[ad_1]

In our recent badysis of the BTC price two days ago, we said that "there is no badet of this type that is only pointing upwards, corrections allow to build a steady growth".

As a crypto trafficker, you can never know when the Bears will pull the trigger and lower the price after the bullish movement. In less than 8 hours, Bitcoin recorded a new high for 2019 of around $ 9,100 (Bitstamp) and quickly reversed the trend to reach the $ 8,000 support area (a loss of $ 1,100).

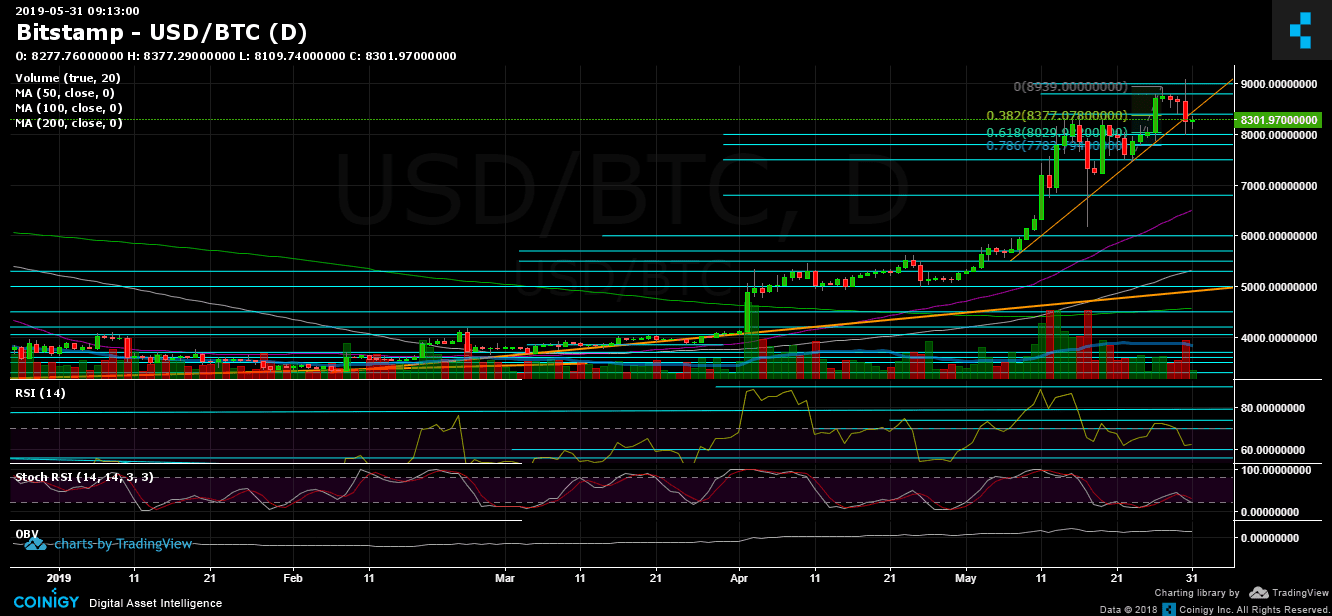

As mentioned above, the recent parabolic move from $ 6,000 to $ 9,000 has just ordered the violent correction. Will $ 8000 remain? Time will tell us. But otherwise, that does not mean that the markets become bearish again. $ 8,000 is considered a very strong support area, with the Fibonacci retracement level of 61.8% (1-day chart).

Two red flags

One thing I would like to point out is the negative divergence in the RSI of the daily chart. This type of training indicates that strong hands are not the ones that currently control the markets.

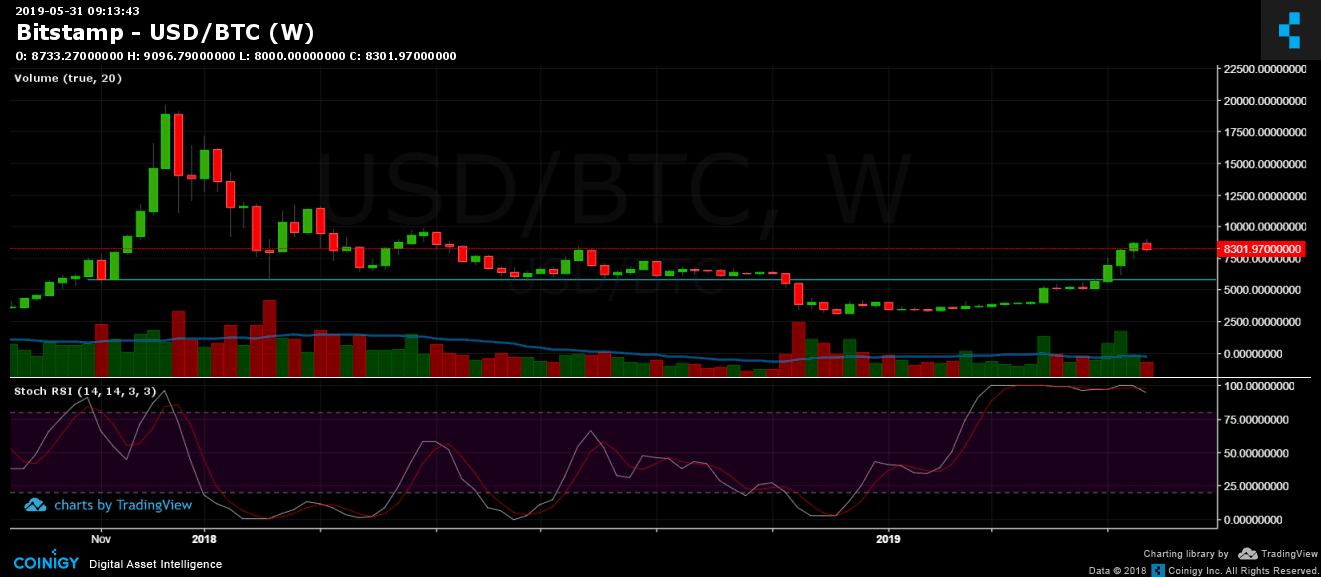

The second thing is the following weekly chart: As can be seen, the important oscillator, the stochastic RSI, had reversed. However, do not enter the bearish territory but watch it closely in June. The last time we saw such a cross took place in December 2017, while Bitcoin traded around $ 17,000.

Total market capital: $ 262 billion

Market capitalization of Bitcoin: 147 billion dollars

Dominance of BTC: 56.3%

Looking at the 1 day and 4 hour charts

– Support / Resistance:

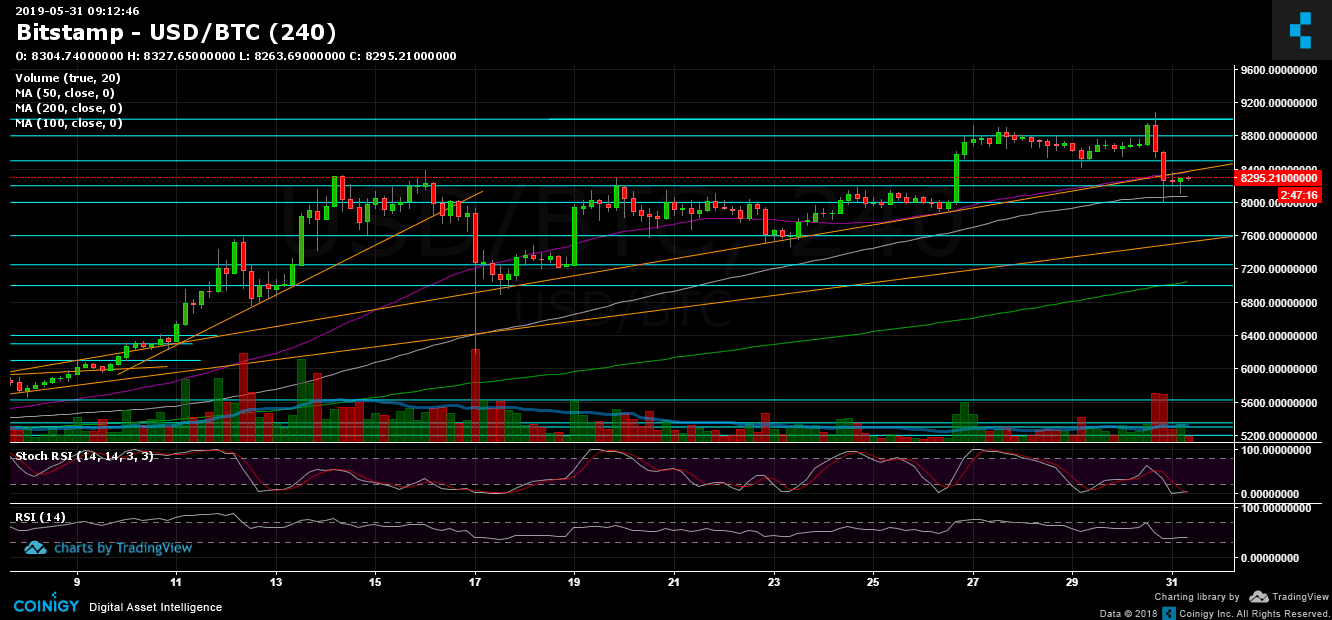

As a result of the $ 8400 breakdown, the next major support is $ 8200. Below are $ 8,000, $ 7800 and $ 7600. The last is the lowest of the past week, as well as the 4-hour MA-100 and the medium-term uptrend line (shown on the 4-hour chart). Lower is $ 7250 and $ 7000.

From there, the closest resistance to last week's double top at $ 8400. Above are $ 8,500, then the resistance zone of $ 8,800 to $ 9,000. The area between $ 9200 and $ 9300 is located above the highest zone of May 2018, before reaching the area between $ 9700 and $ 9800. This is the last hurdle before BTC reaches $ 10,000.

– Volume of trade: yesterday's trade was followed by a very high volume, the highest volume in two weeks. We pointed out that the recent rise last week was followed by a drop in volume (a small number of buyers).

– RSI of the daily chart: the RSI is now facing a significant support level of 60. The Bulls hope to find support here. However, the RSI seems to be losing momentum.

– BitFinex short open positions: since our recent price badysis, there has not been much change, while the number of open short positions is around 20.4 000 BTC positions.

BitStamp BTC / USD Chart over 4 hours

BTC / USD BitStamp 1 Day Chart

CryptoPotato video channel

[ad_2]

Source link