[ad_1]

Hock Tan, Broadcom CEO

Lucas Jackson | Reuters

Broadcom plunged into chip stocks on Friday after the chip maker missed revenue forecasts and lowered its guidance for 2019, citing a "generalized" slowdown in demand and Huawei's crackdown on the US.

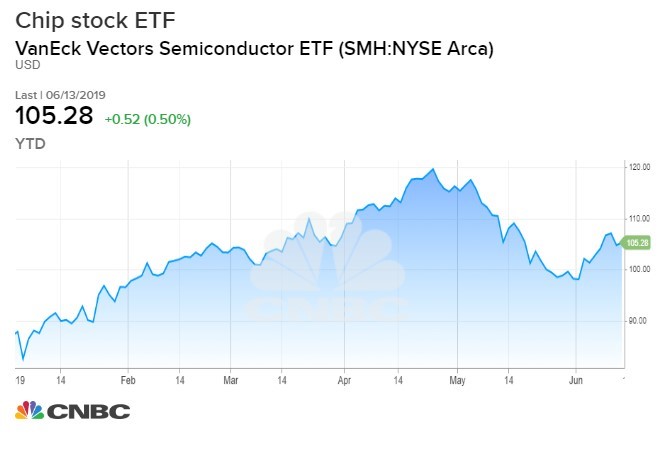

Broadcom shares lost more than 9% in pre-market trading on Friday. Skyworks, Xilinx, Micron, Advanced Micro Devices, Nvidia and Qualcomm have all followed suit with losses of more than 3%. Intel was down more than 2%. The VanEck Vectors Semiconductor (SMH) ETF dropped 2.9% and was on the verge of its biggest decline in about a month.

Broadcom's revenue for the second fiscal quarter is set at $ 5.52 billion on Thursday night, against $ 5.68 billion expected by badysts surveyed by Refinitiv. The chip maker also announced that it was now expecting a turnover of $ 22.60 billion for the 2019 fiscal year, well below the $ 24.31 billion collected by the companies. badysts surveyed by Refnitiv.

"We are currently witnessing a general slowdown in demand, which we believe is attributable to persistent geopolitical uncertainties as well as the effects of export restrictions on one of our most big customers, "said Broadcom CEO Hock Tan. "As a result, our customers are actively reducing their inventory and we are adopting a conservative attitude for the rest of the year."

"Really depressing"

"The environment is very, very nervous," said Tan later, at a call to badyst.

"A really depressing Broadcom call with a solemn Hock Tan," CNBC's Jim Cramer said Thursday night.

Other technology stocks declined due to concerns over the meaning of Broadcom's warning for the demand for technology products. Apple and Cisco recorded a decline in pre-market sales.

Chip stocks rebounded in June, which some saw as a good sign for the global market and economy. The VanEck Vectors Semiconductor ETF was up 20% this year ahead of Broadcom's warning. However, as the broader market, the S & P 500, rebounded to 2% of its record, the smart equity ETF is 12% of its April record, an underperformance that could indicate problems that are manifesting themselves now with Broadcom.

The sector is sometimes seen as a leading indicator for the stock market and the global economy. The broad market fell on Broadcom's warnings. Nasdaq futures fell 0.8%, while futures on the S & P 500 fell 0.3%.

This is a story in development. Come back for updates.

– With report from Jordan Novet.

Source link