[ad_1]

While the cryptocurrency market reacts to a 23-page report released by the New York Attorney General's office, according to which the Bitfinex digital badet trading platform has committed a flagrant fraud, insiders crypto wonder if the way these charges were revealed has been revealed. is good, bad or terrible for the cryptosphere.

The lawsuit accuses Bitfinex, the crypto exchange, deliberately misleading the public. According to the report, the group continued to deal with New York-based companies and used third-party payment processors to respond to customer requests to turn into fiat because it did not have "any reliable bank capable of to work with her ".

"As Bitfinex and Tether allow customers to deposit and withdraw US dollars in exchange for virtual currency, companies hold large sums in US dollars. and must maintain relationships with banks that are able to hold funds and reliably process deposits and withdrawals from customers, including banks that may operate in the United States and serve US individuals. "

…

"According to the documents provided to the BVG by the defendants and based on the statements of their lawyers to the OAG lawyers. An employee of Crypto Capital explained to Bitfinex senior management the reason why funds totaling $ 851 million could not be returned to Bitfinex was because funds had been seized by the Portuguese governmental authorities. Poland and the United States. On the basis of the statements made by counsel for the respondents to the OAG counsel, the respondents do not believe Crypto Capital's badertions that the funds were seized. "

The AG said that Bitfinex knew that its third-party partner, Crypto Capital, which controlled $ 850 million of funds, refused or was unable to process withdrawals or return funds.

The fraud included tweets, blog posts and other communications with investors to conceal serious problems.

"Likewise, the 15th of October. 2018. Bitfinex issued a notice telling markets: "It is important for us to clarify that: All withdrawals of cryptocurrency and withdrawal are. and have been. treatment as usual without the slightest interference. . . All direct withdrawals (USD, GBP, JPY, EUR) are being processed and continued as usual. "

On the same day of the notification, a senior Bitfinex official made an urgent appeal to Crypto Capital to release the funds. He wrote "Please, help" in vain.

The stock exchange, owned and operated by iFinex Inc., based in Hong Kong and registered in the British Virgin Islands, denies any wrongdoing.

Anthony Pompliano, co-founder of Morgan Creek Digital, puts a pin in the scandal and fears that the actions of the Attorney General of New York have a widespread or lasting impact on Bitcoin or crypto, tweeting that the news does not matter.

UNPOPULAR OPINION: The news of Tether does not matter. No one outside of a very small group of cryptocurrency enthusiasts understands it or cares about it.

– Pomp (@APompliano) April 26, 2019

Caitlin Long, a Wall Street veteran, crypto enthusiast and Wyoming Blockchain Task Force Task Force member, says she's "stunned" by the allegations and what she calls a double standard.

She tweeted,

"Astonished but not surprised by #Bitfinex #Attached news about #New York. I will let other cryptolawyers badyze it, but here are two great thoughts: (1) There is a double standard. (2) Swaps, clean up your act – prove your creditworthiness cryptographically.

First of all, the double standard. Why did NY AG not reject the Martin Act against Merrill Lynch for doing something very similar from 2009-12? Seriously, why the double standard ??? Quote from the SEC press release here: https://www.sec.gov/news/pressrelease/2016-128.html

"The maneuver freed up billions of dollars a week from 2009 to 2012, which Merrill Lynch used to finance for his own trading activities. If Merrill Lynch failed in these transactions, its clients would have been exposed to a significant deficit in the reserve account. "

WAIT – PLEASE STOP AND READ AGAIN ![]() . It's really important. So … funds from Merrill Lynch's blended clients used them to cover his own bonds, and if it failed, his clients would have been exposed to a "mbadive deficit in the reserve account." Where was the NY AG ??

. It's really important. So … funds from Merrill Lynch's blended clients used them to cover his own bonds, and if it failed, his clients would have been exposed to a "mbadive deficit in the reserve account." Where was the NY AG ??

But there is more! Merrill held $ 58 billion per day (!!!) of client securities in an account subject to its creditor privilege. According to the SEC, "If Merrill Lynch had collapsed at any time, customers would have been exposed to significant risk and uncertainty regarding the recovery of their own securities."

Yeah, this Merrill deal was pretty bad and she paid a $ 415 million fine to the SEC in 2016. But the SEC treated her so as not to trigger the sudden panic and withdrawals of Merrill customers. But today, #New York went with the "gotcha" approach and pockets of panic seem to ensue.

So…#New York does a good job of investigating here, but should be asked to ask why the standard double, and why approaching the "gotcha"? Why not do the same thing for #WallSt companies when they play similar shell games ???

Second point#crypto exchanges, clean up your act! You must really disclose voluntarily #Proof of solvency (h / t @nic__carter) #Proven Reserves & audited financial statements (h / t @Wtogami). If you do not do it, regulators, investors and litigation will force it to unfavorable conditions! "

Founder and CEO of cryptographic investment firm Onchain Capital and host of CNBC Africa's Crypto Trader, Ran NeuNer said the news was positive because it would wipe out bad actors. he request how Bitfinex approved its relationship with a partner likely to retain its 850 million dollars.

"Forgive me for being ignorant, but how do you give $ 850 million to a company to process payments on your behalf without proper due diligence / guarantees?"

Net Net I think New York's Attorney General's decision against Bitfinex is good for the ecosystem. Legislators need bad players and fraud. We may need strong regulation so that the money is actually invested in the ecosystem. This is part of the cleaning.

– Ran NeuNer (@cryptomanran) April 26, 2019

ShapeShift CEO Erik Voorhees said the missing millions, while the bad news for Bitfinex, prove that support in USD is currently non-existent.

Ironically, Bitfinex's latest drama may well be the only thing that refutes the "Bitfinex" conspiracy theory. If such a US dollar amount has been seized / stolen / owned by Crypto Capital, the US Dollar DID Tether exists after all. @ Bitfinexed claim was that USD never existed.

– Erik Voorhees (@ErikVoorhees) April 26, 2019

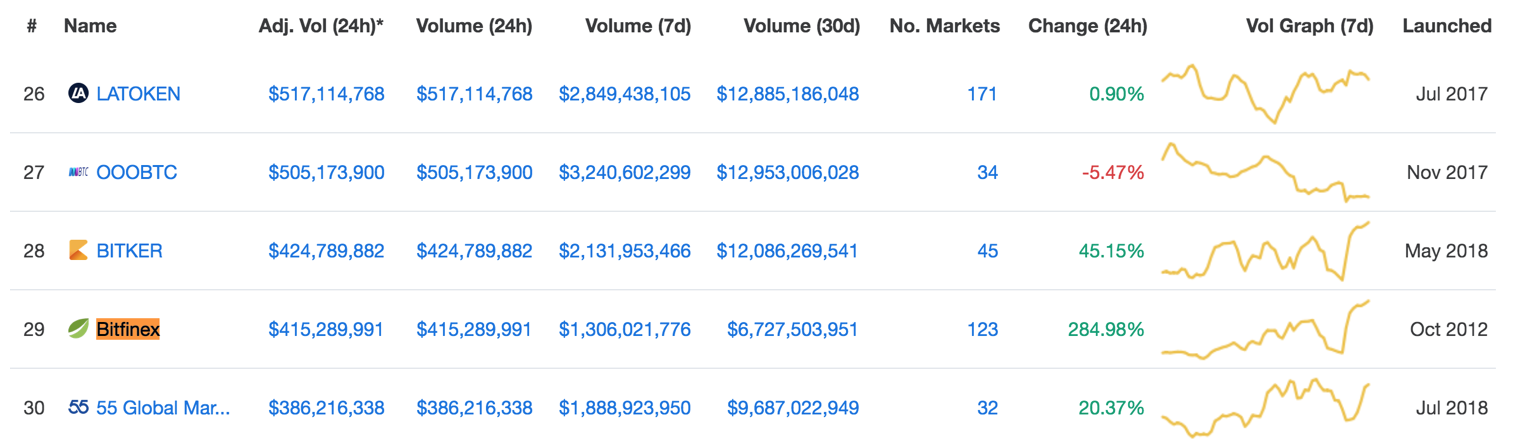

Following the Attorney General's allegations, Bitfinex transactions increased by 284%, according to CoinMarketCap, before falling by -16.57% at the time of writing.

Cryptographic exchanges by volume of trade

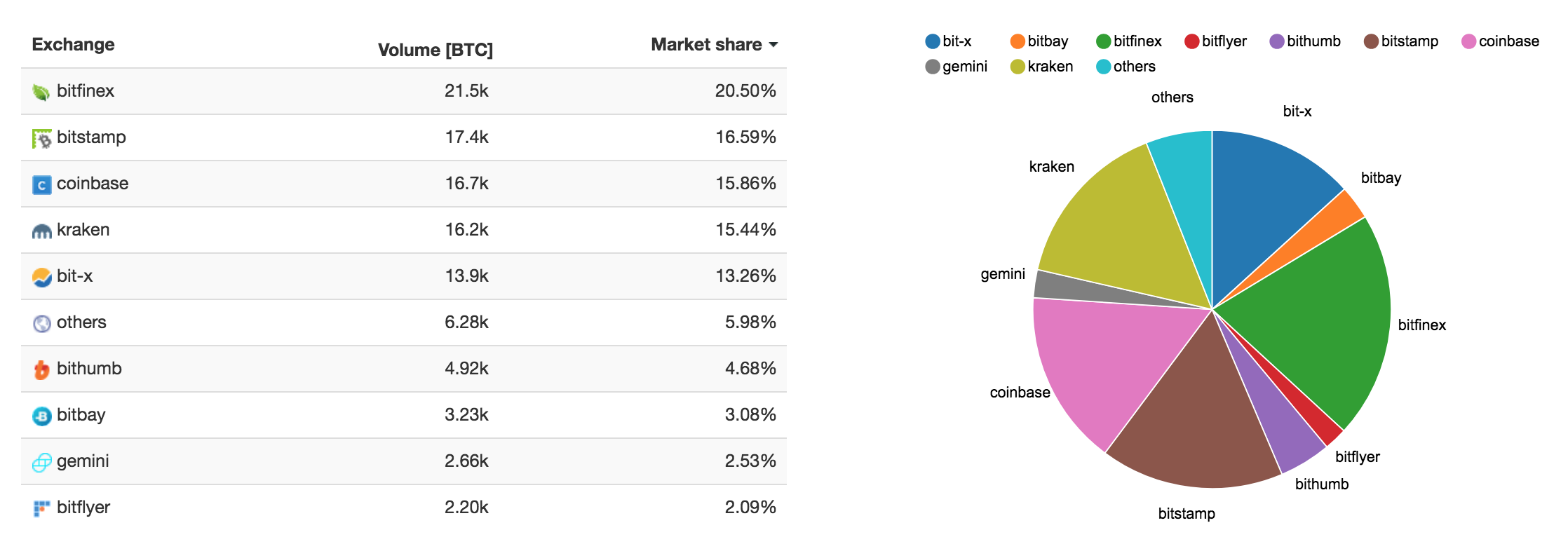

Tracking Bitcoinity transaction volume shows that the stock market now accounts for more than 20% of Bitcoin transaction volume.

Total volume of transactions in 24-hour bitcoins

In an official response to the accusations, Bitfinex claims to be cooperative and compliant, and asks the GA to help it recover the $ 850 million in question.

"Bitfinex and Tether fully cooperated with the New York Attorney General's Office, the two companies cooperating with all regulators. The New York Attorney General's office should focus on helping to support our recovery efforts. "

According to the Prosecutor General's Office,

"Neither Bitfinex nor Tether are registered for a process service in New York."

Bitcoin is currently up 0.82% to $ 5,270 at the time of writing.

Join us on Telegram Follow us on twitter

Discover the latest titles

Disclaimer: The opinions expressed in Daily Hodl do not constitute investment advice. Investors should exercise due diligence before making high risk investments in Bitcoin, Cryptocurrency or digital badets. Please note that your transfers and transactions are at your own risk and that any loss you may incur is your responsibility. The Daily Hodl does not recommend buying or selling crypto-currencies or digital badets, and the Daily Hodl is not an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

[ad_2]

Source link