[ad_1]

Keizer's response included tweets and interviews over the weekend. He tweeted that the letter indicated that Buffett was not satisfied with the stock market. The remarks made in Buffett's letter may have even helped push the price of Bitcoin above $ 4,100.

#Bitcoin Warren Buffett exposes in his annual letter as an absolute fraud and charlatan who relies entirely on bailouts and taxpayer accounting tips.

– Max Keizer, poet tweet. (@ maxkeiser) February 23, 2019

While many pbaded Buffett at the price of Bitcoin as a joke, what Keizer said in an interview with RT weighed much more heavily in the defense of Bitcoin rather than stock market investment.

Gumption must tore the Oracle

Keizer has talked a lot about his dissatisfaction with anything related to traditional investing. He raised the bar on Saturday by specifically attacking Buffett and what was revealed in this letter.

Watch this tweet:

Newsflash: Bitcoin (BTC) exceeds $ 4,000, Max Keizer says Warren Buffet exposes himself as a crook. https://t.co/JgZMdmy2mr

– Max Keizer, poet tweet. (@ maxkeiser) February 23, 2019

In an interview with RT released Sunday, Keizer criticized Buffett, saying that few people would dare to whisper about The Oracle of Omaha. He did not mince words as he blamed Buffett for being partly responsible for corporate misconduct, including Berkshire Hathaway's portfolio.

According to RT, Keizer specifically mentioned Wells Fargo among these companies.

Buffett's fraud is innumerable and goes back several decades.

Share buybacks increase the value of Keizer's Ire

In his letter, Buffett explained that companies that bought back shares were more attractive.

He wrote:

The holdings of American Express held by Berkshire have remained unchanged over the last eight years. At the same time, our stake rose from 12.6% to 17.9% as a result of the Company's redemptions. Last year, Berkshire's $ 6.9 billion portion of American Express was $ 1.2 billion, or about 96% of the $ 1.3 billion we paid for our participation. in the society. As profits increase and outstanding shares decline, homeowners, over time, generally achieve good results.

For Keizer, it seemed like Buffett's equivalent saying "blah, blah, blah, blah, blah".

Regarding share buybacks, or share buybacks from a company, he told RT:

This is pure fraud. Its sole purpose is to commit accounting fraud for the benefit of insiders.

The gold of the mad

In another example of Buffett's opposition to Keizer's opinion, Keizer challenged Buffett's position on gold.

Buffett wrote:

Those who regularly preach evil because of government budget deficits (as I have done regularly for many years) might note that our country's public debt has multiplied by about 400 in the last of my 77 years. years. That's 40,000%! Suppose you forecast this rise and panicked at the prospect of uncontrollable deficits and a worthless currency. To "protect" you, you may have avoided the stock and decided to buy 314 ounces of gold with your $ 114.75.

And Keizer answered:

The real story is to put the gold in context and understand that Buffett's so-called success rests entirely on an intimate relationship with Wall Street and the Fed that gives it virtually unlimited access to a zero-per cent interest-bearing credit.

Buffett has long been a skeptic about bitcoins

Buffett did not mention Bitcoin in the shareholder letter, but that did not stop Keizer from commenting. The Oracle has said it in the past. For example, he calls it "rat poison" and "an badet that creates nothing".

He is right. And there is no bigger rat than Warren Buffett. The world is waking up. Buffett Ponzi schemes are being revealed and the mbades are turning to hard money like bitcoin and gold.

He was asked last year when he would rethink his remarks about Bitcoin, for example by calling him a "real bubble".

He said:

As for crypto-currencies, in general, I can almost say with certainty that they will end badly.

NCC reported Saturday that, within two hours, the price of Bitcoin jumped from $ 3,920 to $ 4,137 by more than 5% against the US dollar. It started to change on Sunday morning, New York time. The price of Bitcoin had fallen below $ 3,800.

READ ALSO: 'The Oracle' Warren Buffett: 'Stay away from Bitcoin'

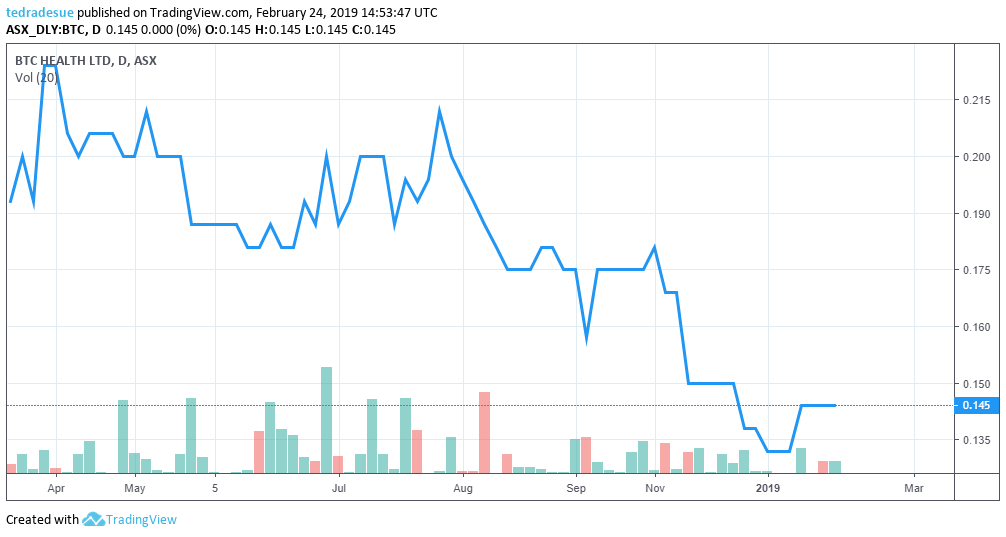

The price of Bitcoin is down. Chart via TradingView

[ad_2]

Source link