[ad_1]

- GBP /USD capped on the dollar's correction after the FOMC minutes, which were a slight disappointment for the markets.

- US equity markets have not been able to gain momentum, marking a pause in the central bank's risk-related hysteria.

- GBP / USD is currently trading at 1.3063, up from the low of 1.3011 and now below the session high of 1.3110 due to an offer on the greenback.

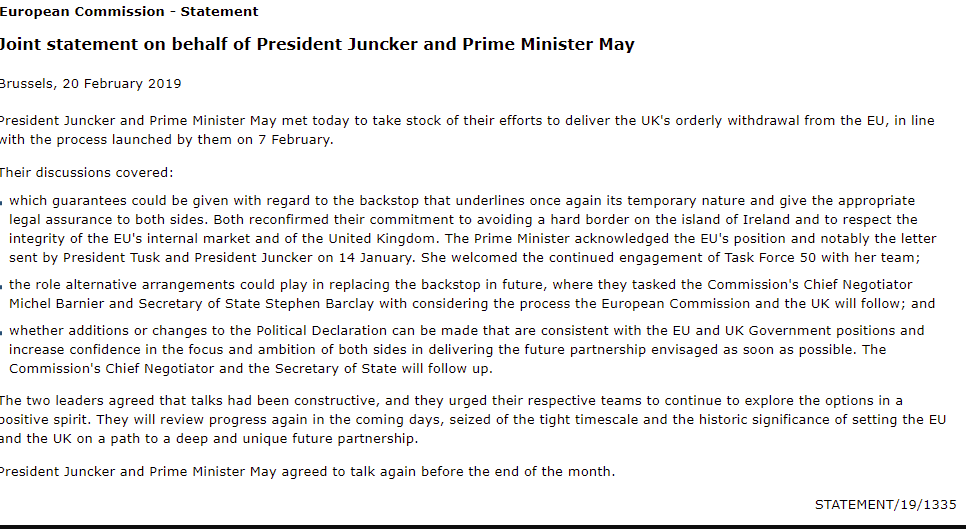

- Filtering Brexit securities with a joint statement on behalf of the EU, Juncker and UK PM May.

The GBP / USD performed well this week, looking forward to the prospects for a Brexit soft where it's totally inconceivable that the UK will leave next month with a deal, according to the majority of markets. However, Prime Minister May warns that no agreement is still on the table and that preparations are underway for such a scenario.

However, the strength of the pound is mainly related to the recent overexploitation of the BoE and currency risk. Recent UK data is strong and an increase in the BoE rate will probably be considered, regardless of the Brexit type. Inflation will have to be contained in the case of a lower pound on a difficult Brexit or even in the case of a stronger economy if all goes well for the EU after the results of the Brexit. At the same time, Mr Juncker said the timing was essential and made progress today at the backstop meeting where Prime Minister May said she had stressed the need for Legally change the backstop at the meeting with Juncker. In addition, the foreign exchange markets have favored central bank meetings as a pretext for taking long-term risks, leading to a mbadive dollar sale.

With regard to the FOMC minutes, it was not that bad and failed to convince buyers to continue buying US indexes. Covering the short-term banknote lifted the DXY from the low of the session to 96.29 to hit a post-event high of 96.56. Additional work by the bulls will be required if the DXY is to return above the threatening health and safety threat on hourly charts – this level is around 96.70. The record of the FOMC meeting was essentially echoing the neutral rhetoric we heard earlier in the week from Mester (the neutral hawk) and Williams. The solution is that the Fed reviews the balance sheet policy for the latter part of 2019 and does not know what to do with the current climate with respect to its interest rate cycle – so the Fed is neutral and remains in the foreseeable future.

Key statements in the form of FOCM minutes, (Source LiveSquawk):

- Participants noted that maintaining the current federal funds rate target range "for a while" presented little risk at the moment.

- Staff provided options to end runoff from the balance sheet in the second half of this year.

- Almost all officials wanted to stop the runoff b / sheet in 2019.

- Many officials do not know what rate changes might be needed in 2019.

- Policy makers recognize that it is "important" to be flexible in the standardization of balance sheets.

- Decision makers agree that adjustments should be made if necessary.

- Several participants felt that further increases were appropriate in 2019 if the economy evolved as expected.

- The patient's posture allows time for a "clearer picture".

- – "few officials" do not worry about the uncertainty not captured in the point graph;

- – having seen solid data on households recently;

- – officials took note of concerns about slowing growth in China;

- – concerns about trade, closures and tax policy;

- – whereas some downside risks are increasing;

- – Officials note volatility, fin narrower. Conditions.

GBP / USD Levels

GBP / USD continues to show signs of recovery in the near term after its recent turnaround before the 61.8% retracement to 1.2740, as noted by Commerzbank badysts who explain that the cable has exceeded 200 days at 1,3002 to mitigate the downward pressure. "Our attention has returned to the recent high of 1.3217. Elliott's intraday counts are contradictory."

Source link