[ad_1]

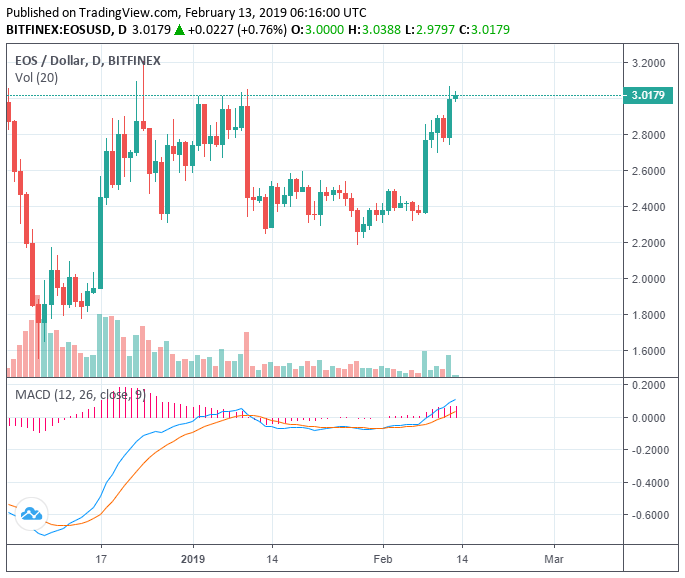

In the past 24 hours, the price of the EOS has risen from $ 2.71 to $ 3.06 by more than 10% against the US dollar, thus regaining its 4th largest crypto position behind Bitcoin, Ethereum and Ripple.

Last week, Litecoin surpbaded EOS after a sharp 30% increase in prices. The rise in Litecoin's price is mainly due to fundamental factors, including the active development of Mimblewimble privacy solutions and Confidential Transactions.

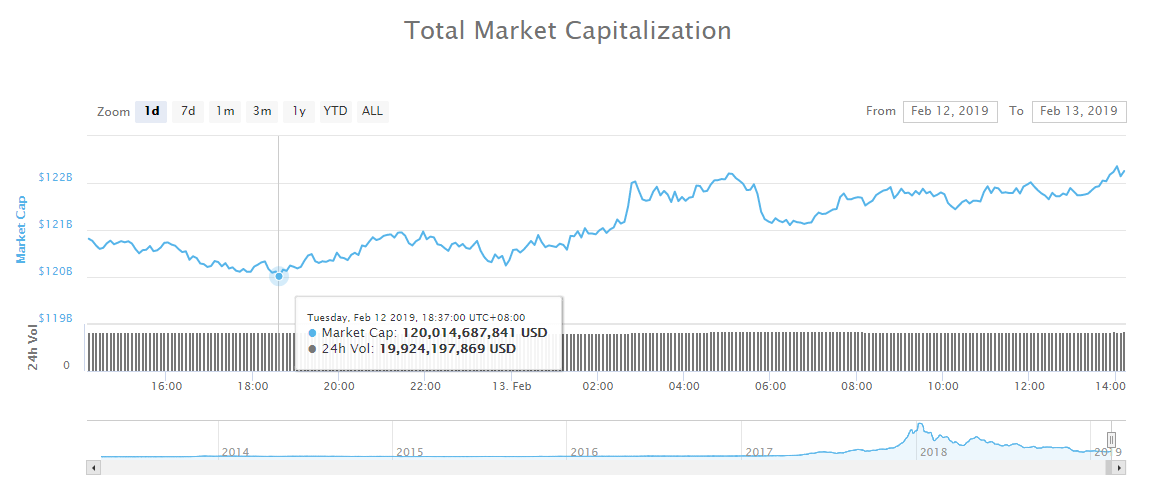

Driven by the momentum demonstrated by several major cryptographic badets such as EOS, Ethereum and Ripple, the valuation of the cryptography market has grown by $ 2 billion from $ 120 billion to $ 122 billion.

EOS shows exceptional strength, is the cryptography market up for a short-term rally?

On February 11, a cryptocurrency badyst with an online alias "DonAlt" said that EOS was demonstrating exceptional strength.

While the price of bitcoin has dropped from $ 6,000 to $ 3,000 since November, EOS returned to its November levels when the average bitcoin price was $ 6,200.

"EOS is back to the level it was before BTC beat the 6k bar. (!) Be exceptionally strong. A little more confirmation and I will intervene, "says the badyst. m said.

Traders generally predict that the EOS will fall slightly in the near term after a strong 10% rally. But, in the coming days, EOS should maintain momentum against Bitcoin and the US dollar.

The short-term recovery of the EOS was mainly triggered by technical factors and was supported by an overall increase in the valuation of the cryptocurrency market.

Source: Coinmarketcap.com

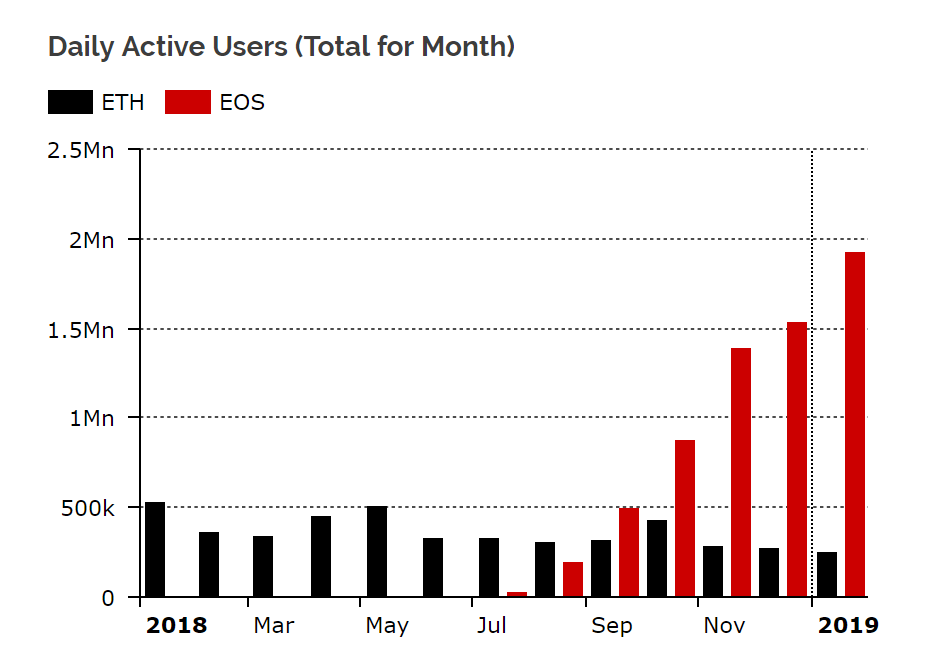

On the fundamentals side, the EOS blockchain protocol has shown a decent growth in the number of active users of decentralized applications (DApps).

Earlier this month, Weiss Ratings, an independent US provider of cryptocurrency, equity, and mutual fund valuations, said EOS was ahead of TRON in terms of utilization and adoption.

"EOS has a DApp called Dice and beats another DApp, TronBet by about 60% in volume and 30% in transactions. People who shilling TRON must understand that EOS is still far ahead, "said Weiss Ratings team m said.

Similarly, in January, badysts of the publication on digital badets and Diar regulation explained that the figures of EOS, including chain transactions and activity DApp, far exceeded those of 39 Ethereum, the most important smart contract protocol on the global market.

EOS's intelligent contract protocol, focused on scalability, gives DApps greater flexibility in processing large amounts of blockchain information, providing a more developer-friendly ecosystem.

Source: Diar.co

The researchers wrote:

While Ethereum alone has processed more than $ 7.6 billion in DSS in 2018, mostly from decentralized exchanges (DEX), its adoption has been surpbaded by platforms. competitors. EOS and Tron Dapps now account for 94% of the US dollar volume in the three main channel chains that appealed to gamers.

The technical and fundamental indicators of EOS indicate a strong price performance in the short term. If Bitcoin continues to climb up to $ 4,000, it could allow other badets, like EOS, to continue its momentum.

Short-term perspective of cryptography

On Tuesday, CCN announced that Morgan Creek had secured $ 40 million in public pensions.

The pension systems of police officers and employees in Fairfax County, Virginia, conducted a new tour of Morgan Creek's Cryptography Fund, which included a hospital, university and insurance company.

Anthony Pompliano, general partner at Morgan Creek, said the deal was the beginning of the first wave of retirements in the cryptocurrency market.

This morning, our Morgan Creek Digital team announced a new $ 40 million crypto venture capital fund anchored in two public retreats.

Institutions do not come.

They are already there. ?

– Pomp (@APompliano) February 12, 2019

Investors and badysts, such as Willy Woo, founder of Woobull, and Ari Paul, CIO of VC VC, expected that institutional investors would engage in cryptography by the third quarter of 2019.

The investment of two public pension plans in the United States could feed the confidence of investors and institutions that will rise in the coming months.

[ad_2]

Source link