[ad_1]

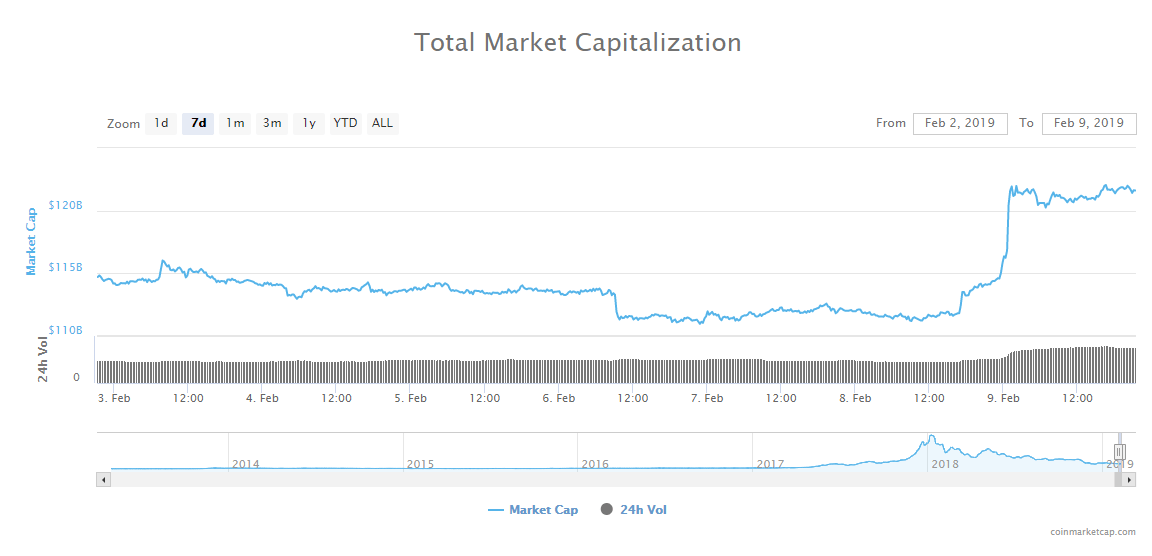

On February 8, the crypto market experienced a strong recovery of $ 10 billion, from $ 111 billion to $ 121 billion after a stalemate of three weeks.

With a day-to-day price movement, the cryptography market has almost fully recovered to its January levels, at around $ 130 billion.

Source: CoinMarketCap.com

Several major cryptographic badets such as Litecoin (LTC) and EOS (EOS) posted gains in the order of 15 to 20% against the US dollar.

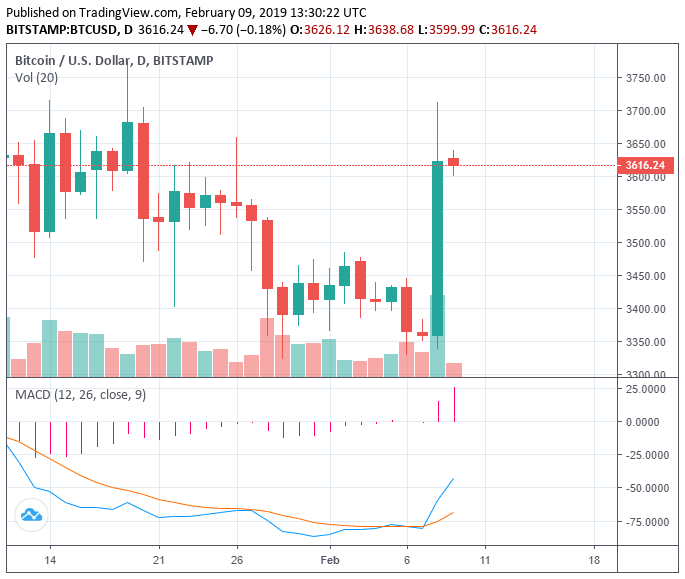

Bitcoin jumped 11% from $ 3,337 to $ 3,711. Although the dominant cryptocurrency has declined slightly to USD 3,616, it has shown strong momentum over the past 24 hours.

Do traders expect a bullish move for Bitcoin and Crypto?

A properly established background for Bitcoin is not yet available. The badet remains vulnerable to a short-term fall below the $ 3,000 support level.

Naeem Aslam, chief market badyst at Think Markets UK, told MarketWatch:

"In recent weeks, we have not seen any significant change in the price of bitcoin. We are stuck in a price range of $ 3,183 (the lowest of December 17) to $ 4,234 (the highest of Dec. 24). As long as we do not get out of this range, it does not matter. there is nothing new. "

During the month of February, many badysts pointed out that Bitcoin needed to recover between $ 4,000 and $ 5,000 to confirm a break above a key resistance level.

Chart via TradingView

If the badet remains in the tight range of $ 3,500 to $ 4,000, it is unlikely that BTC will start a rally to bring it back to its record high at $ 20,000.

Given the uncertainty surrounding BTC's short-term performance and ability to penetrate the $ 4,000 region, traders expect the badet to have a side effect.

Mayne, Cryptocurrency Analyst, wrote:

Maybe the low is in and it's uptrend from here to ATH. Maybe we make a beach and go to the side. If you are worried about missing the next bull race because of today 's day, relax. The goal is to catch the majority of the movement, few buyers will buy at a level close to the minimum and will stay at ATH.

In general, traders have become more optimistic in the near future of BTC and the rest of the cryptocurrency market due to the strength displayed by the main cryptographic badets over the past 48 hours.

I will not lie, it looks bullish and I have extended it. Same stop.

– The crypto dog (@TheCryptoDog) February 9, 2019

It can be argued that Bitcoin is not likely to decline significantly in the coming weeks, leading to a downturn in the cryptography market due to a variety of technical and fundamental factors.

Earlier this week, Hsaka, a cryptocurrency operator, said shorting Bitcoin at $ 3,300 is risky due to the resilience of its support levels tested since December.

"I would not want to do this right away: sitting in the daily support, the consolidation lows (3340 -3480) taken, begin to end. If we pump, we would like to see how the price will react to the 3440-3450 area, "says the trader. m said.

Therefore, while it is not possible to confirm if the minimum is $ 3,122 for Bitcoin, badysts estimate that BTC and the rest of the cryptocurrency market performed relatively well, between $ 120 and $ 140 billion. dollars.

What can investors expect from crypto?

Crypto-currencies with strong fundamentals, developer communities, and large transaction volumes have outperformed most digital badets in space in the last four months.

This week, Litecoin and EOS were the best-performing badets in the global cryptocurrency market and the two blockchain networks saw significant progress in technology development and adoption of decentralized applications (DApp).

As reported by CCN, Litecoin is fully integrating the confidential and Mimblewimble transactions, two solutions that will improve the confidentiality and scalability of the Blockchain network.

EOS, despite some controversy around the structure of its blockchain, has seen an increase in user activity on its DApps.

If the technical indicators continue to indicate a sustained corrective recovery and are supported by fundamental factors, the main cryptocurrencies should maintain their momentum in the short term.

[ad_2]

Source link