[ad_1]

Copyright of the image

AFP

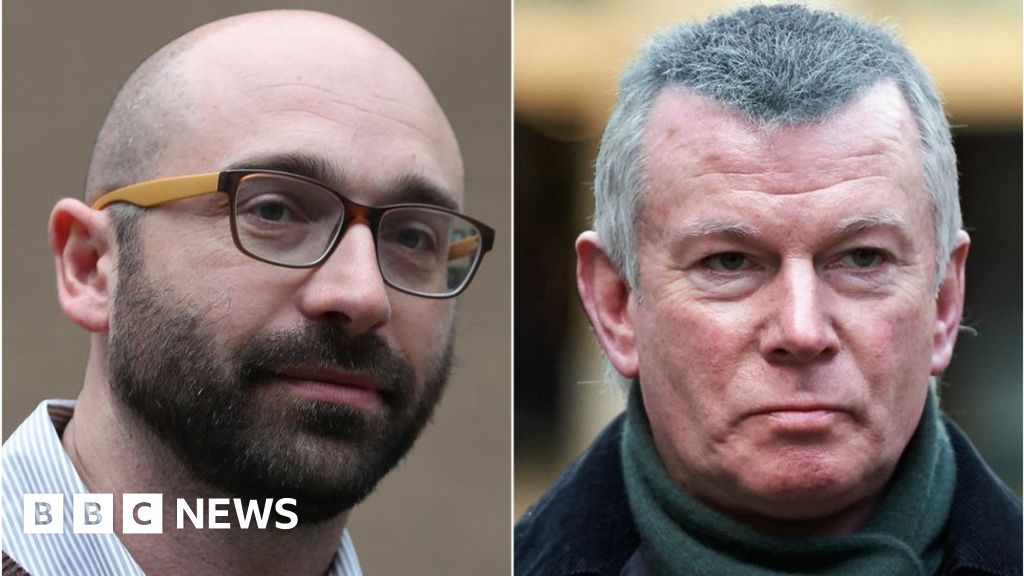

Former Barclays traders, Carlo Palombo and Colin Bermingham, have been convicted of tax evasion at Euribor

Two traders were jailed after being convicted of conspiracy to fudge the overall interest rate of Euribor.

Colin Bermingham, 62, and Carlo Palombo, 40, both former Barclays traders, were convicted of conspiracy to defraud.

Mr. Bermingham was sentenced to five years in prison and Mr. Palombo to four years.

Another trader, Sisse Bohart, was acquitted.

These penalties put an end to the biggest lawsuit to date on interest rate fraud – in this case the Euribor benchmark used to set the interest rates for millions of euro-denominated loans.

Lisa Osofsky, director of the Serious Fraud Office, said: "These men deliberately undermined the integrity of the financial system, allowing them to cover their pockets and defend the interests of their employers.

"We are determined to hunt down and bring to justice those who defraud others and abuse the system."

The Euribor is a key benchmark borrowing rate in euros based on approximately $ 180 million of financial products. The accuracy of this rate is important for maintaining confidence in the financial system.

Every day, a merchant from each bank estimated the interest rate she thought the bank would have to pay to borrow money from other banks, based on the rates the banks were paying that morning.

Estimates would be submitted to the European Banking Federation (EBF) on the basis of current market transactions. These submissions would then be averaged and a rate would be published.

In the 1990s and 2000s, merchants regularly requested that bids be slightly modified to meet the commercial interests of their banks. Banks generally had trading positions or investments that would benefit from higher or lower bids.

The defense of the traders was that it was a normal business practice. The Serious Fraud Office (SFO) says that he is corrupt.

At the sentencing hearing, Judge Michael Gledhill echoed the controversial remarks of Mr. Justice Cooke, who chaired the first trial in 2015 of interest rate-rigging. 39; former UBS trader, Tom Hayes, claiming to want "a message sent to the banking world".

"People convicted of manipulating interest rates will face heavy custodial sentences," he said.

Mr. Hayes was sentenced to 14 years in prison, which was reduced on appeal to 11 years and a half.

Judge Gledhill stated that it was difficult to understand why Mr. Bermingham had been involved in a conspiracy because he was not getting any personal benefit from accepting traders' requests to submit higher claims or more bbad.

But, he added, "Part of the answer lies in the desire to help Barclays prosper, and that may be something that has to do with the desire to be respected by others. be the reasons, you have been convicted for knowingly involved and this conspiracy. "

A second test

Bermingham, Palombo and Bohart were judged a second time by the SFO, a jury having failed to decide by majority in a previous trial in 2017.

Prior to this trial, Christian Bittar, a former Deutsche Bank trader, pleaded guilty to conspiracy to defraud.

Another former Barclays merchant, Philippe Moryoussef, attended previous hearings but decided not to attend the trial. His lawyer told him that he could not trust a fair trial.

Copyright of the image

AFP

Philippe Moryoussef, a former Barclays merchant in the center, was sentenced to eight years in prison in absentia

He was found guilty in his absence and is now a fugitive from the British justice system.

Judges Palombo and Bermingham were sentenced by a majority of votes, two jurors having been found guilty in both cases.

Carlo Palombo's lawyer, John Hartley, said that Mr. Palombo and his family were devastated by the result.

"Mr. Palombo started at Barclays as a young trader and his management taught him early to make inquiries at the bidding office," Hartley said in a statement.

"During the trial, he said at his trial that it was a bbad activity at the bank and that his actions were dishonest at that time and that he had no training on Euribor tenders, no senior management members were on trial. "

In the BBC Panorama "The Big Bank Fix" program in 2017, the BBC revealed a secret registration involving the Bank of England in a practice called "lowballing".

Lowballing occurred during the 2008 financial crisis, when banks artificially lowered their Libor estimates (the interbank rate offered in London), the equivalent of Euribor in dollars and pounds. sterling.

In a statement to the BBC, the Bank of England said that Libor was not regulated at the time.

At the 2016 trials, the SFO said it was investigating lowballing. However, after years of investigation, no prosecution has been initiated.

Defense of Libor Submissions

The case of Mr. Hayes is now before the Criminal Cases Review Board (CRC) as doubts about the safety of his conviction increased. The evidence against him also consisted of "requests from traders" to make more or less liberal arguments.

Copyright of the image

AFP

The former UBS trader, Tom Hayes, was jailed in 2015 for allegedly rigging Libor

His defense in 2015 was that there was a range of potential bids, based on slightly different interest rates that banks were paying to borrow money on a given morning.

The requests to increase or lower it in this interval were legitimate, said his lawyers. Prosecutors rejected the notion of range.

However, in 2017, during Barclays' trial of traders for rigging rates, John Ewan, former director of Libor at the British Bankers Association, agreed that higher or lower bid solicitations in a range could be acceptable. The two accused in this trial, Ryan Reich and Stelios Contogoulas, were acquitted.

At the trial of Palombo and Bermingham, Helmut Konrad, retired banker who had participated in the creation of Euribor in 1999, had heard similar testimony. He had told the court in 2018 that it was "normal" that banks submit a rate equally good, even if a rate would be more profitable for the bank.

At this year's trial, he told the court "as long as we talk about the range of eligible rates, it's good".

Mr. Hartley stated that Mr. Palombo was considering an appeal.

Source link