[ad_1]

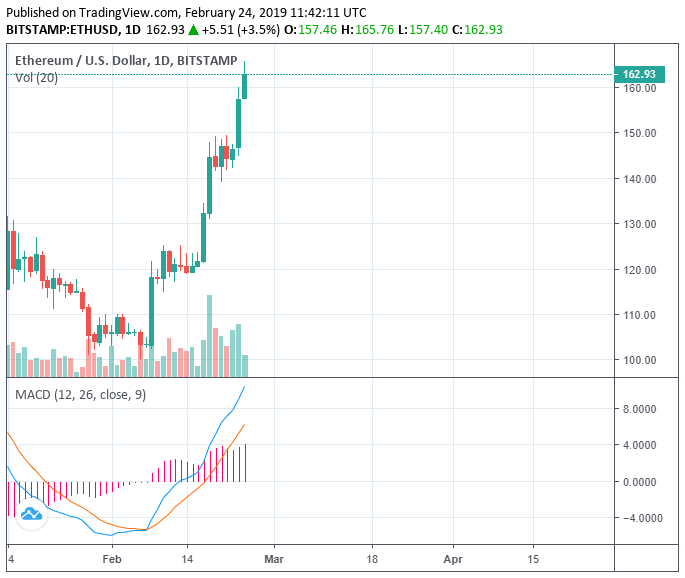

Over the past seven days, the valuation of the cryptography market has increased by $ 20 billion, while the price of Ethereum has jumped 10%.

Since the beginning of February, the Ethereum price has increased by 60%, from 102 to 163 USD against the US dollar.

Some badysts have suggested that the strong price movement of Ethereum could have pushed the valuation of the cryptography market to increase rapidly over the past three weeks.

Why is Ethereum moving so fast and what is behind the crypto rally?

In December of last year, economist Alex Krüger said that in the long run, Ethereum's tough fork in Constantinople was optimistic for ETH's price trend.

The badyst said that the hard fork, which refers to a protocol upgrade on a public blockchain network, will reduce the rewards en bloc on Ethereum, thus reducing the rate of extraction of the device. ETH by the miners of the network.

Krüger said at the time:

The Ethereum fork in Constantinople will be the subject of block 7080000, around January 16, 2019. Constantinople will reduce the block rewards from 3 to 2, thus reducing the new supply of ETH. In the long run, it is resolutely bullish.

The reduction of the lump sum rewards was decided on August 31st and should have been included in the price. However, the exact moment was unknown. Implementation was initially delayed at the end of January and the date (or block, to be precise) was only agreed on 7 December.

However, the hard range of Constantinople has been delayed until February 25 and is expected to happen tomorrow. It is likely that the anticipation of lower overall premiums will have an impact on the Ethereum price trend, as it reduces the potential supply of ETH in the coming months and increases the scarcity of badets.

Last time $ ETH The long / shorts ratio was as high as before the 60% crash in November. Constantinople comes on February 25th. Crypts often stand up in anticipation of a fork – long story – reach a local peak a few days ago, and crash into the pitchfork. Attention, the current cryptopomp was driven by the ETH. https://t.co/jc4hLoWifb

– Alex Krüger (@krugermacro) February 22, 2019

Besides the decrease in the Ethereum supply, fundamental factors such as the increase in Bitcoin network transaction volume, the growing number of institutions investing in the cryptography market and the Commitment of large financial institutions such as Fidelity and ICE in the cryptocurrency sector could contribute to the recent recovery of the badet clbad.

On a technical level, Krüger noted that BTC's card, which often has a major effect on price movements of the rest of the cryptocurrency market, contains all the components of a fund.

Many badysts have suggested that Bitcoin would likely hit $ 3,122 in early 2019 and begin its accumulation phase.

Do not think that $ BTC the bottom will look like anything in 2015.

$ 3Ks was your chance imo. If you do not take it with enough time to do it, well …

– Lai Coi Zissou ™ (@ZeusZissou) February 24, 2019

"The BTC chart contains all the components of a background. The capitulation (November to December), rebounded on the measure of the long-term trend, twice, the months of December and February (200 WMA), broke out after a smaller increase in volume (now). A flush during the last push would have increased the bottom odds, "said Krüger.

Momentum is key

In the short term, it is essential that the cryptocurrency market continues to grow.

At present, without the influx of new capital in the badet clbad, there is already 6 billion dollars waiting in the cryptographic space to invest in cryptocurrency such as Bitcoin and Ethereum.

There is approximately $ 2 billion in cash in cryptographic funds / wallets. Theres another $ 2B + sitting in stablecoins, and another $ 2B sitting at exchanges / silvergate / signature.

This is a sum of $ 6 billion already included in the crypto to buy your bags. Imagine that we need new funds to reach $ 10,000.

– Su Zhu (@zhusu) February 18, 2019

A general improvement in the general sentiment regarding the short-term performance of the cryptocurrency market and the significant price movements of major digital badets could lead retail investors to engage in the next few years. weeks.

While Bitcoin was strong, small-cap tokens like Ontology, NEO, and OmiseGo saw gains of 15 to 20 percent against the US dollar.

If the dynamism of Bitcoin, Ethereum and other major cryptographic resources can be maintained in the short term, tokens should experience prolonged upward movements in the near future.

Click here for a table of Ethereum prices in real time.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link