[ad_1]

Fast setting

- In 2018, despite the bear market, the stock market generated profits of $ 446 million. less than CEO forecasts

- Earnings declined sharply in the second half of 2018 due to lower trading volumes and higher investments in infrastructure

- Coinbase likely had smaller profits despite forecast of $ 456 million in October

by Larry Cermak

41 minutes ago · 3 minutes reading

The general manager of Binance, Changpeng "CZ" Zhao, told Bloomberg in early July that he expected net profit from trading to be between $ 500 million and $ 1 billion in 2018. However, according to The Block's calculations, the firm was a little timid to hit the bottom of CZ's forecast, bringing in a total of $ 446 million.

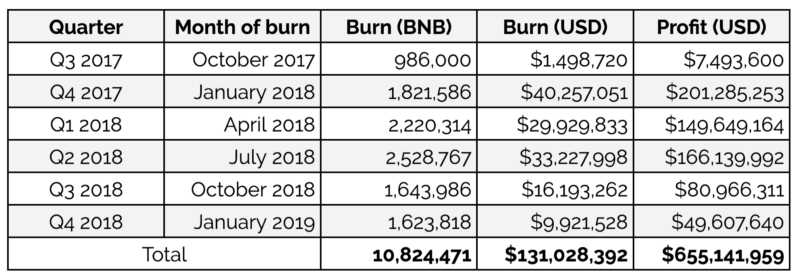

Of course, Binance does not disclose its financial data, but the benefits can actually be deduced quite easily with a simplistic mathematical calculation. Since its initial offer to the OIC in 2017, Binance has raised $ 15 million for 100 million Binance Coin (BNB) out of a total bid of $ 200 million. According to the white paper, Binance uses 20% of its net profit to buy BNB and destroy 100 million BNB tokens. After each BNB engraving, Binance publishes a disclosure report.

To date, Binance has had six BNB burns in three quarters, in which it has destroyed just over 10.8 million BNB. Each engraving is made on the basis of the BNB price on the day of the combustion, which means that if the NBB totals are multiplied by the BNB price on the day of the burn, we can obtain a USD equivalent of 20% of the profits. Binance's profit is simply five times the equivalent in USD of each engraving, if the company stays true to its commitments in the white paper.

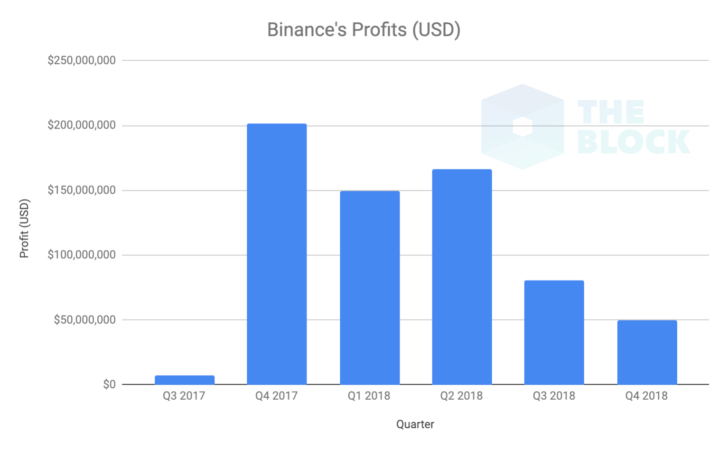

In total, Binance reported approximately $ 655 million over the six quarters of its short existence. Binance's most profitable quarter was the fourth quarter of 2017, when it generated more than $ 200 million. In 2018, the company generated net earnings of $ 446 million, $ 54 million lower than the lower end of CZ's estimate. As the data shows, nearly 71% of annual profits were generated in the first half of 2018. In the third quarter, profits fell 51% from the second quarter. And in the fourth quarter, profits continued to fall; another 39% quarter over quarter.

The decline in profits coincides with a decrease in the volume of transactions, which was felt in cryptographic exchanges. In October, Binance began donating all registration fees to charities, which could also put negative pressure on fourth quarter earnings. Binance has also invested heavily in opening separate fiat-to-crypto exchanges, developing decentralized exchange and increasing staff. Binance opened its second fiat-crypto exchange in January after its launch in Uganda last October.

In comparison, according to a paper examined by Bloomberg in October, Coinbase projected profits of $ 456 million in 2018, but it is not certain that they are meeting their target. If Coinbase overestimated the demand, like CZ, it is likely that Binance will eventually generate larger profits in 2018.

Coinbase charges much higher fees, but generates a much lower trading volume than Binance. In January, the volume traded by Coinbase was less than one-eighth that of Binance. Comparing with the traditional financial world, NASDAQ, the second largest stock exchange in the world, generated net income of $ 734 million in 2017, but employed 4,700 people, 15 times more than Binance.

Binance is the largest cryptocurrency exchange in terms of trading volume and has consistently defended this position throughout 2018. The company employs more than 300 people and has about 10 million users.

With the contributions of Frank Chaparro.

Source link