[ad_1]

Asia Pacific markets summarize their points of discussion

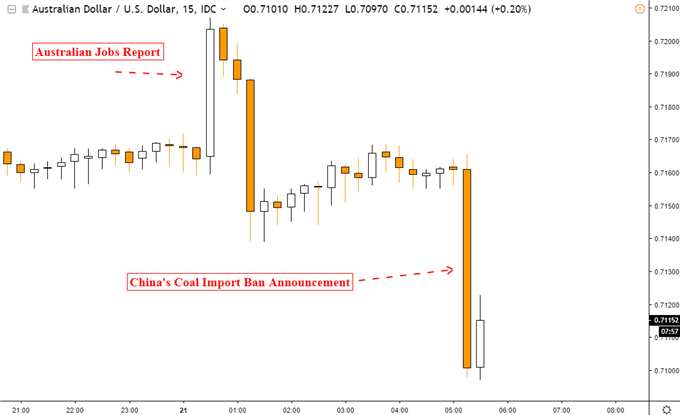

- The Australian dollar collapses on the ban on importing Australian coal into China

- Most stocks in the Asia-Pacific region continue to rise after the upbeat news from the US-China trade

- Markets focus on durable goods orders in the US, the USD / IDR expects the Bank of Indonesia

Discover what decisions to buy and sell shares of retail traders say about the price trend coming!

NEWS – Chinese port of Dalian bans Australian imports of coal

After an impressive report of local jobsThe AUD / USD suddenly dropped about 0.9% on a Reuters report that the Chinese port of Dalian banned imports of Australian coal to a level not exceeding 12 million tonnes this year. According to the report, this must last indefinitely. In addition to China being Australia's largest trading partner, coal is one of its major export products. This could have a negative impact on the economy after the global economy has already darkened. The Chinese economy is slowing along with the major European countries.

15 minute reaction graph of AUD / USD

Chart created in TradingView

Asia Pacific Equity

Most benchmark Asian-Pacific stock indexes have risen after gains on Wall Street after the FOMC meeting minutes revealed that policymakers stop runoff in the balance sheet later this year. In APAC's Thursday session, the actions got a boost when the reports came across the progress of the US-China trade talks.

The two countries currently form six MoUs covering topics such as agriculture, intellectual property and services. In addition, efforts are being made to extend the March 1 deadline before the US can increase tariffs on imports from China. These titles seemed to fuel the feeling regional scholarships aimed above.

From Japan Nikkei 225 climbed about 0.4% at closing, extending gains after a violation of critical resistance barriers. The Australian ASX 200 climbed 0.70% as it continued to make progress following a bullish reversal early this year as planned. The Shanghai Composite of China climbed by around 1%, with the KOSPI hardly changing.

Markets will target durable goods orders in the US, given the Fed's data-driven position. The slowdown in retail sales growth last week produced a reaction to the risk aversion of market-wide actions. Meanwhile, the Indonesian rupee is waiting for a rate decision from the central bank. Keep an eye on what they have to say about the fundamental value of their currency.

FX Trading Resources

— Written by Daniel Dubrovsky, Junior Forex Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

[ad_2]

Source link