[ad_1]

Binance Coin, a popular utility chip issued by Binance, was one of the most successful crypto-currencies of 2019. Despite BNB's impressive performance in the first quarter, Nick Tomaino, founder of Crypto Venture Fund 1confirmation, believes that is the right time for short selling.

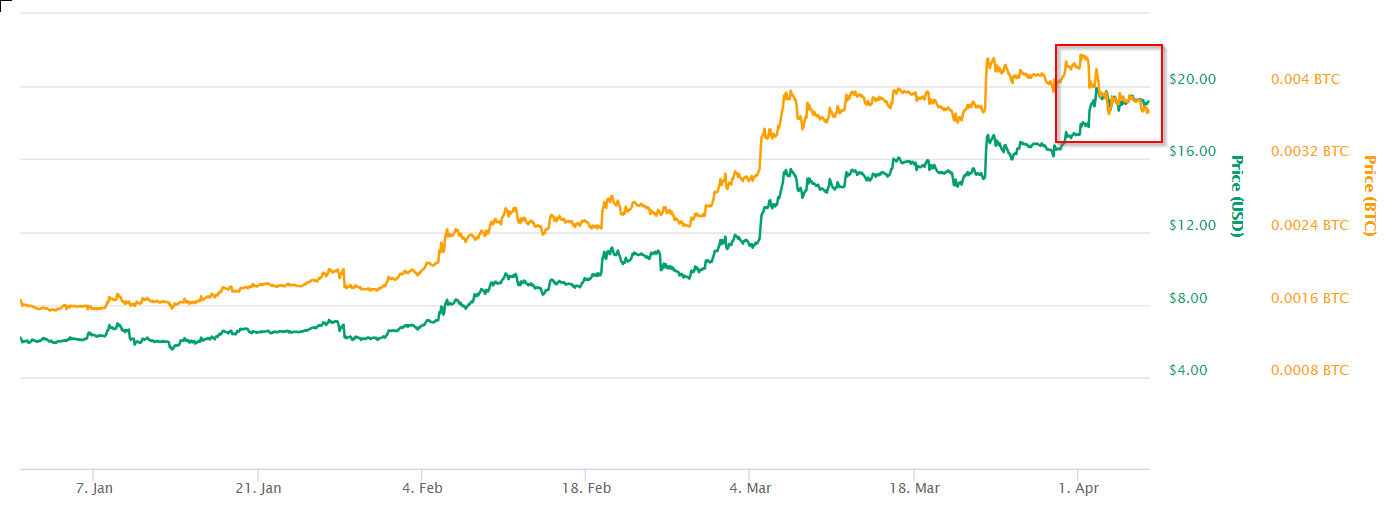

In the first three months of 2019, Binance Coin (BNB) was arguably the best performing cryptocurrency. From the beginning of January to the end of March, the NBB rose from USD 6.02 to USD 17.29 on the basis of CoinMarketCap aggregated data, an increase of 187%.

In particular, Binance Coin's performance almost perfectly reflects BTC's performance, with a positive beta higher than that of BTC. For example, if BTC increases by 2%, the NBB can increase by 4%.

However, recently, the recent growth of Bitcoin seems to have decoupled the relationship between BNB and BTC. The NBB's price has been relatively stable over the last few days, reflecting the feeling that the exchange rate tends to behave better in bear markets. In addition, each BNB rose from a maximum of 0.043 BTC to 0.037 BTC per coin.

In the past week, Bitcoin has increased 25.2%, compared to 10.6% for Binance Coin.

"Do not believe crypto-currencies, with the exception of the NBB"

Tomaino, a former employee of Coinbase, believes Selling crypto-currencies is a "losing game". However, he claimed that Binance had only succeeded thanks to its commercial model of "regulation". arbitration"And his" minimal "know your customer (KYC) requirements.

Shorting crypto-currencies is a losing game. But if I had to crimp a cryptocurrency now, it would be Binance Coin. Here's why (from my western bias):

– Nick Tomaino (@NTmoney) April 4, 2019

In addition to very flexible trading limits and a strategy of adding "aggressively" new crypto, these few factors have allowed the stock market to enter the market and gain 40% market share in less than 10%. two years, suggested Tomaino.

However, Tomaino claims that Binance has managed to capture this market share while offering a "poorly designed product". He criticized the company on Twitter for a user experience "worse than many decentralized exchanges" (reputed to be difficult to use). ) and for the failure of the exchange to significant contributions to the cryptographic space.

In competition with Bitcoin?

Tomaino goes on to say that the NBB is essentially in competition with Bitcoin since the "economic model" of the two coins is regulatory. arbitration.

However, unlike Binance, the most dominant cryptocurrency protocol in the world can not be stopped because of its decentralization. On the other hand, an exchange can be a new regulation or a catastrophic piracy.

With the BNB in competition with Bitcoin, Binance "does not allow anything new," said Tomaino.

That said, there is still one bullish case for the BNB token. Tomaino says that if Binance continues to dominate the crypto-encrypted exchange market, the token will probably succeed. Binance must evolve with the improvement of decentralized exchanges (DEX), said Tomaino.

Everything is about money

Tomaino concluded his argument by suggesting that BNB holders are loyal to the financial advantage, not Binance, which diminishes the value of BNB:

Finally, from what I can say to the community of Binance coin holders, that does not mean that make money. In the end, it's a community of believers that gives value to cryptocurrencies. Something tells me that BNB holders will soon be on the next opportunity to earn money

– Nick Tomaino (@NTmoney) April 4, 2019

Presenting a counter-argument to Tomaino's claims, Dovey Wan – a "market-cycle agonist" investor and partner of the crypto fund Primitive Ventures – said that arbitration is a simplistic way of explaining Binance's business model.

Competition from Huobi, Upbit and KuCoin

Pale has explained that the majority of digital badet exchanges founded by Asian entrepreneurs apply a business model similar to that of Binance.

My counter-arguments with a cross-border bias. Fil??

1. "Regulations Arbitration"Is a Western fairy dust simplified to the extreme.

Most Asian exchanges, whether compliant or not, do what Binance does: aggressively index new badets with minimal resources. KYC, such as Huobi, KuCoin, Upbit https://t.co/yvtuOHXbna

– Dovey Wan ? (@DoveyWan) April 5, 2019

For example, Wan noted that Huobi Global, KuCoin and Upbit all operated with a minimum of KYC/ AML and aggressively inscribed new coins to generate more revenue, much like Binance.

Instead, Wan says that to succeed, crypto-currency exchanges require only three competitive advantages: robust security, adequate liquidity, and affordable trading costs.

Binance has been able to provide the best liquidity while maintaining the lowest fees. In addition, the exchange has never suffered major hacking. regulation arbitration it does not magically give you depth in your order books, nor does it give you a "robust backend," she said.

It also offers another explanation of Binance's success: innovation. When the exchange began mid-2017, he was the first to negotiate the NEO gas tokens well before other players in the industry have managed to do so. This, according to Wan, helped attract the first cohort of investors to the Changpeng Zhao exchange.

Nothing wrong with centralized trust

In addition, Wan said that Binance management took the initiative to expand its operations during the crackdown on cryptocurrency by the Chinese government, which began in September 2017.

According to his badessment, Binance's current success can be attributed to its excellent customer support service and its "real depth of negotiation". This, at a time when other exchanges have been accused of manipulate transaction volumes.

There is nothing wrong with "centralized trust" in people like Changpeng Zhao, Binance's CEO, Wan said.

Diversification of operations

Wan baderts that Binance is not a vulnerable society, but seeks to close. Its activities are divided into numerous subsidiaries, including Binance Academy, Binance Info and Binance Launchpad.

Binance currently employs around 300 professionals and does not have an official office. This, she baderts, actually makes Binance "decentralized". In addition, the stock market has not received substantial VC funding, which allows it to remain more independent.

Finally, Wan argued that if a company as controversial as Tether Ltd. manages to obtain banking partners, there is no reason why Binance is not able to do so in the future, even in the face of regulatory control. Wan concluded his argument by saying:

'' Regulatory arbitration& # 39; is not arbitration but [an] result of the game [involving the] theoretical dynamics of the attitude of different countries with regard to cryptography. Like when China [banned crypto], I found it extremely bullish because that means the United States will never forbid it. Same thing [applies] to Japan, Korea, [and] Singapore."

Overall, whether a crypto investor has a long or short position on the NBB, it seems that there are strong arguments for both parties. Binance is the world's most successful cryptocurrency exchange and NBB holders could share this success. The question of whether other competitors will be able to usurp this position, and thus jeopardize the value of BNB, is still unresolved.

Binance Coin, currently number 7 in market capitalization, is down 1.31% in the last 24 hours. BNB has a market capitalization of $ 2.69 billion with a 24-hour volume of $ 151.95 million.

CryptoCompare's graphic

Binance Coin is down by 1.31% in the last 24 hours.

Filed under: Altcoins, crypto stock exchanges, price badysis, price monitoring, trade

Related News

Mentioned Coins

The companies mentioned

Commitment to transparency: The author of this article is invested and / or has an interest in one or more of the badets discussed in this post. CryptoSlate does not endorse any project or badet that may be mentioned or badociated with this article. Please consider this when evaluating the content of this article.

Warning: The opinions of our writers are solely theirs and do not reflect the opinion of CryptoSlate. None of the information you read about CryptoSlate should be considered as investment advice. CryptoSlate does not support any project that may be mentioned or badociated with this article. The purchase and trade of cryptocurrencies must be considered as a high-risk activity. Please do your own due diligence before taking any action related to the content of this article. Finally, CryptoSlate takes no responsibility if you lose money by exchanging cryptocurrencies.

[ad_2]

Source link