[ad_1]

2 hours ago | Jon Nielsen

Total market capitalization has grown modestly

The market generally moved laterally this week and continued to try to stabilize after the strong rally seen earlier this month. The total valuation was set at $ 176 billion on Monday morning and managed to stay steady until early in the evening, when the total ceiling was lowered by 2.8% to reach 171 billions of dollars. After a few fluctuations on Tuesday, the reverse movement finally took place later in the day and the market rallied from $ 171 billion to $ 177 billion, a growth of 3.5%.

The market then stabilized in the middle of the week and evolved into a $ 3 billion range until Friday when the total valuation threatened to break $ 180 billion. However, a slight downturn saw the market fluctuate again around $ 177 billion, and a recovery over the weekend saw the total cap return to nearly $ 180 billion.

After receiving $ 181 billion, a larger retracement began to take place in the last 24 hours. The total ceiling has fallen back to about $ 177 billion. The market continues to fluctuate around the same value at the end of the week.

Daily trading volume reached about $ 49 billion on Monday and fell during the week. However, a rise on Thursday saw daily volume reach $ 49 billion and trading volume again threatened to exceed $ 50 billion over the weekend. The daily volume of 24-hour transactions is currently $ 49 billion, while the total market valuation is $ 177 billion.

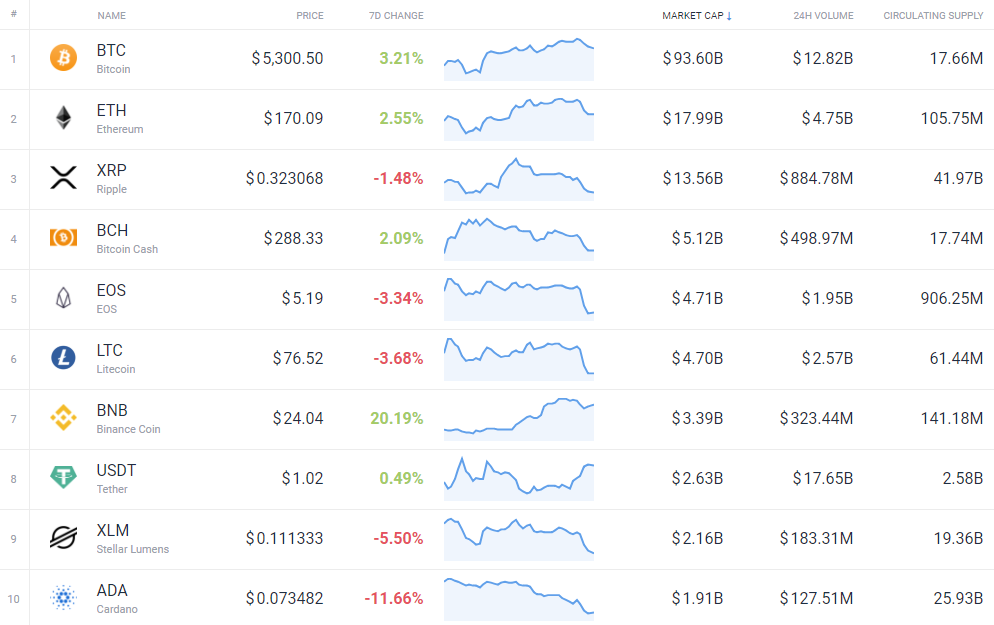

The lateral movement had mixed results on the best-selling parts, Bitcoin grew by around 3.2% and Ethereum by 2.5%. BNB was the big winner and jumped by just over 20%, while Bitcoin Cash posted modest gains of 2%. At the same time, the ADA dropped by about 12%.

BAT jumped 40% in the top 100 as support for the older version of their browser came to an end and the project continued to grow. MONA almost matched BAT's excellent performance, while DGD posted a very strong 34% increase. MCO and WTC have completed the list of the top 5 winners with respectively 25 and 20% winnings.

Bitcoin advanced to $ 5,300

Bitcoin started the week at $ 5,185 and gained value before going from $ 5,225 to $ 5,080 later in the day. This represents a decrease of 2.7% and a reverse movement occurred nearly 24 hours later. BTC climbed from $ 5,090 to $ 5,260 on Tuesday night, an improvement of 3.3%.

From that moment, Bitcoin started to stabilize and move in a range of 50 USD until Thursday, when the price reached around 5,325 USD. However, the price fell to $ 5,265 Friday morning before continuing to rise regularly this weekend, and BTC rose 2.1% to $ 5,379 Sunday morning.

Bitcoin's daily trading volume was around $ 11 billion on Monday and close to $ 13 billion on Thursday. Trading activity was sustained over the weekend and 24-hour trading volume currently stands at $ 12.8 billion, while BTC trades at $ 5,303 and retains a market capitalization of , $ 6 billion. Bitcoin also enjoys a 52.8% domination.

Ethereum has dropped to the $ 170 level

Ethereum started the week with price movements similar to those of Bitcoin and rose from 169 to 161 dollars on Monday. That's down 4.7% and the ETH picked up Tuesday from $ 163 to $ 170 early Wednesday.

However, the big move took place early Thursday and soared 4.7% from $ 168 to $ 176 later in the day. This naturally led to a decline, but the ETH managed to stay close to $ 174 until late in the weekend. However, after falling in the early hours of Sunday, the ETH rose from 175 USD to under 170 USD and the ETH continues to fluctuate around this figure at the end of the week.

The daily volume of Ethereum transactions was $ 4.25 billion Monday and exceeded $ 5 billion Thursday. The volume of 24-hour transactions is currently $ 4.7 billion, while the ETH trades at $ 170 and maintains a market capitalization of $ 18 billion.

Source link