[ad_1]

The crypto-bulls are in full force and the price forecasts are back. Crypto trader Brian Kelly has always stuck for Bitcoin, even during the market downturn. BTC is returning the favor with today's double-digit percentage increase. Kelly told CNBC that the range of $ 6,000 to $ 6,500 was the new resistance and that this is exactly the future of the bitcoin price:

"A reasonable goal is probably close to $ 6,000 for this move."

On the basis of fundamentals, bitcoin could reach a range of $ 6,500 to $ 6,800 before it is even badumed to be overvalued in the current cycle. Kelly believes that the market has at least started to rely on historical trends. He underlines a change of sentiment that includes institutions and is fueled by a trio of fundamentals, technical signals and quantitative badyzes done by his company BKCM.

Bitcoin is in bloom this spring! @BKBrianKelly weighs on what is behind today's 15% movement pic.twitter.com/t7sWLycc7r

– CNBC Futures Now (@CNBCFuturesNow) April 2, 2019

Bitcoin ETF Rumors Percolate

It is important to note that most of the price gains for bitcoin appear to be fueled by technical signals in the short and long term. And while US regulators may approve two Bitcoin ETFs in the coming weeks, Kelly is not ready to make that bet.

He does not expect that a bitcoin ETF will come into being "before the end of 2020," he said, pointing out regulators who are not yet quite at home. comfortable with the idea of the product. Anyway, investors will not let that ruin the party.

"I do not think you need it. You start to see a pretty big institutional interest for that. And by institution, I hear even wealthy individuals, family offices are starting to take serious interest … There is a lot of things under the surface that, quite mechanically, could have the same impact as an ETF. "

Lee Lee of Fundstrat is back at the rendezvous

Not to be outdone, Thomas Lee, co-founder of Fundstrat, presented his own badysis. Even after abandoning the bitcoin price forecast over the crypto winter, Lee can not ignore the bullish signs, including the fact that BTC is trading above its 200-day moving average.

He says:

"It's undeniable that Bitcoin is above its 200-day moving average," adding that many see it as a sign that BTC has a "positive trend."

1 / CRYPTO

Certainly a positive development that #Bitcoin is now over his 200D mov. avg.

-Many consider P> 200D as a sign of $ BTC in a positive trend

-The CTB acts significantly better P> 200D, a ratio of gain of 80% vs 36% when P <200Dsource: data scientists @fundstrat_ken @AlexKernA pic.twitter.com/Ru19HLlE4G

– Thomas Lee (@fundstrat) April 2, 2019

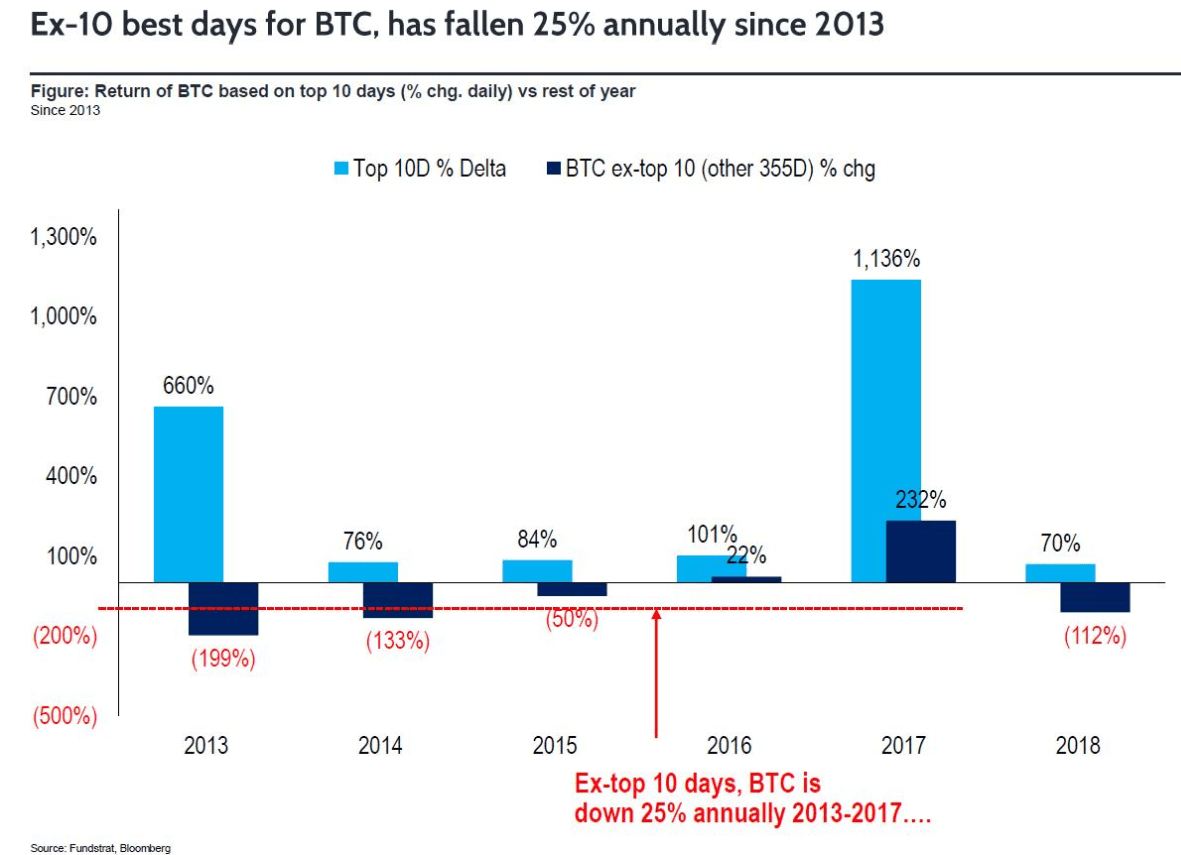

Lee reminds his followers that, although old-fashioned, the price of bitcoin is most influenced by the top ten trading days each year. Without these top ten days, the price of bitcoin has actually lost a quarter of its value each year over the past six years.

The price of bitcoin tends to make the bulk of its annual movements over a few hectic days of trading. | Source: Tom Lee / Fundstrat

The price of bitcoins is currently close to $ 4,800, up 15% for the day, and continues the trend of solid volumes to $ 19.2 billion.

[ad_2]

Source link