[ad_1]

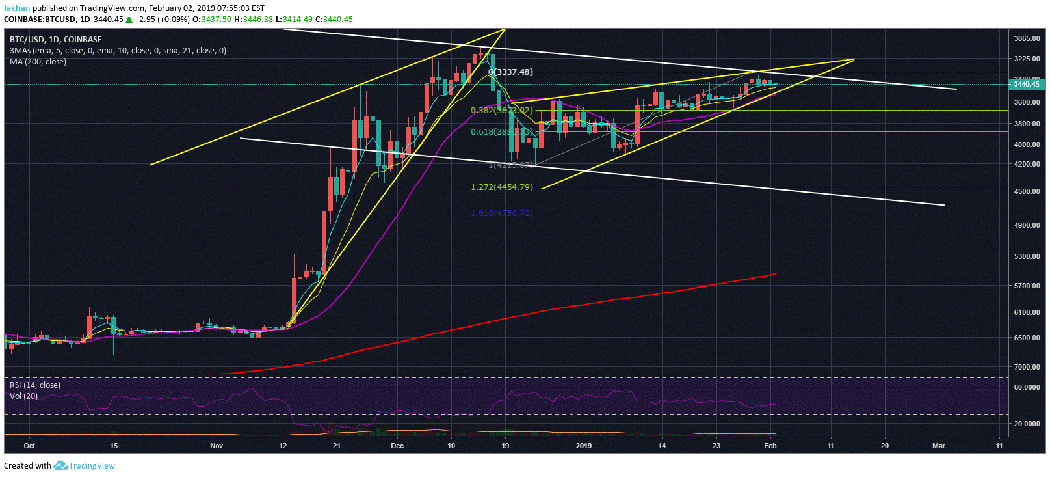

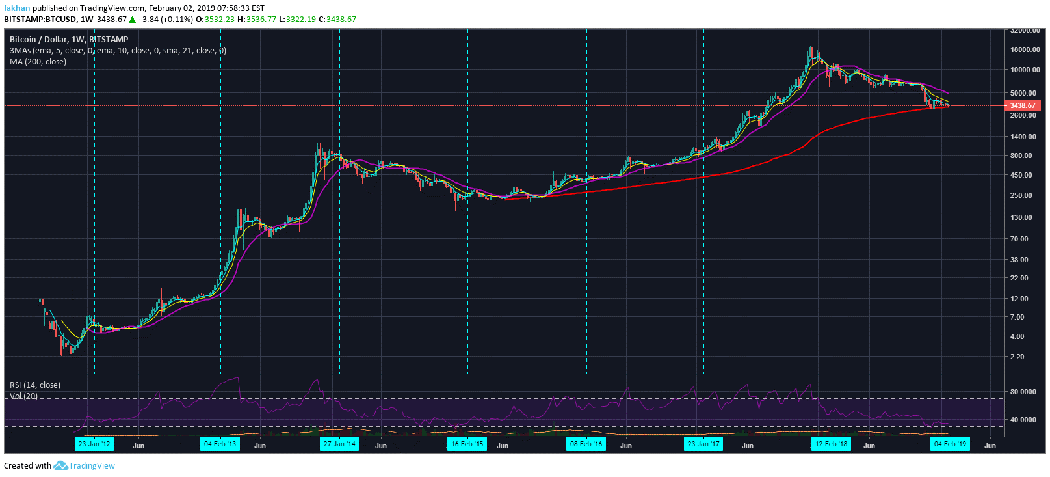

There is a high probability that Bitcoin (BTC) has already laid the groundwork. However, the bear market is far from over and the price may take some time to dissipate and stay above the EMA at 21 weeks in order to formally start a new bull cycle. Even if we refuse to believe that this is the background, the daily inverted BTC / USD chart clearly shows that the price has no more leeway for the movement to progress within the indicated upward corner. on the inverted graph. So, if the price has to go down again, it will have to increase first. On the inverted BTC / USD chart, this would mean a falling down of the downtrend channel before a further rebound on the upside.

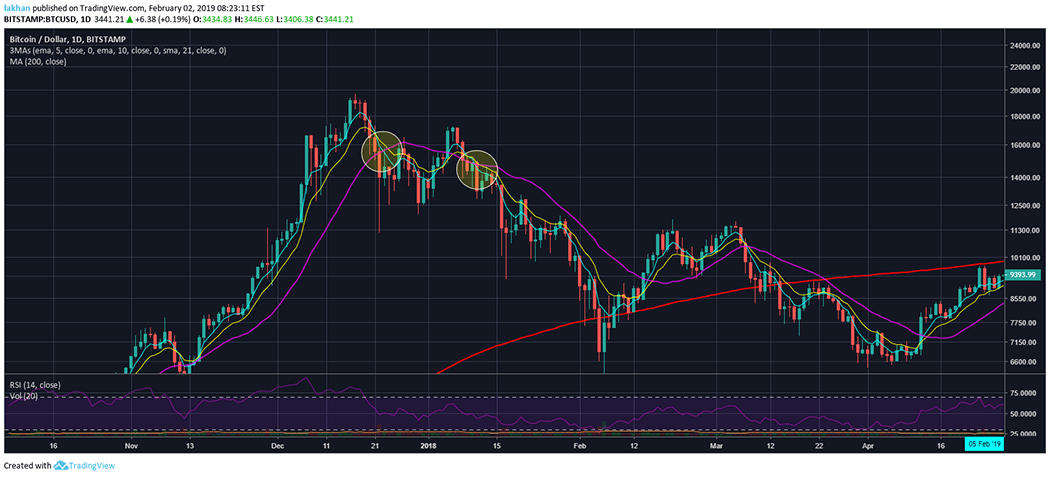

The inverted chart for BTC / USD shows that the last time the price went into a rising wedge; it broke below and continued to diminish until reaching the bottom of the descending channel. If the same thing happened this time, as is highly likely, we should expect Bitcoin (BTC) to exceed the price of $ 4,000 in the coming weeks. A break under the 21-day EMA on the BTC / USD inverted chart at this point would be exactly like a 21-day break under the EMA for the second time after Bitcoin (BTC) has exceeded its limit. The second time, when Bitcoin (BTC) was trading around $ 15,000, confirmed that the withdrawal was not a minor correction, but that Bitcoin (BTC) had in fact entered a long-term downtrend.

A 21-day EMA break on the inverted BTC / USD chart would have exactly the same consequence, which means that Bitcoin (BTC) will officially exit the downtrend, but it may take a little while to enter in the uptrend. In the meantime, there will be a period of lateral movements that could last for most of 2019 and the BTC / USD limit will remain tied during this period. That said, the probability of a fall to $ 3,000 or less is extremely low at this stage. The majority expect this to happen, while the majority expected the price to be between $ 25,000 and $ 30,000 while in reality it was about to go beyond. During times like these, you will see some of the most reputable badysts and traders give in to emotions and ask for a $ 2,000 or $ 1,000 drop, maybe because people think they're n & # 39; There is not much to lose in terms of reputation. to be wrong like a bull.

This is true for most. If you call for a BTC / USD price of $ 100,000, you are more easily criticized than someone who calls for a prize of $ 1,000. That's why even some of the most reasonable voices are afraid to express themselves and say what they think about the future of Bitcoin (BTC) or other cryptographic currencies from an investment point of view. . We must recognize that the World Bank and the IMF have said that the sector has a lot of potential and that the market should grow five times. However, some of the industry leaders, such as Charles Hoskinson, believe that Bitcoin (BTC) could take another ten years to recover, while investors such as Tim Draper and John McAfee believe that we will far exceed the previous record. in the next two years.

Earlier this year, Fundstrat's Tom Lee made several Bitcoin (BTC) predictions, all of which proved false as the market continued to dive deeper without any floor in sight. However, some people have made very reasonable predictions that seem to be made. One of these predictions was made by Arthuer Hayes, the founder of Bitmex, who called for a minimum of $ 2,000 to $ 5,000. We already seem to have reached our lowest level in this range and the price should pick up in the coming weeks with a steady rise to $ 4,000, followed by a retest of the previous market structure around 6,000 $ in the near future.

Source link