[ad_1]

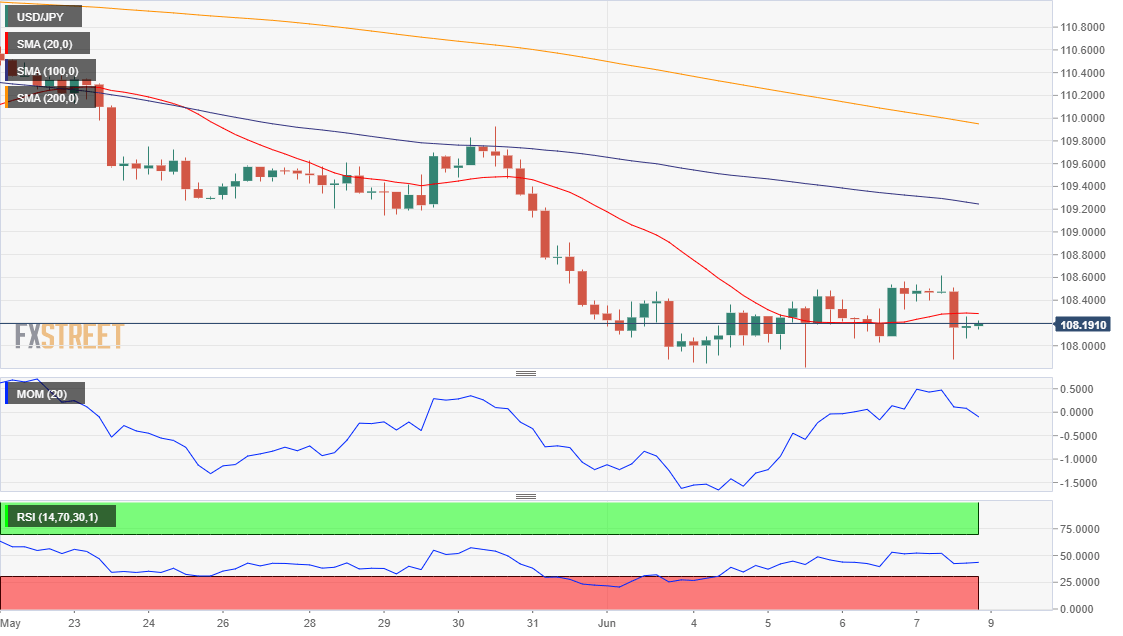

USD / JPY Current price: 108.19

- US Treasury yields reached the levels last reached in September 2017, in light of US employment data.

- Japan will release the final version of the first quarter GDP, revised downwards to 0.4%.

USD / JPY ended the week slightly lower at around 108.20, confined in recent days to a narrow range. Nevertheless, he posted a low and a low for the third week in a row, after crossing the 108.00 level for the first time since last January. The safe haven currency benefited from the strength of the dollar and the drop in US Treasury yields to their lowest level since September 2017, although gains were limited by higher shares. Wall Street exploded due to speculation that the US Federal Reserve Yen strength At this early this week, Japan is expected to release the final version of the first quarter GDP, which is expected to be revised to 0.4%, up from 0 , 5% previously. The country will also release its April trade balance, with an expected deficit of 664.3 billion yen.

The daily chart of the USD / JPY pair indicates that the bearish potential remains firmly in place, with the pair developing well below a bearish DMA that keeps falling below the larger ones. The Momentum indicator in the graph mentioned has continued its decline in negative limits, while the RSI indicator is slightly down, staying close to oversold values. In the shorter term, and according to the 4-hour chart, the technical situation is also bearish, as the pair retreated after a 48.2% retracement test from its last pullback to 108.60, now below an SMA The technical indicators in the mentioned chart rebounded from the daily troughs, momentum moving to neutral levels and the RSI around 45, not allowing any further progress to be made.

Levels of support: 108.30 108.05 107.85

Resistance levels: 108.60 109.00 109.40

View live chart for the USD / JPY

Source link