[ad_1]

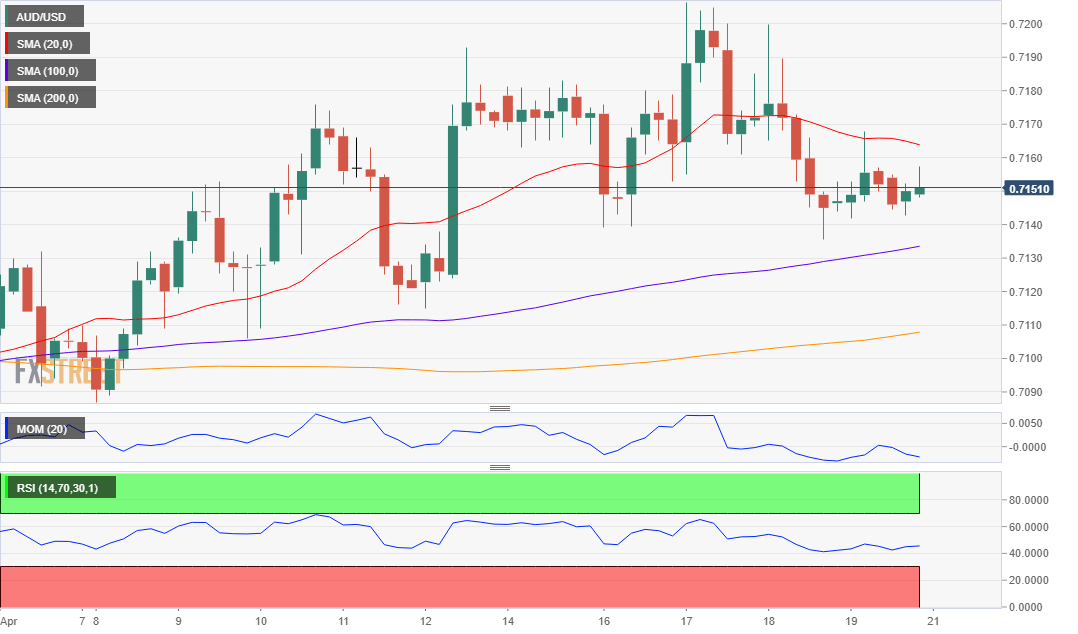

AUD / USD Current Price: 0.7151

- Australian inflation in the first quarter will come out next Wednesday.

- Slow start of the week as the Australian markets will be closed on Easter Monday.

The AUD / USD closed the week with modest losses at 0.7150, beating Thursday at a new high of one month, at 0.7250, due to the strong dollar. Although Australian employment data was better than expected, the Australian dollar pulled back due to the weak performance of Asian and European equities, and encouraging US data helped reduce fears of a possible slowdown in the world's largest economy. US stocks managed to reduce their losses on the last active day of the week, keeping the pair at normal levels. Australia is on an extended weekend and local markets will remain closed on Monday, which should result in limited market moves for the next Asian session. Relevant data will be released next Wednesday when the country unveils first quarter inflation measures.

The AUD / USD offers a neutral to positive position, as in the daily chart, it continues to trade between directionless moving averages, the 200 DMA capping the rise at around 0.7200 and the 100 DMA playing a supporting role dynamic around 0.7135. . The technical indicators have fallen back within positive levels, now consolidating themselves just above their circles, a sign that business interests remain limited. In the 4-hour chart, the pair is below its SMA of 20 while it is above the largest, with technical indicators remaining in the negative range, suggesting a possible short-term decline to the price area of 0.7100.

Support levels: 0.7135 0.7090 0.7055

Resistance levels: 0.7070 0.7205 0.7250

View live chart for AUD / USD

Source link