[ad_1]

The bull market of Bitcoin was a bubble that burst in 2018, but the "painful" event had a major advantage: it attracted a lot of money and talent for the booming sector. This is the appreciation of Matt Hougan, global research manager at Bitwise, creator of the world's first cryptocurrency index fund.

"It was a mbadive race and a mbadive withdrawal," Hougan told Barry Ritholtz of Bloomberg on his podcast. "[It was a] total bubble. "

Although the financial "bubbles" naturally have a negative connotation, Mr. Hougan said that the bitcoin bubble had sparked a keen interest from the media for the blockchain and the crypto market.

In addition, soaring crypto prices have attracted a formidable pool of talent in the industry that otherwise would not have had the chance to run without the spectacular daily headlines of 2017.

Hougan: The Bitcoin bubble looks like the tech bubble

Matt Hougan, director of research at the bit level: Bitcoin was a bubble. (screen capture)

In this sense, Hougan said the bitcoin bubble was no different from the Internet bubble from 1996 to 2001, which conferred collateral benefits similar to the fledgling technology industry of the time.

"That's what happened with the Internet, which has attracted a lot of talent. This has brought a lot of capital and interest to development for the ecosystem. "

"So I think that interesting things will come out of this. But yes, it was a difficult year in 2018. "

"I think [bitcoin] is the next dotcom. Remember, the Internet bubble created Pets.com, but also Amazon. "

Hougan also said that 95% of existing crypto-currencies would die out, which is good for the market.

"There are 2,000 crypto-currencies in the world. 95% of them are useless and will die a painful death. The faster it happens, the better.

"But from these" ashes "will merge important things, just as the ashes of the dotcom have emerged from Amazon, Google and Facebook, etc."

Hougan believes that it is important for the cryptography market to eliminate all fake virtual currencies so that the most worthy can survive and thrive.

Bitcoin is the gold of the new millenium

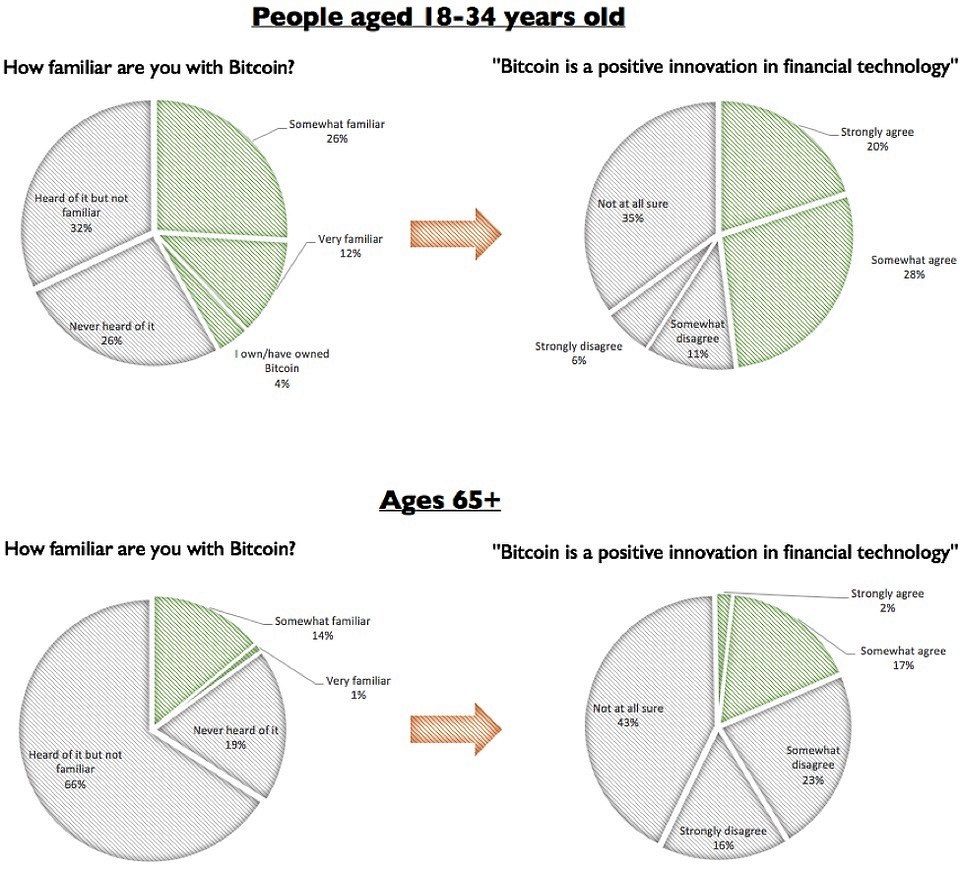

Hougan also said that bitcoin was the golden version of the millennial generation. He cited recent surveys showing that the Millennials (born between 1981 and 1996) had a favorable view of crypto-currencies compared to baby boomers (people born between 1946 and 1964).

"Every generation has an badet that they love or a way to make themselves known that they love."

"The biggest generation likes gold, so people loved active mutual funds. Gen X loved hedge funds. Millennials love crypto.

Hougan attributes this to the decentralized nature of crypto, which removes the middle man. He thinks it's particularly appealing to the younger generation.

Hougan's optimistic view of Generation Y contrasts with that of CNBC badyst Scott Nations, Scott Nations, who says Generation Y is too silly to realize that bitcoin is a bubble they should avoid as Plague.

(Blockchain Capital /Twitter)

Matt Hougan: Do not lose perspective

Regarding the rapid fluctuations in daily prices on the crypto market, Hougan noted that large heavyweights such as Amazon, Apple and GE have all weathered the huge swings in stock markets.

As a result, he does not pay too much attention to the constant hype that Bitcoin is dead. He says that this whole cyclical shake is part of the course, so everyone has to calm down.

"Bitcoins have had six or seven withdrawals, 70% and more in the past. And each of these paved the way for a new rally. "

"I'm not saying that this will necessarily happen here, but it's 70% less, it's increased by 300% in the last two years, so it depends on your perspective."

Institutional investments will come

Like bull Mike Novogratz, Matt Hougan is convinced that the money institutions will eventually flow into the market. It's just a matter of time.

To support this statement, Hougan said Fidelity was developing its blockchain unit to facilitate the adoption of crypto by the general public.

"Fidelity hires up to 150 people to allow institutional investors to buy a crypto and store it under a name they trust. One of the biggest brands of the future. "

"We know we had interviews with 2,000 institutional and financial advisers last year. Crypto arouses considerable interest. They want good ways to make themselves known.

"Keep the course": Bitcoin billionaire Bull, Mike Novogratz, gives tips for the Bitter Crypto Winter https://t.co/cRQ1FfzutU

– CCN.com (@CryptoCoinsNews) February 3, 2019

Featured image of Shutterstock

[ad_2]

Source link