[ad_1]

The American generation sitting on more wealth than any other – the Baby Boomers – was all about bonds in 2020, but just started to bring a retail load back to the stock markets.

That’s according to independent research firm Vanda Research, whose latest weekly data tracker showed individual investors were returning to stocks earlier than expected after a bruised February. And leading the pack were Americans born between 1946 and 1964, Vanda Research said.

VandaTrack

“Baby boomers bought more bonds than stocks throughout 2020, while millennials bought stocks aggressively. Older investors only started engaging with the stock market again towards the end of last year (November 2020) and their activity peaked this month. This is the first time we’ve seen baby boomers leading equity inflows, ”said Giacomo Pierantoni, research analyst at Vanda, in email comments.

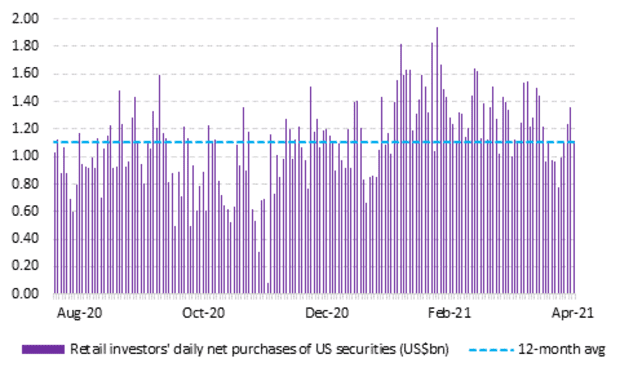

Since mid-February, individual investors have underperformed the S&P 500 SPX,

by 11%, according to VandaTrack, which provides daily data on net purchases by individual investors of U.S. equity exchange-traded funds. Analysts expected a period of hibernation after that, but new data revealed average daily purchases of U.S. securities reaching $ 1.2 billion on April 6, then $ 1.5 billion on April 7, more than doubling from a low of $ 772 million on March 26.

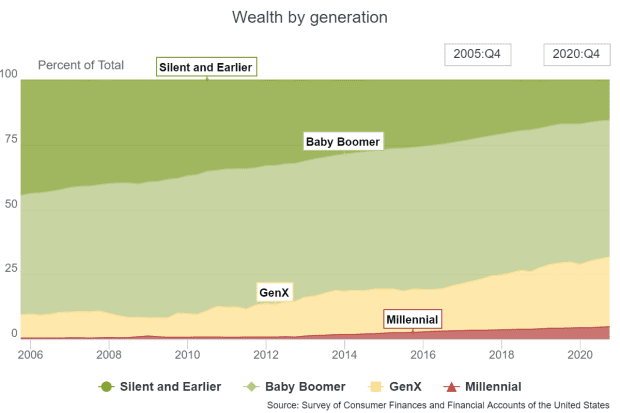

This inspired Vanda analysts to examine where the stock surge might come from. “There is some data to suggest that the wealthiest of the baby boomer generation may have been responsible for the surge in shopping. The average age of investors in platforms like Schwab or TD Ameritrade is close to 50 and they are much richer than millennials, ”Pierantoni and senior strategist Ben Onatibia said in a note.

In the fourth quarter of 2020, the baby boom generation held just over half of total U.S. household wealth, according to data from the Federal Reserve. That’s an amount of $ 64.72 trillion, compared to $ 5.89 trillion for millennials born after 1980 and $ 33.06 trillion for Generation X, born between 1965 and 1980.

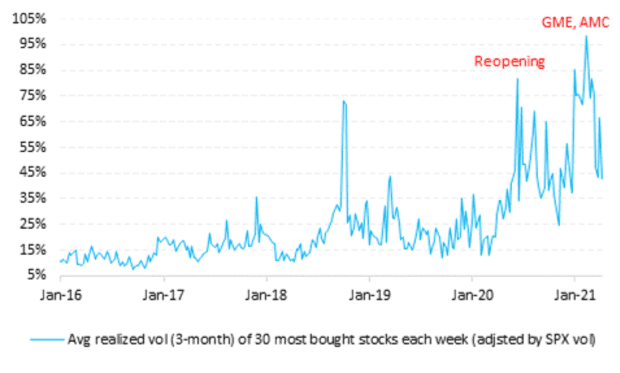

The types of stocks purchased also offered clues, they said. “Their behavior is also much more conservative than that of young investors. Most of the stocks that reached the top of our rankings this week are high quality blue chips, while more speculative stocks like [videogames retailer GameStop]

GME,

or [movie-theater chain]

AMC,

have given up, ”they said.

The chart below from VandaTrack shows the average realized volatility of the 30 most bought stocks each week (compared to the S&P). The chart “also suggests that investors are more conservative than in previous rallies,” they said.

VandaTrack

Continued and sustained deployment of COVID-19 vaccines in the United States and President Joe Biden’s $ 1.9 trillion infrastructure package could encourage investors to invest in equities, even if markets appear to stall at these levels records in recent times.

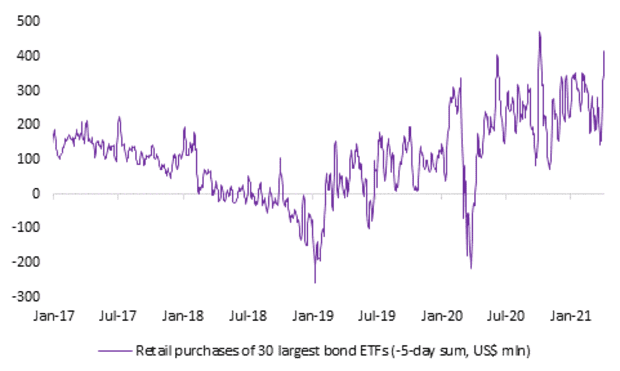

Another reason Vanda suspects baby boomers are in the markets is due to unusually large flows to sovereign bonds and credit exchange traded funds.

Last week, he noted, individual investors injected more than $ 416 million into the 30 largest fixed-income ETFs that trade in the United States, the highest amount on record. The iShares iBoxx $ Investment Grade Corporate Bond ETF LQD,

was the biggest contributor, with $ 128 million in purchases, Vanda said.

VandaTrack

Charles Schwab, Vanda

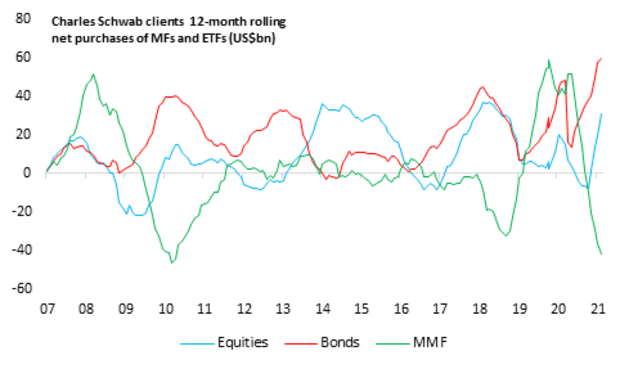

“While most Robinhooders tend to stay away from ‘boring’ fixed income products, baby boomers, who are closer to retirement, often prefer them to stocks. Monthly data from Charles Schwab’s clients shows that entries into bond ETFs and MFs [mutual funds] were twice as big as stocks, ”said Pierantoni and Onatibia.

Lily: ETF Wrap: One year and the change, and OK, boomer

Source link