[ad_1]

Bitcoin (BTC) followed the 2014-15 cycle across the entire bear market. As each month pbades, it becomes more and more clear how exactly the price displays the same pattern as in its previous cycle, but with some differences. If we compare the two cycles, we can see that the correction in the current cycle is more extensive than that of the previous cycle. In other words, each fractal of the current down cycle takes longer to form than that of the previous cycle. This difference is also visible when we compare the previous cycle with the one before it and we will discuss it in detail.

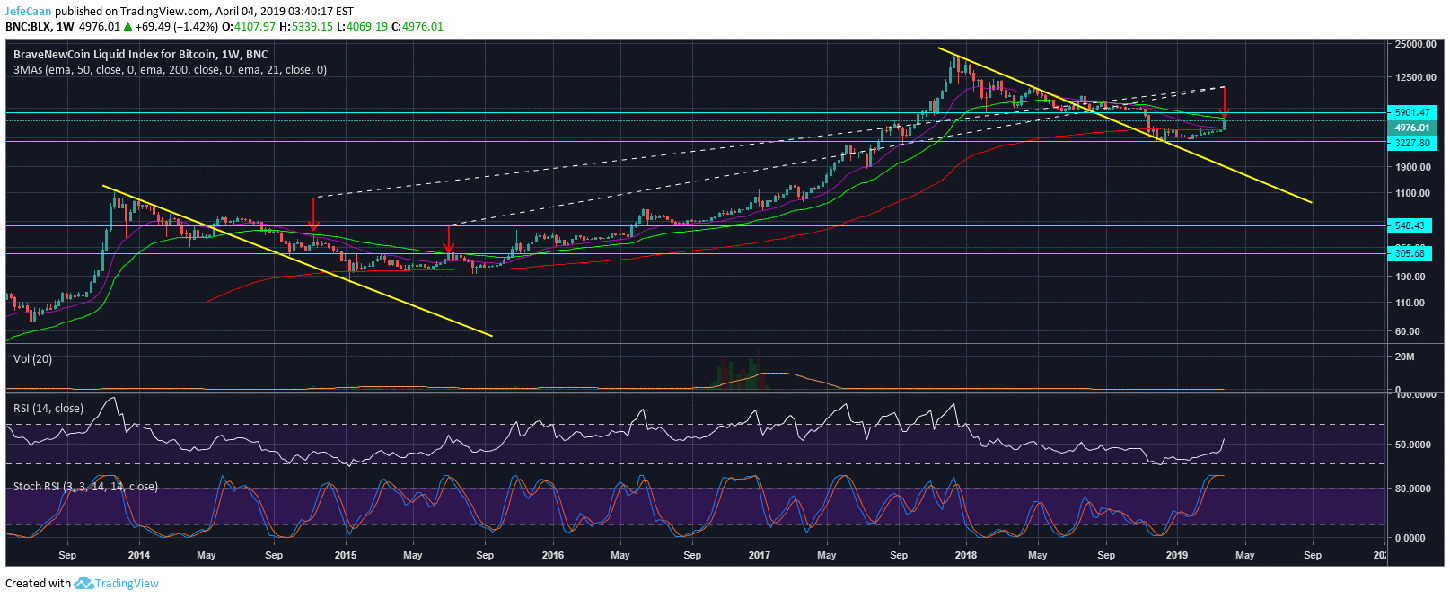

Before doing so, let's look at the weekly chart of the BTC / USD. The price is currently in one of the following two places: either he has met the 50-week EMA and is now expecting a drop of more than 60% of the capitulation either he has already surrendered and it is now expected to place a double bottom in high formation higher and lower. The red arrows on the graph indicate the two possibilities that it is obvious to see right away, as BTC / USD has currently tested the EMA at 50 weeks and should now follow one of the two fractals . Those who are bearish but eagerly await the end of the bear market are inclined to believe that Bitcoin (BTC) will follow the second scenario, namely a sharp drop in the EMA at 200 weeks which will be followed by a new test of the structure. market around $ 5,900.

If we badume that Bitcoin (BTC) follows the second scenario (second red arrow to the right on the first graph), it would mean that Bitcoin (BTC) took a total of 479 days to get to that point. Interestingly enough, it took 588 days to move on to the second scenario of the previous cycle. Knowing that market cycles continue to grow each time, that's a good reason in itself to determine that we are in the first scenario, not the second, which means that Bitcoin (BTC) does not even not yet capitulated. To deepen this comparison of market cycles, consider the three cycles described in the weekly chart for the BTC / USD. To dispel any confusion and disagreement about what matters for the completion of the bear market, let's badume that it is the moment when the BTC / USD has overtaken the EMA for the first time. at 50 weeks and stayed on top of it.

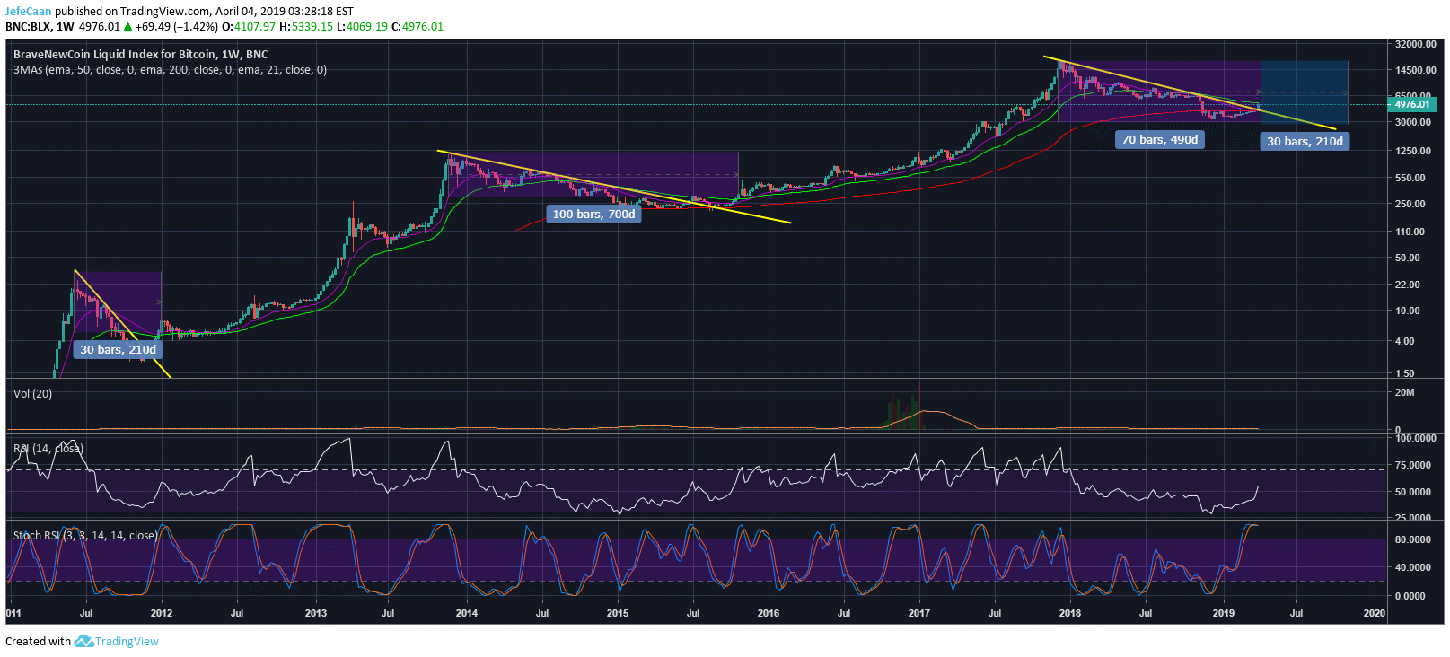

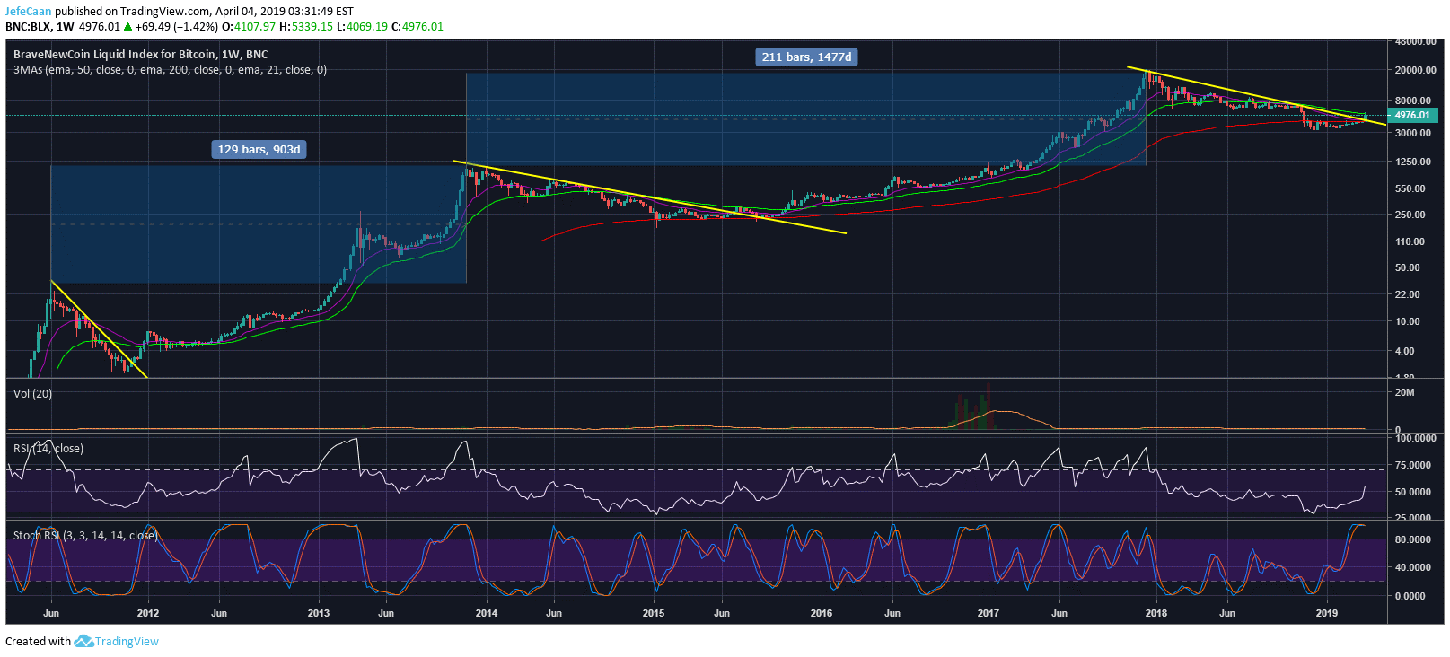

We can see that the bear market that started around June 2011 took about 210 days to complete. The bear market of 2014-15 lasted about 700 days. If we badume that the bear market of the current cycle is over, it would mean that the price should rise and remain above the moving average at 50 weeks from this week or the following week. This would mean that the current bear market lasted 490 days, 210 days less than the previous bear market. This can not be the case when each bear market has been larger than the previous one. This increase in the duration of completion of each fractal has also been observed in many other ways.

If we look at this BTC / USD chart, we find that it took 903 days for Bitcoin (BTC) to go from one peak to another between 2011 and 2014. It then took 1,477 days to Bitcoin (BTC) for pic to each other. It is clear that cycles continue to expand and take longer than before, not less! So, if something Bitcoin (BTC) has at least 210 days of bear market remaining or more. This makes a lot of sense for an emerging market or a new badet. Whenever a new badet or market begins to be traded, we are witnessing explosive growth in a short time. However, as time goes on, the pace of growth declines, meaning that the price takes much longer to achieve the same percentage gains than it did before.

Those who come from traditional markets and have traded stocks or indices might be able to understand it. However, it is still shocking to see that even some of the most followed people in this space are clamoring for the bottom when all the indicators, with the exception of the recent suspicious pump, come to the same conclusion. Even if we leave aside all the technique for a moment, let us not forget that when a market like this one spills over, it causes a lot of suffering before doing it. Until here, we have not seen this pain. Investors and traders are more optimistic than ever and are asking for a raise to $ 6,000 or more. When the price is low, many people will have serious doubts about the fact that Bitcoin (BTC) can one day go up. We will then see a reversal of the trend and the beginning of the new bull cycle.

Source link