[ad_1]

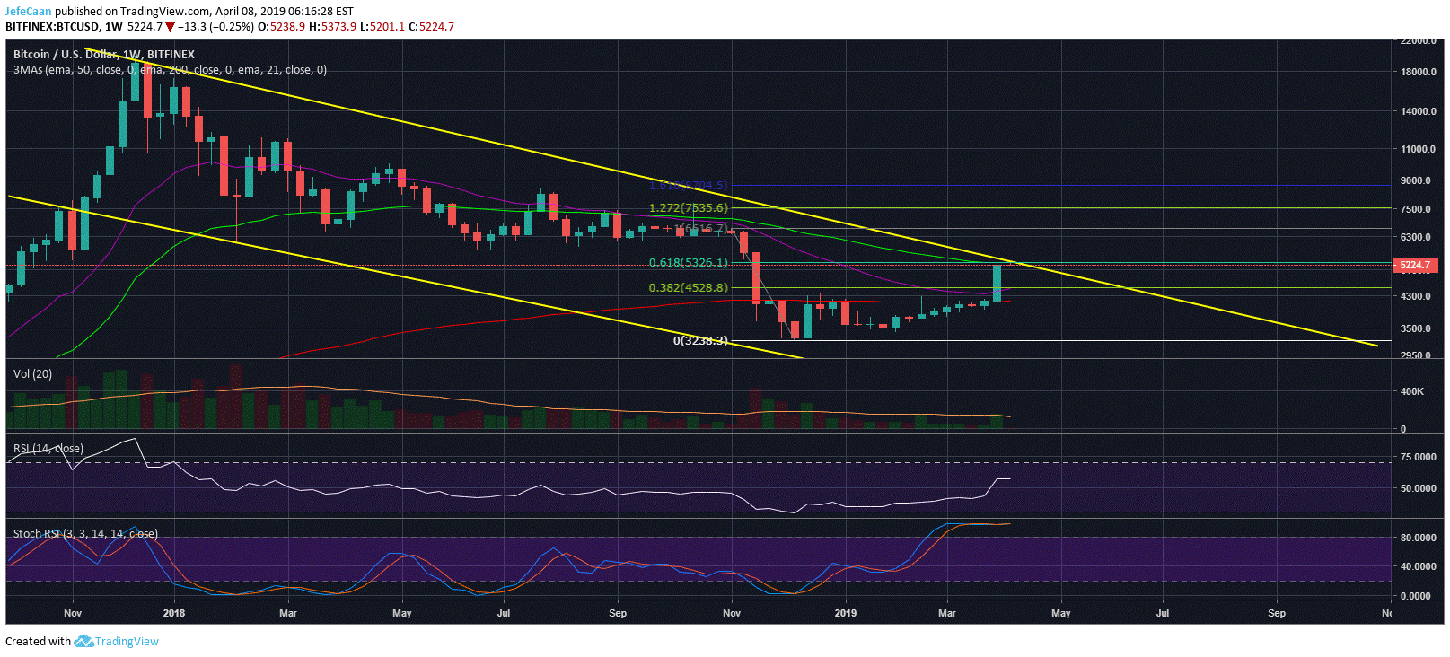

The most anticipated event of the week, namely the weekly BTC / USD closing, is now over. The price has just closed below its 50-week EMA as well as the Fibonacci retracement level of 61.8%. This means that the current weekly candle now has a higher probability of being red and could at least fall to 200 weeks if not lower EMA. The stochastic RSI on the weekly chart shows that Bitcoin (BTC) has not been as overbought since the beginning of the bear market. Even when the price climbed at the end of 2017, the stochastic RSI was well below what it is currently. This means that there should be no doubt about the fact that the price is about to fall, the only question is when.

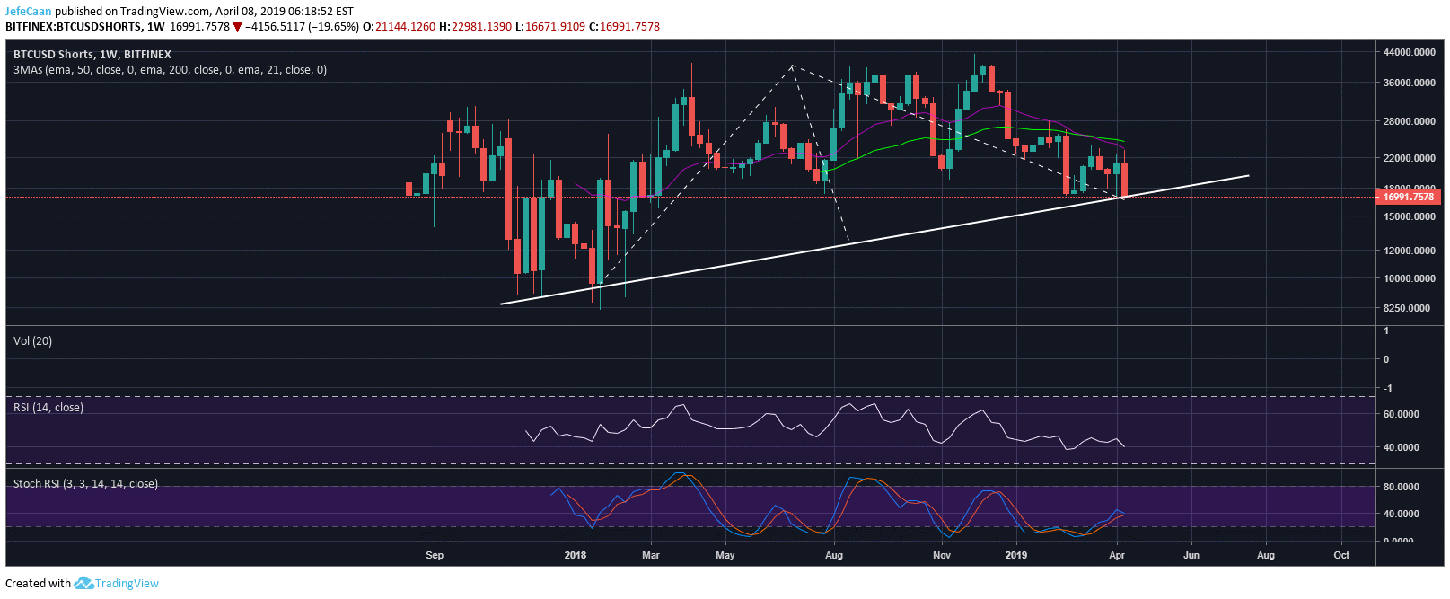

The closure of Bitcoin (BTC) below the 50-week EMA and the 61.8% Fib retracement level should have boosted bear confidence, but that's exactly what happened. The number of marginalized shorts has decreased by about 20% and may continue to decline if the BTC / USD trades on the side. Bitcoin (BTC) is perhaps quite close to its bottom, but it remains no less than it's more overbought than it was when the bear market began. Maybe the feeling is also much more optimistic than it was at the time. When the price peaked around December 2017 and the rally slowed, many people were worried that BTC / USD had a parabolic race and would not have to go down. This time, however, some upward pressure convinced the majority of bulls that the bear market was over, no matter what the experts say.

If the rise in the BTC / USD were gradual and sustainable, with higher highs and lows, it would be a little difficult to deny that it could not continue to rise even if the price had been overbought in the short term. However, it is now what has happened. We have seen a clear lack of upward momentum in price action. There is too much friction and the price is too low to exceed the resistance levels, but we see a pump going up and the bulls are excited again. However, every time the bulls grow after a pump, the whales flow there. Until now, they have let the price go up to trap as many bulls as possible with their highly leveraged positions.

The weekly chart of BTCUSDShorts shows what is happening. The number of marginalized shorts has declined to support the trend line as bulls confidently expect a recovery to $ 6,000 or more. Retailers were affected by this sudden shift in sentiment towards bulls, which is why shorts have shrunk so much. The weekly chart shows that BTCUSDShorts has long been waiting for a strong reversal of the trend, which would see the number of shorts increase again. This means that Bitcoin (BTC) is still far from being out of the background and that it could have significant disadvantages in the months to come.

Source link