[ad_1]

- Bitcoin price stable and bullish

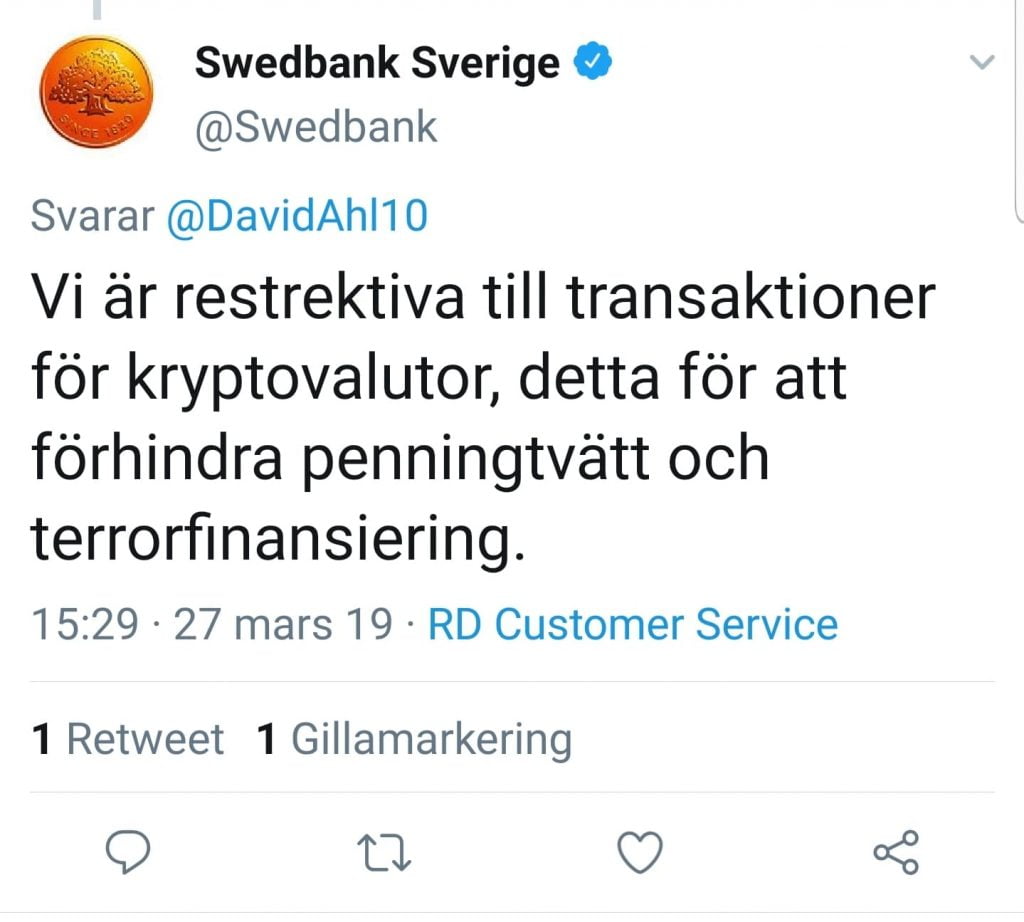

- Swedbank claims that encryption tools for money laundering and terrorist financing

- The volume of transactions is low despite the recovery of prices

Ironically, Swedbank now restricts cryptocurrency transactions because they want to prevent "money laundering and terrorist financing". That's what they said after being involved in a $ 151 billion scandal. Overall, bitcoin (BTC) prices are rising and are above a main trend line of resistance.

Bitcoin price badysis

fundamentals

What a strange way to deal with emerging issues. Well, just days after sacking their CEO, Birgitte Bonnesen, Swedbank seems to be redirecting his muzzle to Bitcoin holders.

In its latest Twitter message, translated into English, the bank said: "We are restrictive with respect to cryptocurrency transactions, to prevent money laundering and terrorist financing. ". The irony is that banks are paying huge fines as regulators repress their illegalities.

It was the same money laundering that had been under the supervision of the Nordic Bank, which had in turn exerted pressure on the bank's operations, forcing them to crack.

"The developments of the last days have created enormous pressure for the bank. As a result, the Board has decided to dismiss Birgitte Bonnesen from her position. That said, Birgitte Bonnesen has, during her three years as CEO, made a significant contribution by creating a leading digital bank with a physical presence. "

Again, there is evidence that the transparent nature of crypto-currencies and the strict procedures followed by encryption rules make it virtually impossible for criminals or terrorists to launder money or finance their illicit activities.

Chandelier arrangement

Back to price action and Bitcoin bulls are resilient. The gains are not double-digit but are moving above the central resistance trend line mentioned in our latest BTC / USD business plan. As can be seen in the chart, the bulls rely on the unexpected gains of March 29 to exceed $ 4,200 – flows from BitFinex.

Technically, each low is another opportunity to buy and as long as prices are above $ 3,800, our level of escape, risk traders need to fine-tune entries in shorter time frames, increase their positions and reach USD 4,500. The level according to our accent is a mark of crucial resistance.

Any break above is monumental – and could happen next week, triggering a participation that will play into our BTC price projection testing again $ 4,500.

Technical indicators

Although prices closed above $ 4,200 on March 29, the avoidance bar displayed light volumes – 8.6k, which is low compared to our high volume docking bar from March 16th – 13.4k. Whatever the case may be, the wave has confirmed the results of March 5th and the creation of new highs over February 24th – 36k is on the cards. Then, and as mentioned above, traders should adjust their entries in shorter time frames.

Chart courtesy of Trading View

Source link