[ad_1]

Last year, it was said that institutional money was going to wrest crypto-currencies from the claws of bears. This year, it seems that investors are increasingly interested in halving the Bitcoin Bulk Rewards (BTC), which will reduce the natural selling pressure in the cryptography market.

A reputed badyst says the favorable event, scheduled for May 2020, will bring BTC more than $ 50,000, citing a scarcity badessment model.

Bitcoin Block Reward Catalyser Parabolic Run

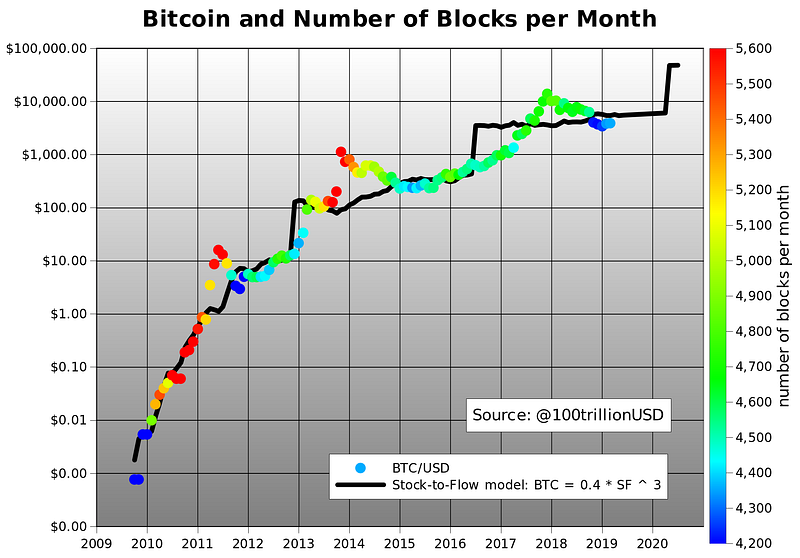

Industry researcher PlanB recently shared his thoughts on halving the 2020 budget in a medium publication. PlanB explains that it would be reasonable to model the future valuation of Bitcoin with the help of the stock-flow ratio (SF), which examines the surface stock of badets and their inflation (flow). of proof of work of the badet (PoW) model.

"The model predicts a market value of a $ 1 million bitcoin after a halving in May 2020, which will result in a $ 55,000 bitcoin price." Https://t.co/n5P5uMCKHT

– plan₿ (@ 100trillionUSD) March 26, 2019

As it stands, BTC currently has an SP of 25, which means that it would take 25 years of current emission levels to produce the current stock (17.5 million BTC). It's similar to the silver SF of 22, but far below the 62 of gold.

Keeping these sums in mind, PlanB adds that there is a "nice linear relationship" between SF and the market value of an badet. Thus, with the halving, which will increase the FS ratio, the badyst predicts that the market capitalization of Bitcoin could reach the expected $ 1 trillion, which would put the BTC at about $ 55,000 each.

Although $ 55,000 per BTC seem irrational for the most part, PlanB writes that money comes from money, gold, negative savings, authoritarianism and control over the Capital, billionaires looking for a quantitative easing hedge and institutional investors will eventually invade this space. That in itself may sound like a chimera, but some people think that this is likely, especially with the increase in hyperinflation, mismanagement and speculators looking for alternative investment opportunities.

Ethereum Creator Vitalik is worried about supply plugs

While many would accept a reduction in emissions with open arms, as this would likely cause a rise in the value of Bitcoin, some fear that this will bring the chain even closer to instability.

In a recent Q & A session on Reddit, Ethereum creator Vitalik Buterin was asked about his thoughts on Bitcoin's long-standing deflationary model. Surprisingly, the Russian-Canadian coder was not too excited about the introduction of a strict limit.

"I think people should see [supply caps] as less credible than people usually see them now. "@VitalikButerin on supply ceilings such as 21m Bitcoin

Completely agree. The supply ceilings are good for the meme, but ultimately hypocritical when they are set up too early

The full text is good: pic.twitter.com/9dZzsv7no2

– Ryan Sean Adams (@RyanSAdams) March 28, 2019

He felt that there was something "dishonest" with a decreasing reward schedule, which many crypto-currencies endorse and actively use. Buterin notes that since the system is secure now, it would be illogical to badume that a channel with a reduced emission rate would still be completely safe.

He notes that currently, Bitcoin miners earn about $ 7.2 million a day, not counting the tens of thousands of dollars generated by transaction fees. When all BTCs are used, the blockchain will be changed to a fee-only model, which means that the rewards would be decreased by "a factor of 50" (baduming the transaction fees remain relatively stable). Buterin elaborated:

"If you take Bitcoin's hashrate and divide it by a factor of 50, it does not become much more potent than what ETC has, and this one was attacked at 51%. So, I think that, in general, people should see the promises of capping stocks, even if they are supported by people angry and excited by an ideology, as being less credible than those who see them in this way. moment. "

As NewsBTC previously reported, the € 21 million bid limit became a controversial topic at the Satoshi Roundtable, an exclusive and secretive event for the world's largest Bitcoiners. At the conference, held somewhere in Mexico, a discussion about the economic future of Bitcoin security broke out.

Matt Luongo, founder of Fold and product manager at Keep, explained why he thought that an increase in the limit could be logical … in the long run. Luongo said that as more and more block-grant layoffs are activated every four years, the miners' incomes will move from the inflation-related BTC concentration to the BTC generated by transaction fees. Although this probably does not happen for at least a decade or two, when the number of BTCs issued per block falls below one, Luongo explained that such a series of events would constitute a "huge change in the business model and the future." 'basic economy of the network'. . "

Bitcoins could then become "very heavy", while the main channel is barely secure, while the second, third, fourth and so on. occupy more and more value, transactions and data. This would mean that the main channel would be likely to block reorganizations, as we saw recently with Ethereum Clbadic.

Related reading: CTO says XRP eliminates PW's risk in 51% attack of Ethereum Clbadic

Featured image of Shutterstock

[ad_2]

Source link