[ad_1]

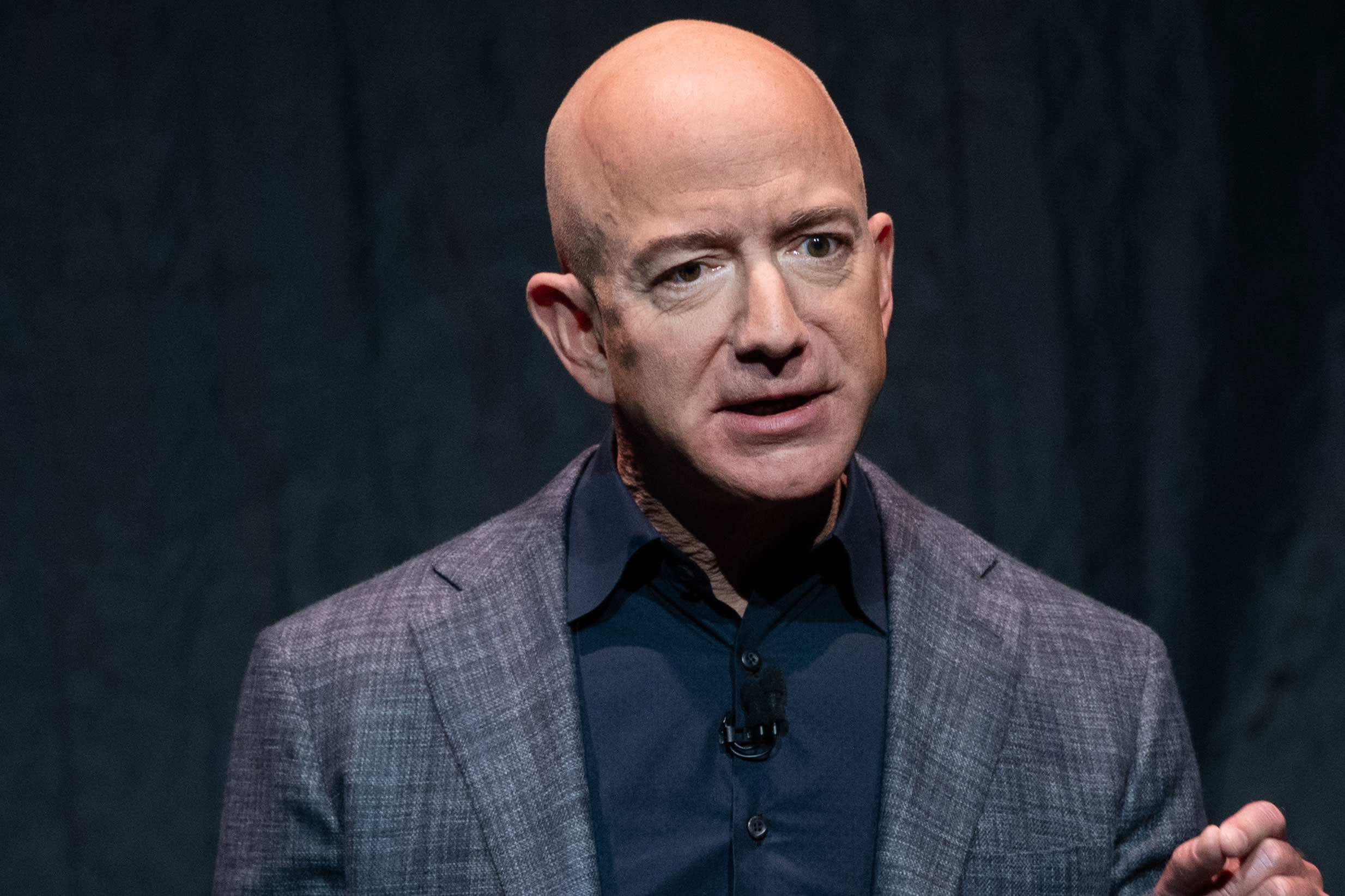

Amazon CEO Jeff Bezos announces Blue Moon, a lunar landing vehicle for the Moon, at a Blue Origin event in Washington, DC, May 9, 2019.

Saul Loeb | AFP | Getty Images

Jeff Bezos has seen many changes since the IPO of Amazon in 1997, particularly with regard to its appearance and level of wealth. But there is one thing that has remained constant: its relentless focus on the future.

This approach, which Bezos touted in its first letter to investors 22 years ago, was abundantly exposed this week in Amazon's second-quarter earnings report. Amazon beat Wall Street estimates of revenue but did not make a profit, mainly because of the increase in overall spending, a trend that continues.

"The investment will intensify in 2019," said Thursday the chief financial officer of Amazon, Brian Olsavsky.

Shipping costs accelerated 36% to $ 8.1 billion, the highest level in five quarters, after the company spent more than the $ 800 million expected to make delivery one day the standard for Premium members. In other words, Amazon is now reducing its profit margin to send more things faster and, if the thesis works, to attract even more consumers to Prime.

Amazon shares fell nearly 2% on Friday after the disappointing earnings figure. But the stock is still up 29% this year and Amazon remains the world's second most valuable publicly traded company, behind only Microsoft.

Here's what Bezos wrote in his 1997 letter to shareholders – shortly after the initial public offering – which was included in every annual letter to remind people of what's important:

"We will continue to make investment decisions in the light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions," Bezos wrote in the letter. of the time.

The founder and CEO of Amazon, Jeff Bezos, in 1997

Paul Souders | Hulton Archives | Getty Images

It's quickly become a familiar theme.

In 2000, in the midst of the Internet crash, Bezos wanted to "draw your attention to the section entitled" Everything is in the long run "" referring to the letter of 1997. The following year, while the market s & # 39; "And collapsed and Amazon suffered another huge loss, said Bezos," if we do our job properly, today's customers will buy more, tomorrow. " And in 2012, after the company recorded its biggest loss in more than 10 years, Bezos reiterated his point of view by writing: "Adopt a long-term vision, and the interests of customers and shareholders alike. line. "

Amazon is a company very different from what it was 22 years ago, when the activity consisted solely of selling books via the Internet. Then, it was necessary to sell everything that a consumer would like online. And along the way, Amazon pioneered the cloud infrastructure market, developed a great online advertising business, and took the lead in voice badistants. It also began generating real profits, making a record profit last year and giving the company more money to re-enter its core retail business.

"In the end, Amazon invests, as usual, in long-term growth opportunities," wrote in a Friday Benquarter quote Ben Schachter of Capital, which recommends buying Amazon shares. "While this is reducing margins, we believe that the increased positive impact and, perhaps more importantly, the widening of the competitive gap are worth it."

"It's all about the long term"

During the second quarter, Amazon saw a significant increase in two major categories of spend: marketing and shipping. Marketing costs increased by 48 percent to $ 4.3 billion, while Amazon spent more on promoting its products and hiring salespeople, primarily for its AWS cloud unit. Shipping costs were related to investments in the expansion of delivery in one day.

In addition to disappointing results, Amazon's third-quarter operating profit guidance was well below expectations. But revenue growth rebounded to 20% in the second quarter, after being the lowest of the previous four years. All major segments of its e-commerce business have accelerated, including third-party online sales, which have seen the fastest growth in two years.

Although investors remain cautious about high spending, their reaction has been largely moderate, leaving the company with another edge over its lean margins. None of FactSet 's badysts felt compelled to lower their rating after the announcement, and the 45 people who made recommendations still view the action as a purchase.

"We would be the buyers of all the weaknesses as long as the trends remain intact," wrote Lee Horowitz, of Evercore, in a note on Friday.

WATCH: How Amazon made record profits in 2018

Source link