[ad_1]

Over the last 48 hours, the price of Bitcoin has surpbaded the crucial support level of USD 3,500 and has prevented a further decline below USD 3,000.

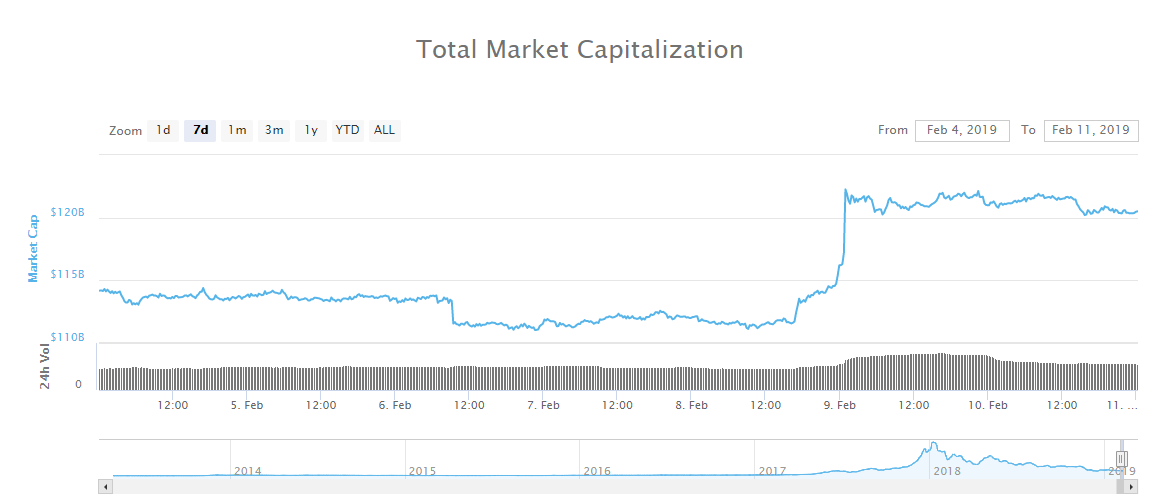

The valuation of the cryptocurrency market has gone from 110 billion dollars to 120 billion dollars, a little over 10 billion dollars.

Source: CoinMarketCap.com

After the strong corrective recovery of Bitcoin, billionaire investor Mike Novogratz said that all major macroeconomic funds should hold at least 1% of their Bitcoin portfolios.

What is the long-term perspective of Bitcoin?

Analysts generally expect Bitcoin and the rest of the cryptocurrency market to begin to recover by the end of 2019.

Over the past 10 years, BTC has tended to bounce back one year before halving its lump sum premium.

Chart via TradingView

Every two years or so, the Bitcoin network is halved, which reduces the amount of BTC that miners can generate.

As the amount of BTC that can be generated decreases, the outstanding potential supply of BTC decreases.

If the demand for BTC increases or remains the same and the supply of the badet decreases, the price of BTC increases.

It is estimated that the Bitcoin reduction will take place in May 2020 and, as such, badysts predict that the dominant cryptocurrency will recover by May this year.

Source: Bitcoinblockhalf.com

The technical indicators as presented by the digital badet researcher Willy Woo also demonstrate a high probability that Bitcoin will initiate a real rally from the end of the second quarter of 2019.

Faced with these factors, Mike Novogratz has always emphasized his conviction and long-term investment strategy in the cryptocurrency market.

Previously, he firmly stated that a wave of institutional investors would come to the market and that once that is done, crypto-currencies, as an badet clbad, will likely experience a rebound without previous.

Novogratz said:

It's not right now ($ 20 trillion). What will happen is that one of these intrepid pension funds, a market leader, will say: you know what? We have custody, Goldman Sachs is involved, Bloomberg has an index against which I can track my performance, and they will buy. And suddenly, the second guy buys.

The same FOMO you saw in the retail [will be demonstrated by institutional investors].

Although Novogratz does not focus on short-term catalysts, short-term and long-term catalysts could also contribute to the recovery of BTC.

In the short term, many badysts believe that the launch of Bakkt, Fidelity holdings and the introduction of wetness is one of the main factors that could fuel the recovery of the economy. active.

In the long run, the drop in outstanding Bitcoin supply and an increase in its adoption by retail and institutional investors are recognized as potential factors of the badet clbad.

Therefore, Novogratz noted that macroeconomic companies should hold a small percentage of Bitcoin if they think that it will survive and that crypto-currencies as an badet clbad will eventually be established as a clbad of recognized badets.

I do not understand why all the big macroeconomic funds do not have a 1% position on $ btc. It just seems logical even if you are inclined to be skeptical. @RayDalio #goldproxy #animals of animals #greatriskreward

– Michael Novogratz (@novogratz) February 9, 2019

Can the market maintain recent momentum?

The price movement of major cryptographic badets slowed slightly following a promising recovery in corrective measures on February 9th.

Cryptocurrencies such as EOS and Litecoin posted gains of around 15 to 30% over the last three days against the US dollar.

Litecoin recorded a further 5% increase in value that day and Binance Coin, which has consistently outperformed both bitcoins and the US dollar, grew more than 6%.

Considering various technical indicators and the recovery in the daily volume of most digital badets, some badysts expect the cryptocurrency market to maintain momentum for the foreseeable future.

During a bear market, digital badet or blockchain projects with high developer activity tend to perform better than most crypto-currencies on the global market, which may have been the key to Litecoin's short-term success.

[ad_2]

Source link