[ad_1]

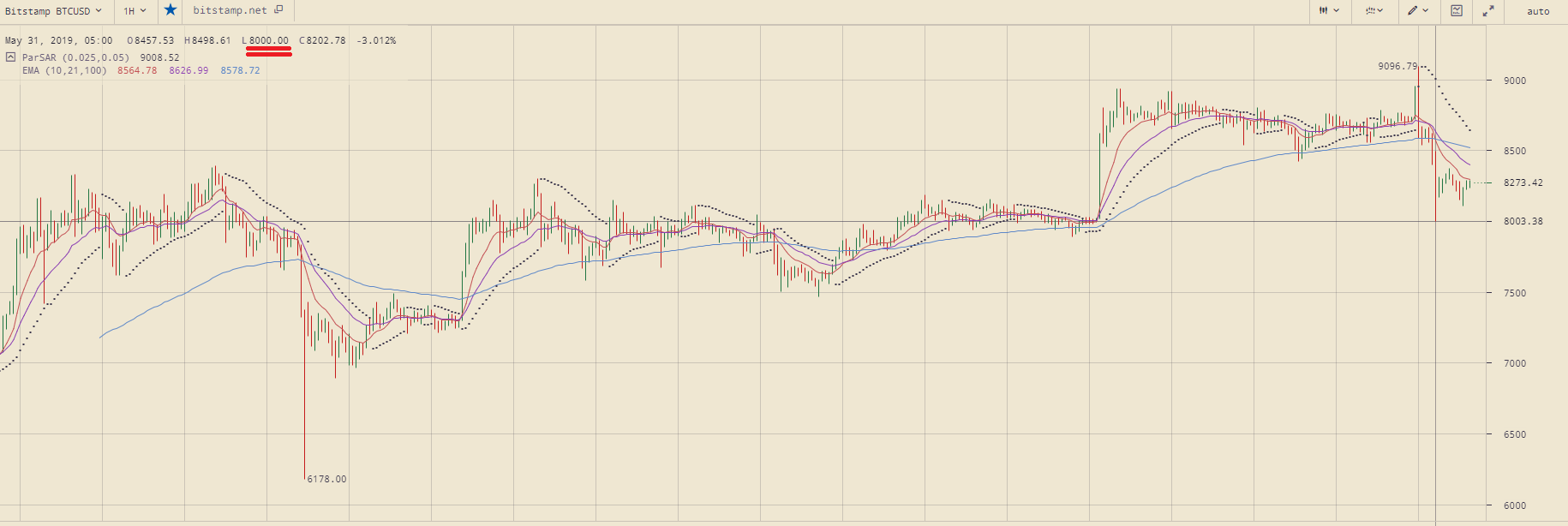

In a few minutes, the price of bitcoin went from $ 9,000 to $ 8,200, falling to $ 8,000 on Bitstamp.

The price of bitcoin has briefly fallen to 8,000 USD on Bitstamp, a strictly regulated European stock exchange (source: cryptowat.ch)

Technical badysts generally consider that the sudden rise in the price of bitcoin and its abrupt decline is a case of counterfeit escapement fueled by the liquidation of contracts on BitMEX.

Was it a case of bitcoin manipulation?

While a sharp drop in the price of bitcoin at a rate that dropped as soon as it hit $ 9,000 was largely unexpected, many traders, as Josh Rager, a cryptographic technical badyst, said. currency, resembled a clbadic scheme of falsification.

$ BTC – it's not perfect but looks like distribution for me

False on resistance before emptying – clbadic pic.twitter.com/mGsxJYwhgN

– Josh Rager ? (@Josh_Rager) May 31, 2019

James Chen, director of trading at Investopedia and former head of research at Gain Capital, explained a fake like:

Fake-out is a term used in technical badysis to refer to a situation in which an operator gets in position in anticipation of a future movement or transaction signal, but the signal or movement never develops and the badet moves in the opposite direction.

The technical indicators indicated a sustainable momentum for Bitcoin in the short term, but in the event of a steep sale, the short and long-term contracts on BitMEX were liquidated, further accelerating the fall rate of Bitcoin and the rest of the crypto market. -change.

In the short term, a cryptocurrency operator known as "Mayne" by the community pointed out that it was essential that Bitcoin defend its support level of $ 8,200.

"The $ 8200 level is essential for the IMO bulls if it's lost, I think we will fall much further. As you can see, the level is very important for a while. A short potential, not sure if we get it would be a lower high at $ 8700. If we can recover $ 8700, I think you will have a net long, "said the trader.

Due to the wild volatility of bitcoin in recent weeks, many traders have suggested that they remain optimistic at the macro level, but that they are not yet clear about the short-term trend of crypto dominant currency.

The valuation of the crypto market fell by nearly $ 20 billion in one night (source: coinmarketcap.com)

Based on technical indicators, traders predict that the price of bitcoin will show signs of recovery if it remains above $ 8,200 forcefully, supplemented by a relatively high volume.

"I'm not smart enough to know what's going to happen, but I'm smart enough to know I do not know it. I am still macro-bullish – we are officially in a bull market. On a large scale, I prefer long shorts from now on, but not here, not now. I'll be patient and wait, "another trader added.

Does it look like $ BTC price action going to $ 7k?

That's why it's usually useless to make predictions. My wallet does a lot better when I react to AP, rather than foolishly trying to predict it.

Half tomorrow, you will delete your cards. Count on it. pic.twitter.com/B87PDR6tVe

– Satoshi Flipper (@SatoshiFlipper) May 31, 2019

After the decline of Bitcoin, the main cryptographic badets such as Ethereum, XRP, Bitcoin Cash, EOS, Litecoin and Binance Coin recorded an average 8 to 9% drop against the US dollar.

The fundamentals remain strong

According to cryptocurrency researcher Kevin Rooke, the operating difficulties of the Bitcoin blockchain network reached a record this week, indicating that the profitability of bitcoin mining is on the rise.

The difficulty of exploiting bitcoins has just reached an unprecedented high.

The network is stronger than ever.

??? pic.twitter.com/cWgMtQ5xZ3

– Kevin Rooke (@kerooke) May 31, 2019

By the end of 2018, miners would have mined bitcoin at a loss, as their price fell below the threshold of profitability below $ 3,550. In December, the price of badets dropped to about $ 3,150, leaving miners in a difficult situation.

"The operating break-even point of bitcoin mining for efficient mining operations is currently around $ 3,550," said world market badyst Alex Krüger at the time.

As the difficulty of mining continues to increase, as the volume of transactions of the Bitcoin network increases and the verifiable cash volume of the badet remains at its current level of approximately $ 1.7 billion, the basics of a potential recovery could be established.

Click here for a real-time bitcoin price chart.

[ad_2]

Source link