[ad_1]

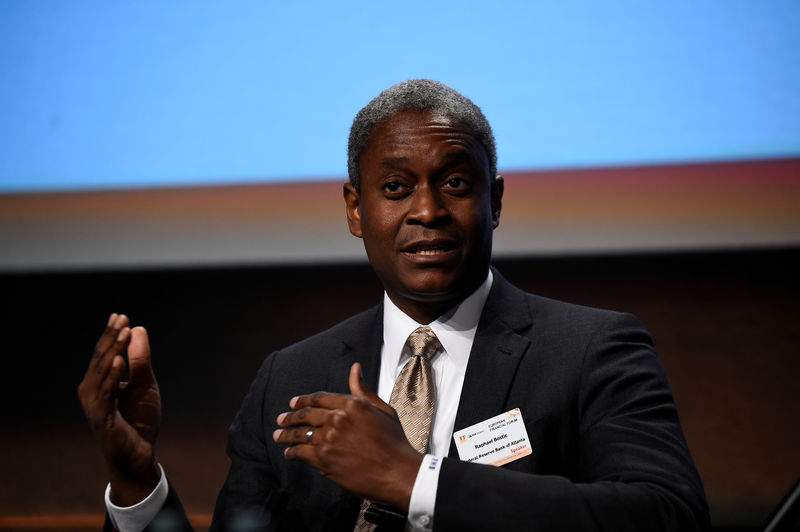

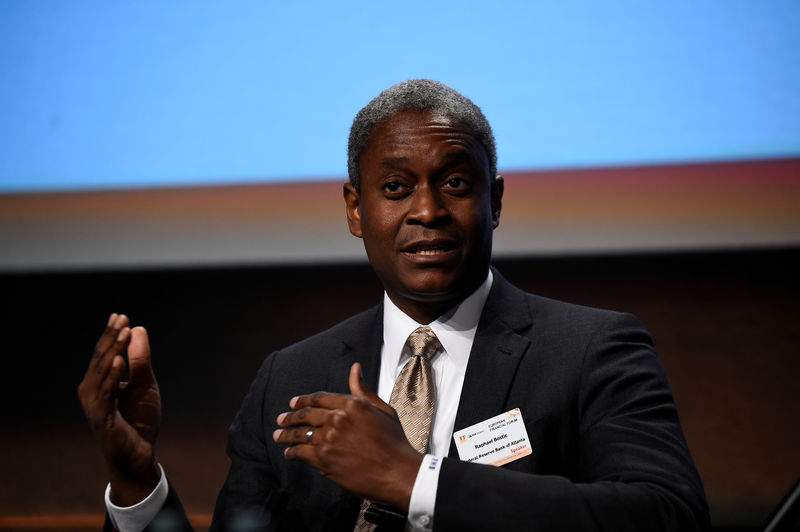

© Reuters. PHOTO FILE: The President and CEO of the Federal Reserve Bank of Atlanta, Raphael W. Bostic, speaks at an event of the European Financial Forum in Dublin

By Ann Saphir

SAN FRANCISCO (Reuters) – The Federal Reserve's slow approach to monetary policy does not guarantee the continuation of interest rates for the rest of the year, the president said on Friday. the Federal Reserve of Atlanta, Raphael Bostic.

"Staying up is definitely an option, but depending on the reaction of the economy, both upward and downward rates are on the table for me," Bostic said at the conclusion of the meeting. A conference on monetary policy at the San Francisco Fed.

The comments were among the first made by a Fed decision-maker since the US central bank made an unexpected change last Wednesday. The forecast released after its two-day political meeting indicated that 11 of the 17 Fed policymakers were not predicting any rate hikes this year, compared to just two who had this forecast in December.

President Jerome Powell cited the low inflation rate, the slowdown in the global economy and risks such as trade tensions between the United States and China on the need to stay patient "for a while. time". He said the economic data at the moment did not give a clear indication of what the next Fed action should be.

After the Wednesday announcement, the financial markets, which had already considered any possibility of rate hikes this year, have begun to anticipate a rate cut next year.

And on Friday, a key feature of the US Treasury bond market reversed for the first time since 2007, with long-term rates being lower than short-term rates in what is traditionally a harbinger of the recession.

Bostic, who spent most of his speech touting the benefits of the Fed's new monetary policy approach "with ample reserves," finally took time to deliver a direct message to markets about what he described as inaccurate reading of the Fed's intention.

The patience of the Fed, he said, does not mean that she has ruled out any rate hike for the rest of the year and that she is not limiting her options.

"I am open to all possibilities because we want to support a sustained economic expansion, favorable conditions in the labor market and inflation close to the symmetrical 2% target of the committee," said Bostic, referring to the federal open market committee. "Markets should understand this, so I hope I have clearly stated my position."

Asked about the level of inflation that would result in an increase in rates, he replied that he had not focused on an accurate point estimate. Inflation could rise a few decimals above the Fed's 2% target and not worry, he said.

But if other economic data, including those of the labor market, as well as inflation figures "suggest a possible overheating of the economy, I think I would be comfortable moving out," he said. -he declares.

In February, Bostic said he expected the Fed to raise interest rates once this year, after stepping up efforts in 2018. He did not say number of rate increases that he now deems appropriate.

The Fed is worried more and more about reaching its 2% inflation target and is skeptical about the tax cuts and deregulation of the Trump administration that are going generate faster economic growth.

The same goes for the financial markets.

The gap between 3-month T-bill and 10-year note yields has fallen below zero for the first time since 2007, after manufacturing data in the United States failed to meet expectations. .

Earlier Friday, data from Germany showed that the factories sector continued to contract, another worrying sign for the global economy.

[ad_2]

Source link