[ad_1]

French riot police clash with protesters in the yellow vest at Bastille Square Photo: Alfred / SIPA / REX / Shutterstock photos

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

Faced with the sluggishness that has settled over Europe, France has boosted the eurozone by beating the growth forecasts of the last quarter.

French GDP rose 0.3% between October and December, according to new figures, dispelling any fear that growth will fall to just 0.1%.

This corresponds to France's growth in the third quarter, which eases fears of a slowdown.

Economists were expecting bad statistics, following protests "yellow vest" that invaded Paris for many weeks: mbad demonstrations, battles with the police, roadblocks and attacks shops and cars

And indeed, consumer spending and investment declined in the last quarter.

According to the statistics institute of INSEE, the French economy continues to grow, thanks to the surge in exports.

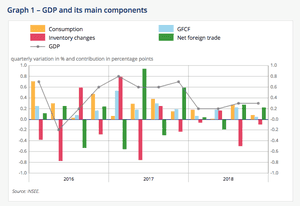

French GDP in detail Photo: Insee

INSEE reports:

Household consumption expendituredecelerated (0.0% after + 0.4%), likewise total gross fixed capital formation slowed down (GFCF: + 0.2% after + 1.0%). Overall, final domestic demand, excluding inventory change, slowed: it contributed 0.1 point to GDP growth, after 0.5 percentage point in the previous quarter.

Imports rebounded in Q4 (+ 1.6% after -0.7%) and exports accelerated significantly (+ 2.4% after + 0.2%). Overall, the foreign trade balance again contributed positively to GDP growth: +0.2 point, after +0.3 point in the third quarter. Conversely, the change in inventories had a negative impact on GDP growth (-0.1 points after -0.5 points).

The numbers are not exactly superb – The annual growth rate of France has fallen from 1.5% in 2017 to 1.5% in 2018, which shows how much the "euroboom" has collapsed.

Reaction to follow ….

Also coming today

The United States and China must resume their trade negotiations today; overshadowed by the criminal charges against Huawei.

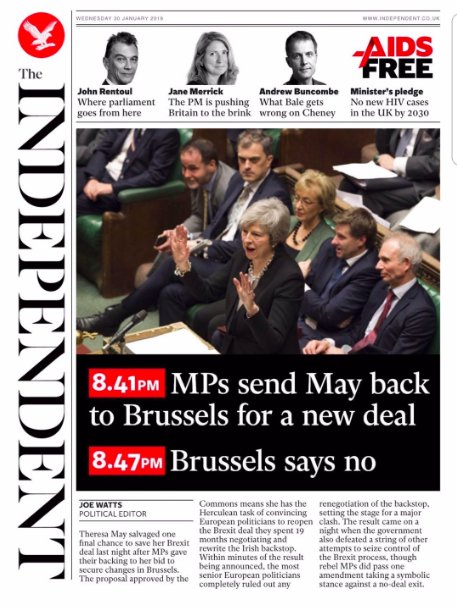

The pound could be volatile today after MEPs voted for Theresa May to come back to Brussels to renegotiate Irish support in her Brexit deal – something the EU has already said no, no. again, nor yet.

James Felton

(@JimMFelton)Leading front page by The Independent pic.twitter.com/efJunXyo7a

Sterling suffered a small drop last night, losing a cent against the US dollar as traders calculated that a Brexit without a transaction is now more likely.

This is likely to push up stocks in London this morning (as a weak pound increases profits abroad).

The US central bank meets to define monetary policy tonight. The Fed will likely leave interest rates unchanged, but this could highlight the detrimental effects of the US government's closure on the economy.

In addition, we are getting new data on UK borrowings, which could indicate a drop in mortgage approvals last month.

L & # 39; s calendar

- 9.30 GMT: data on UK consumer and mortgage approvals

- 10am GMT: consumer confidence in the euro zone

- 19:00 GMT: US Federal Reserve sets interest rates

[ad_2]

Source link