Contact Notch, E-mail him to [email protected]

Follow Nick on Twitter @nickcawley1

Other weekly technical forecast:

Crude oil forecast: 50% discount? Can the bulls continue the rally

Forecast in Australian dollars: AUD / USD and EUR / AUD could be at turning points, facing trend lines

Source link