[ad_1]

"Selling in May and Leaving" is a popular saying on Wall Street and a long-standing investment strategy. Historically, the S & P 500 has had better results between November and April compared to other months. A large number of investors who manage their own stock portfolios and have no specialized investment expertise support such seasonality models to buy and sell. Everyone loves to have a summer break and Wall Street is no stranger to such breaks. Most professionals go on vacation between May and August, which means they will not want to worry about their investments in their absence. So, most of them end up selling in May. Considering that many people on Wall Street are involved in Bitcoin (BTC) this time and that the BTC / USD reacts strongly to the S & P 500 (SPX), we could see a sharp drop in the price of Bitcoin (BTC) between May and October.

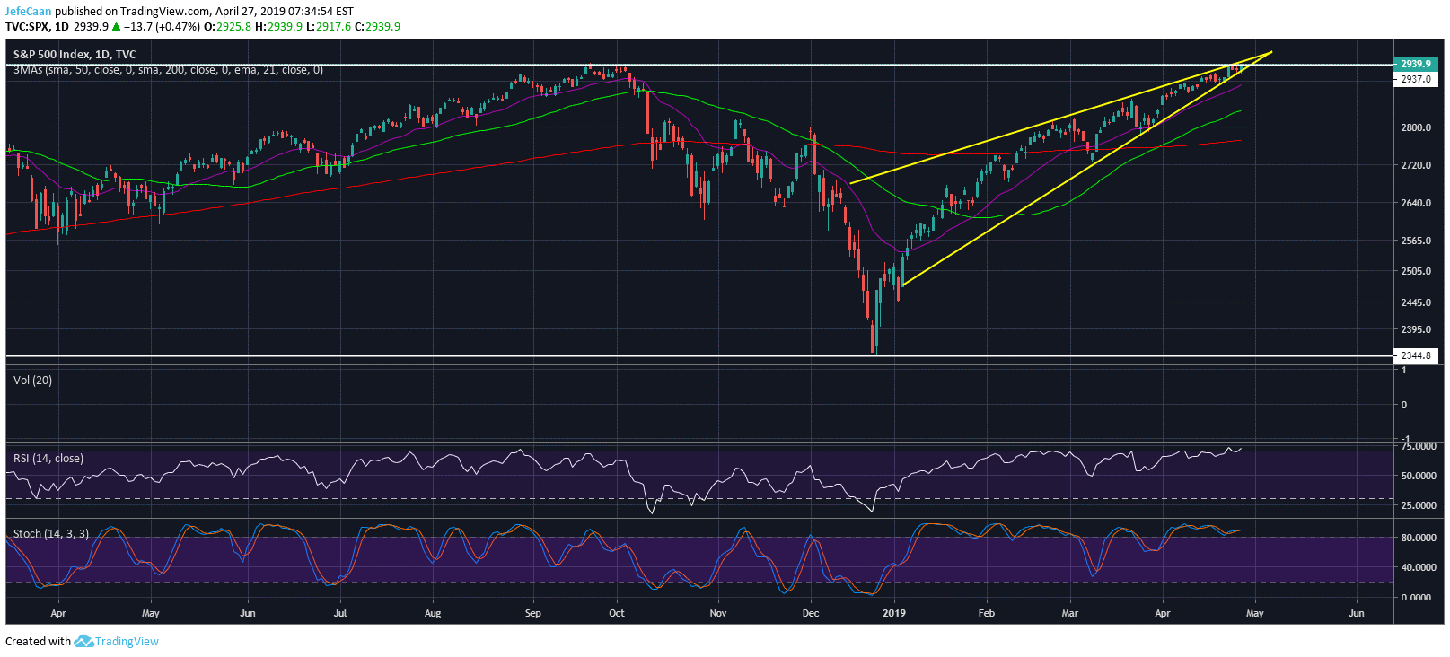

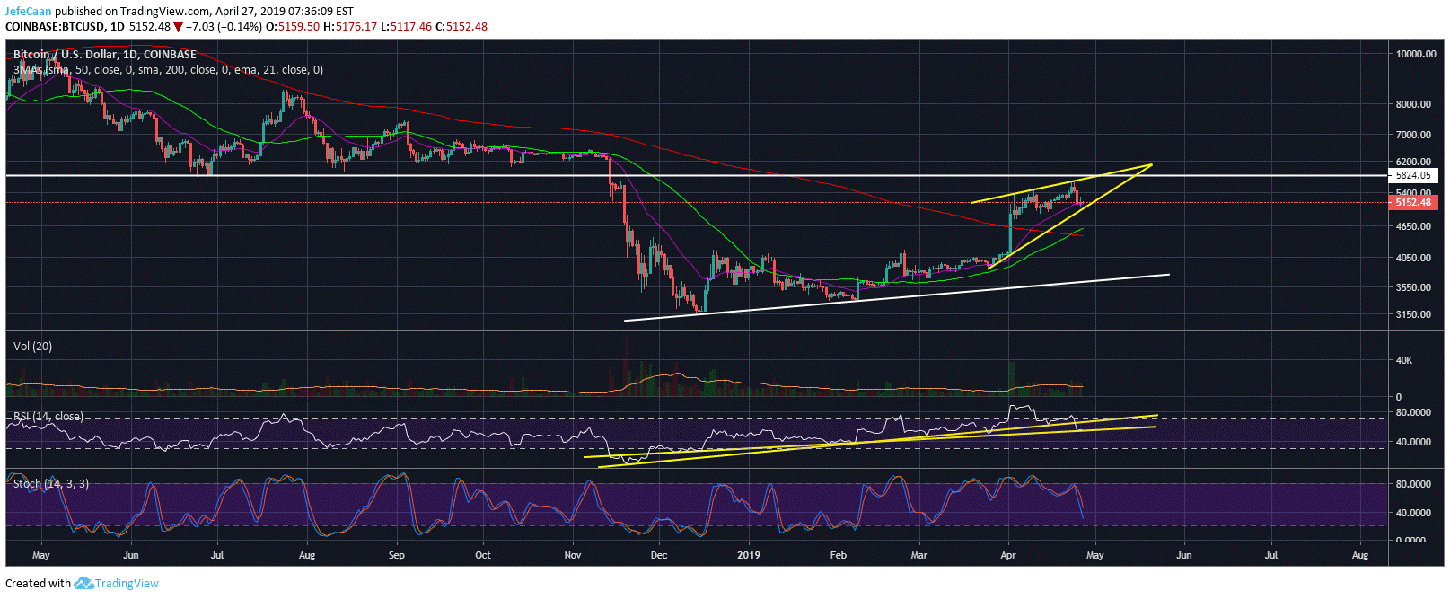

If we look at the daily chart above for the S & P 500, we find that it began to decline aggressively in November 2018. The index continued to fall until it reached its peak. It reaches a temporary background in December 2018. If we look at the price of Bitcoin (BTC) around the same time, it was below the $ 5,800 mark and reached new lows for the year. , standing at around $ 3,128. The price of Bitcoin (BTC) rebounded after the S & P 500. While the BTC / USD is appreciated in a rather confusing way, the S & P 500 has since progressed with confidence. It is interesting to note that the price is now out of reach to trade in the rising wedge to which it has been traded. This means that we are about to experience a sharp break in the S & P 500. Given the fact that the index is heavily overbought daily. frame and that the rising corners usually break down, it would be the catalyst for the next "Sell in May and Go Away".

For equity investors, the situation is very clear because it would be the perfect time to go out. However, investors in Bitcoin (BTC) are still facing a dilemma, the price still being revisited from the previous market structure around $ 5,800 to $ 6,000. If we look at the RSI on the BTC / USD daily chart, we can see that one of the trend line supports has been clearly broken. However, looking at the other trend line, it seems that the price could still make a last upward move.

This confusion can be seen at different levels. The BTC / USD recently formed a gold cross when the 50-day moving average exceeded the 200-day moving average, but we have not yet seen the price benefit from it. Recent events in the cryptocurrency market have made the game plan a little easier to understand. The controversy between Tether and Bitfinex could lead investors to turn their USDT into Bitcoin (BTC) in order to reap the benefits. This would be the ideal configuration to review the market structure, which had been broken before, between $ 5,800 and $ 6,000, followed by a marked downturn. This would allow the BTC / USD to catch up with the S & P 500 before both fall steadily over the next few months.

Source link