[ad_1]

Sir Philip Green is fighting to save his Topshop empire from collapse and time is running out.

The billionaire Arcadia group, which employs around 19,000 people, is desperate to set up a rescue strategy that will close some 50 of the group's 570 UK stores.

If an agreement can not be reached well before the group's next lease payment in late June, Arcadia – which includes Topshop, Dorothy Perkins, Miss Selfridge, Wallis, Evans and Burton – could face an administration.

Green, who is no longer in the UK since October, would like to conclude his exit from the group he bought for 850 million pounds 17 years ago. With his reputation in shambles after the collapse of BHS and his accusations of inappropriate behavior, the entrepreneur lost all appetite for Britain's high street.

An alternative solution to the Arcadia administration could be an immediate sale, but industry experts believe that an agreement is highly unlikely without a process of reducing costs and reducing the black hole burden of the group's pensions – which raises to £ 537 million. Even then, only Topshop is likely to attract much interest, although owners such as Edinburgh owner Woolen Mill's Philip Day and Sports Direct boss Mike Ashley may be tempted to buy smaller brands. they go bankrupt.

Arcadia had hoped last week to announce its restructuring plan, known as the "Voluntary Enterprise Arrangement" (CVA), which would allow it to close stores and reduce rents. But the council is struggling to get enough support from homeowners, 75% of whom must approve the changes.

The process is particularly complex for Arcadia in that it involves up to eight companies, each of which would be subject to a vote of owners and other creditors.

To ensure a smooth transaction, the homeowners are asking Green to donate more than the £ 100 million in loans it promised to invest in improving Arcadia's stores. It is understood that they also want to invest in cash rather than in loans. The owners are lobbying Green to reorganize stores and modernize all of its business to offer modern digital transmission services so that Topshop and sister chains such as Outfit, Wallis and Miss Selfridge can compete with H & M , Zara, Asos and Boohoo.

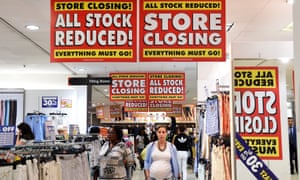

A Topshop branch in a London shopping center. A photograph: Alamy

Green has offered homeowners a 10% share of any future sales proceeds from the company, but they expect more.

As part of the rescue deal, Arcadia also wants to halve payments to its pension fund to £ 25 million a year, only two years after agreeing to raise it to £ 50 million.

The project has a deficit of more than £ 537 million on the basis of maintaining the company. But if Arcadia went bankrupt, it would cost up to 750 million pounds. Pension regulators and fund administrators are likely to focus on this figure. The success of the CVA depends on its support, as the fund is a major creditor.

Arcadia has offered to transfer to the fund the property of the flagship store of Oxford Street, the flagship store of Topshop, in central London, but this property, worth about 400 million pounds sterling, is heavily mortgaged and only about 100 million euros. At the present time, administrators and regulators are waiting for a better deal. Arcadia declined to comment on its restructuring plans.

After years of underinvestment, Arcadia sales declined 5 percent in the 12 weeks to March 10, according to market badysts Kantar. In the overall apparel market, sales increased 1.4% over this period.

According to badysts, group sales began to decline in the summer of 2015, when its market share fell by one percentage point to stand at 3.2%. This may not seem like a big change, but it reflects millions of pounds in lost revenue. An badyst who declined to be named said:[Arcadia] is always miles behind the curve. It's a pretty ugly image. Real estate retailers and property specialists describe Arcadia's many stores as not very busy or lousy.

Patrick O'Brien, retail badyst at GlobalData, said: "Brands have been under-invested for many, many years and have fallen out of line with their target market. If you look at Miss Selfridge or Dorothy Perkins, these are very outdated brands that really do not resonate with the type of buyers who buy online on Asos or Boohoo. "

BHS, Oxford Street, London, shortly before its closure in 2016. Photo: Andy Rain / EPA

Regarding the group's online activities, he said: "Nothing has been invested to the extent that they can compete with groups like Asos or Boohoo. It's just another website to be innovative. "

Over the years, Green has withdrawn millions of pounds sterling from its business in the form of dividends, loan payments and property profits. The Green family took a dividend of 1.2 billion pounds sterling from Arcadia in 2005, just three years after the company's purchase.

According to the accounts of the parent company of Arcadia, Taveta Investments, Tina Green, Sir Philip's wife in Monaco, has received nearly 220 million pounds sterling interest and repayments of loans related to the BHS channel now collapsed between 2009 and August 2017. The Greens, who bought BHS in 2002 for £ 200m, were ceded to their Arcadia group in 2009. The channel was then sold to a group headed by a former bankrupt, Dominic Chappell, for £ 1 in 2015 and sank about a year later. Green defended his management of BHS, claiming that he had invested "substantially" in the business.

Including BHS payments, the Greens have raised at least £ 356m from Taveta since 2009, including £ 53m for the purchase of BHS 'headquarters at Marylebone House and £ 72m in rents mainly for property BHS.

Richard Hyman, independent retail consultant, said: "Arcadia brands have reached a peak in terms of detail before [Green] bought them. Until recently, Topshop was doing very well, but in recent years it has become a shadow of what it was.

"These companies do not have a proposal that cuts enough with the consumer. I think [Green] is in a real corner. He left it too late.

Source link