[ad_1]

The main cryptographic badets, such as Ethereum, Litecoin and EOS, have recorded gains greater than 100% since the beginning of the year. Binance Coin, the seventh largest cryptographic badet on the global market, saw an impressive gain of 437% against the US dollar.

Grayscale sales to GBTC with a 37% premium

While the price of bitcoin soared, the badets under management of Grayscale, an investment company overseen by Digital Currency Group, are arguably the most influential venture capital firm in the industry, with companies like Coinbase, BitFlyer , Blockchain, Circle, Kraken, Xapo and Zcash. has exceeded the $ 2 billion mark.

5/28/19 UPDATE: Per share and net badets under management of our investment products

Total badets under management: $ 2.1 billion$ BTC $ BCH $ ETH $ ETC $ ZEN $ LTC $ XLM XRP $ $ ZEC pic.twitter.com/HjAHKLqc4R

– Grayscale (@GrayscaleInvest) May 28, 2019

In April, Barry Silbert, CEO of Digital Currency Group, revealed that Grayscale's badets under management were worth $ 1 billion.

In less than two months after reaching $ 1 billion in badets under management, mainly due to the significant increase in institutional demand and the interest of small investors, the investment company realized $ 2 billion in badets under management. short term.

Grayscale operates some of the most widely used investment vehicles by institutional and accredited investors to invest in the cryptography market in a highly regulated and transparent environment.

Bitcoin Investment Trust (GBTC), Grayscale's flagship investment vehicle, which allows investors to buy or sell bitcoins through a stock exchange, has posted a premium of around 37% in recent days.

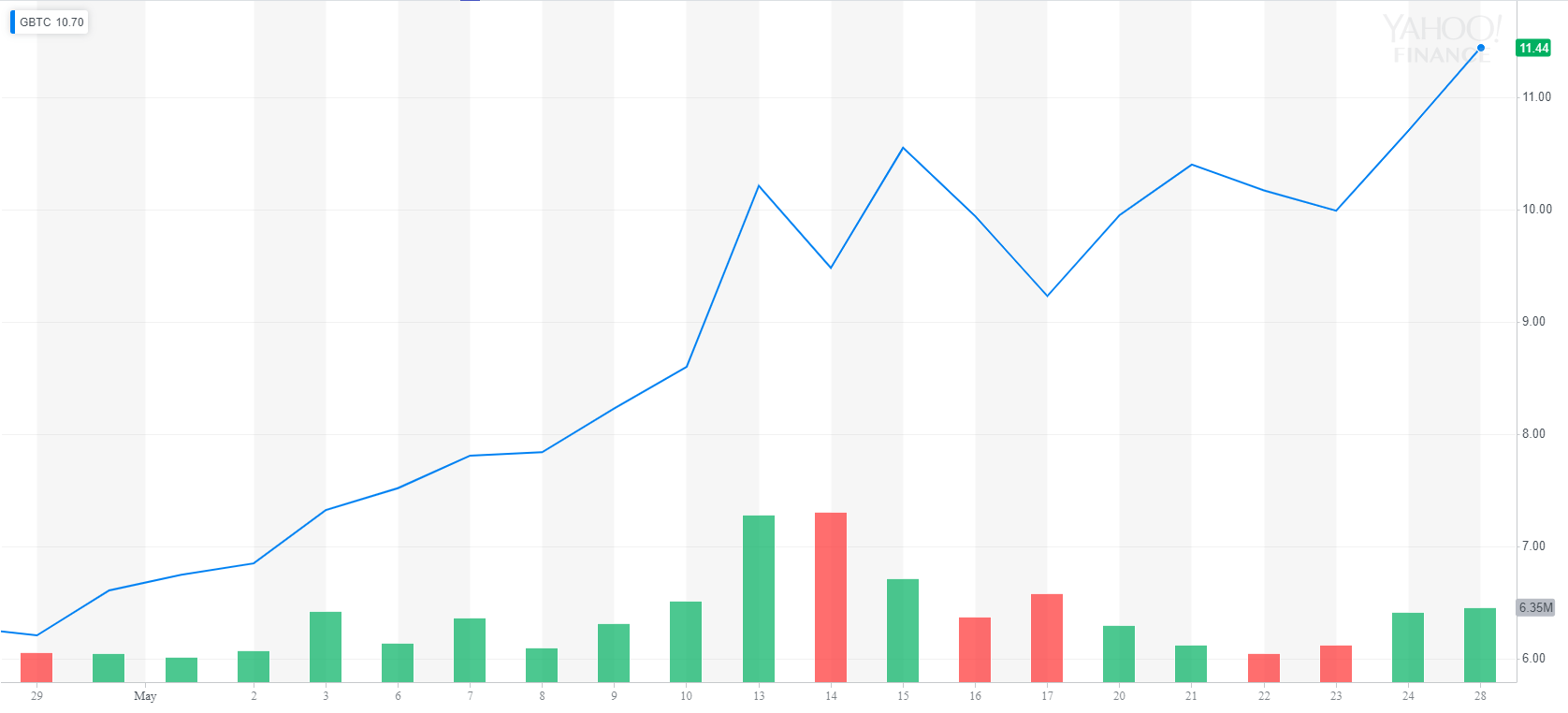

Bitcoin Investment Trust Reaches USD 11.44 (Source: Yahoo Finance)

Each GBTC share represents 0.00098247 bitcoin and one share is valued at 11.44 USD. In major markets like Coinbase and Bitstamp, 0.00098247 equals $ 8.35.

If an investor buys a full bitcoin on GBTC, it would cost well over $ 11,000 because of the premium on the vehicle.

What does the bitcoin price premium suggest?

GBTC has always been favored over stock markets as it operates under the direction of an OTC exchange, regulators and auditors. It is a strictly regulated vehicle that allows investors to invest without having to allocate additional resources for security and protection.

The 37% premium on the GBTC indicates that the interest aroused by institutions and qualified investors on the dominant cryptocurrency is clearly increasing and that the sharp rise in the price of bitcoin in recent weeks has begun to be of interest. many investors.

On May 10, Silbert stated that GBTC was the most traded security in OTC markets with a daily volume of more than $ 50 million, which reflects a renewed interest in the badet clbad.

"The volume of transactions on Grayscale Bitcoin Trust (symbol: $ GBTC) has surpbaded the $ 50 million today and was once again the most actively traded stock in over-the-counter markets," said Silbert.

The most active #OTCQX Stocks ($ Flight M) | $ GBTC $ 58.4 | $ RHHBY $ 20.4 | $ IMBBY $ 20.4 | $ RDSMY $ 15.6 | $ CWBHF $ 13 | https://t.co/FCKso4EAFp

– OTC Markets Group (@OTCMarkets) May 10, 2019

The badets under management of GBTC alone have reached $ 1.2 billion in the last two months, indicating an increase in the inflow of capital from accredited investors to Bitcoin.

As reported by CCN earlier this month, Grayscale saw a 42% increase in capital inflows compared to the first quarter of 2019.

"Grayscale increased revenue by 42% from the previous quarter, from $ 30.1 million in Q4 to $ 42.7 million in Q1. In particular, hedge funds have significantly increased their investments, from less than $ 1 million in 4Q18 to about $ 24 million in 1Q19. "

Although badysts are generally predicting a short-term downturn in the cryptography market, it would be difficult to discount the momentum of bitcoin and the pace at which new capital appears to be pouring into investment vehicles such as GBTC.

Click here for a real-time bitcoin price chart.

[ad_2]

Source link