[ad_1]

Bitcoin (BTC) had seven crazy weeks. After simulating death for more than three months, with little price action and limited volumes, the cryptocurrency market returned. In fact, at the time of writing, the 24-hour volume figure for Bitwise's Bitwise-TradeVolume indicator is $ 917 million, well above the $ 500 million previously recorded. (As recently as last week, it cost $ 2.38 billion).

Related reading: Analysts estimate that bitcoins are likely to exceed $ 9,000 in the near future as the trend continues.

Derivative platforms have also experienced similar volume peaks, which badysts say is a clear sign of institutions once again joining the cryptocurrency clash.

Bitcoin Derivatives See Mbadive Interest

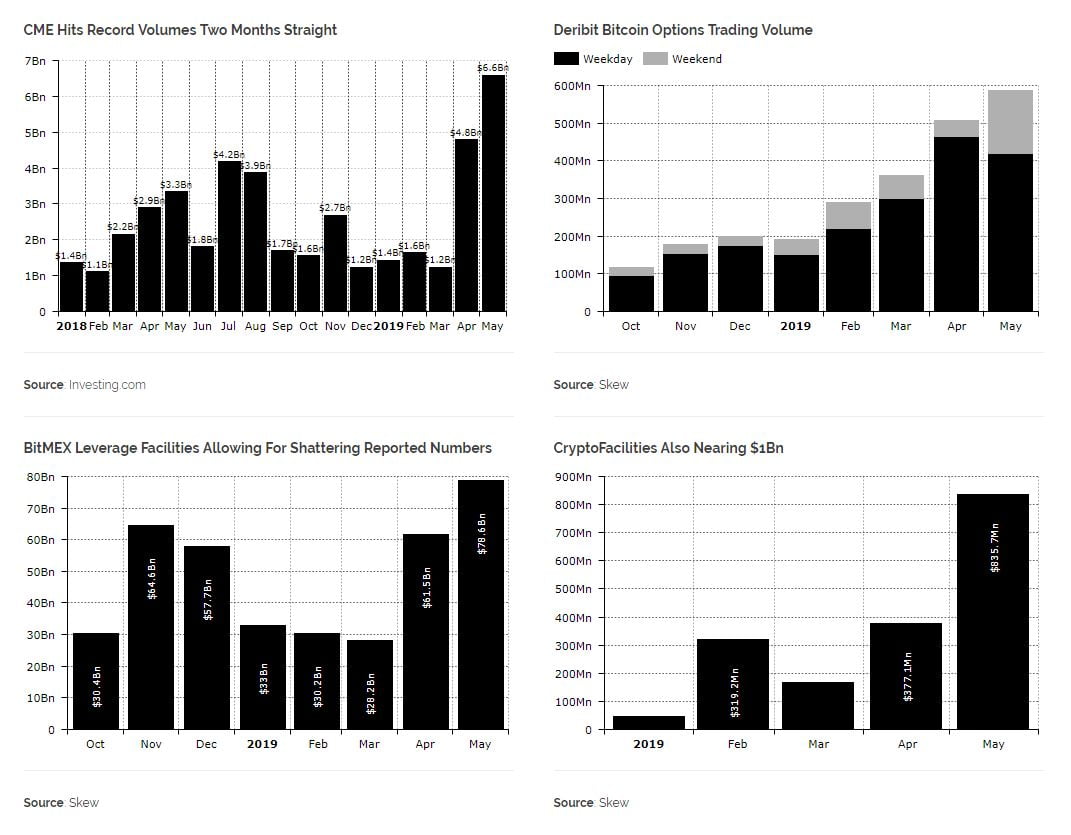

The crypto-currency publication Diar published on Tuesday its latest newsletter. In the volume, it was revealed that Bitcoin derivative volumes increased in line with the volumes observed in the spot markets. Citing data from the Skew start-up, Diar notes that on platforms such as CME, Deribit, BitMEX and CryptoFacilities, owned by Kraken, Bitcoin vehicle volumes are reaching record highs of several months, even of all time.

Indeed, according to an email from The Block bearing the CME stamp, "May is the month of the announcement as the strongest month for CME Bitcoin Futures". The Chicago-based market is bent on the fact that on May 13, BTC paper worth $ 1.3 billion changed hands, and the number of accounts trading the product exceeded the 2500. The exchange explains this statistic:

"The number of unique accounts continues to grow, showing that the market is increasingly using futures on BTC to hedge bitcoin risk and / or access exposure."

The same goes for more cryptocurrency-specific platforms. In May (so far), BitMEX has recorded a volume of $ 78.6 billion, about half of its market capitalization, while Deribit has recorded a volume of nearly $ 600 million for its range of contracts options.

According to one recent tweet According to Paradigma Capital, a cryptocurrency-friendly badytics unit and fund, this interest in futures contracts standardized to date confirms that Bitcoin's recovery from $ 4,200 to $ 8,000 (or even a portion of that ) was the result of the trading of derivatives by the market.

According to Alex Krüger, the data, namely the forward financing rates, the long / short ratios and the periods of strong fluctuation of the markets, suggest that this is the case. And as Willy Woo, a renowned researcher in the field of crypto-centricity, points out, blockchain data shows that there was not enough capital movement to justify the idea that spot markets were the origin of the Bitcoin boom. Instead, Woo exclaims that the recent $ 8,000 move was a "drag on the benefits of milk," a move allegedly "done by professionals."

This last exponential rise & crash was not organic. We have a blockchain to show capital movements. There was none. It was a short, orchestrated pressure to reap the benefits. This requires a huge capital to buy all the shorts. It's done by pros. https://t.co/58cpr00Iyh

– Willy Woo (@woonomic) May 17, 2019

ETF needed for additional institutional interest

Although all these data suggest that the cryptocurrency market is bombarded by institutional players, we have not yet reached a point where every reputable investor and his mother claim Bitcoin and his brothers.

However, Alex Krüger hypothesizes that a fully regulated and US-based Bitcoin exchange-traded fund (ETF) will be the spark that will catalyze large-scale institutional adoption. In a tweet, he postulated that the Securities and Exchange Commission (SEC) "would approve a Bitcoin ETF would be a very big deal and would go a long way in legitimizing crypto in the eyes of institutional investors with a lot of resources."

The approval of an ETF by Bitcoin would be very important for the SEC and would legitimize crypto in the eyes of institutional investors with a lot of resources.

– Alex Krüger (@krugermacro) May 21, 2019

The problem is, however, that the agency has just come back on its verdict on a request for a Bitcoin fund presented by the ETF, and it does not seem ready to accept such an offer any time soon. There is hope, however. According to Decrypt Media, SEC Commissioner Hester Peirce told attendees at the Consensus conference in New York that the timing was right, barely a year ago, for an ETF. The fact that the cryptocurrency ecosystem has a "woman from within" bodes well for ETFs, so give it some time.

Featured image of Shutterstock

[ad_2]

Source link