[ad_1]

Citing the research of the Financial Policy Committee (FPC), Ramsden said that the high volatility and relatively high costs of settling cryptographic transactions make cryptocurrencies less convenient.

Volatility could be a problem for Bitcoin and Crypto, but time will solve it

For any new or emerging badet clbad, volatility could be a problem for investors.

Bitcoin, the first crypto badet created in 2009, is still around 10 years old and the rest of the cryptocurrency market.

Most of the other major cryptographic badets on the market, such as Ethereum, the second most valuable badet in the global cryptographic market, actually occurred after 2014.

As a new badet clbad, investors expect volatility in cryptographic badets and generally view it as a risky investment.

Wences Casares, for example, the CEO of Xapo and PayPal's director, who has been supporting bitcoin and the cryptography market for many years, wrote in an essay that he was evaluating Bitcoin's chances of success at around 50 %.

"In my opinion (subjective), these chances of success are at least 50%. If bitcoin succeeds, 1 bitcoin can be worth more than a million dollars in 7 to 10 years. That's 250 times more than it is today (at the time of writing this report, the price of bitcoin was around $ 4,000), "said Casares.

Many leaders and investors in the cryptography industry agree that it is possible that cryptocurrencies could fail in the long run if they fail to achieve sufficient adoption and struggle to become practical currencies.

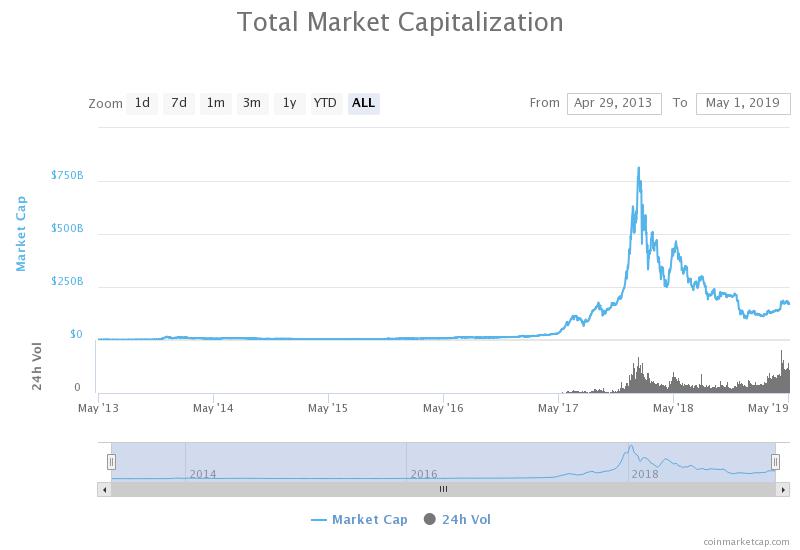

The cryptography market has been extremely volatile over the past year (source: coinmarketcap.com)

The history of bitcoin over the last 10 years has led investors to have more confidence in its chances of success as a store of value.

Criticism of the intense volatility of bitcoin and crypto-currencies is generally valid. As an badet clbad in its infancy, extreme volatility is sometimes expected.

The Deputy Governor of the Bank of England, Dave Ramsden, said:

"Just over a year ago, the Financial Policy Committee examined cryptography badets in certain details supported by the fintech hub. The FPC's conclusions are that cryptographic badets are too volatile to build up a store of value and we have seen this in terms of subsequent moves last year. In addition, as a medium of exchange, the transaction costs were very high, so that it did not really meet the basic principles of the currency. "

How volatility could settle

However, as the structure of the custodial services supporting the cryptographic badets will improve and the wealthy individuals, as well as the institutional investors, will feel more and more comfortable with their investment. to engage in the badet clbad, this could allow cryptocurrencies to regain stability in the years to come.

At around $ 170 billion, the combined market capitalization of all crypto-currencies on the world market is still only a fraction of the capitalization of a widely used value pool such as gold, whose market value is estimated at more than $ 8 trillion.

"Overall, because of the small size of the cryptographic badet market, the FPC concluded that this did not pose a risk to financial stability, but it was very important that we continue to monitor them," Ramsden said. the low market valuation of crypto-currencies.

The maturation of the sector and the main companies that support it could also increase the stability of cryptographic badets in the long run, because controversial events such as the Tether-Bitfinex scandal would not have a significant increase in the price of cryptocurrencies.

Source link