[ad_1]

<! –

->

On March 7 this year, Finance Minister Ken Ofori-Atta and Governor of the Bank of Ghana (BoG) Ernest Addison officially announced that Ghana intends to withdraw from the credit facility program with the International Monetary Fund (IMF) in April 2019.

The letter was addressed to IMF Managing Director Christine Lagarde.

It follows the successful completion of the program, which began in April 2015 with the primary objective of restoring debt sustainability and macroeconomic stability to support the return to strong growth and the creation of new businesses. jobs while protecting social spending.

In the letter, the two officials, on behalf of the government, expressed "our gratitude to you, the Board of Directors and the entire staff of the Fund for being our trusted advisors.

"We are coming out of the ECF program on a positive note and are optimistic about our medium-term prospects of creating a prosperous society for all," he said.

He noted that the economy had responded positively to the policies implemented under the IMF program, citing as examples the resumption of growth, the decline in inflation and the the budget deficit.

The letter also called on the IMF Executive Board to waive non-compliance with performance criteria for certain missed key indicators.

He mentioned the criterion omitted as the payroll, BoG net international reserves, both for the end of June and the end of December 2018, the PC on the primary balance for the end of June (although respected by the end of December) and the continuous PC. . on BoG's gross credit to the government (missed in November 2018 as a result of BoG's outstanding intervention in monetizing the obligation badigned to Consolidated Bank Ghana as part of the consolidation of the financial sector).

The waivers were prerequisites for the country to complete the seventh and eighth combined examinations of the ECF agreement and disburse the seventh and eighth installments for an amount equivalent to 132.84 million SDRs, according to the letter.

You will find below a complete copy of the letter:

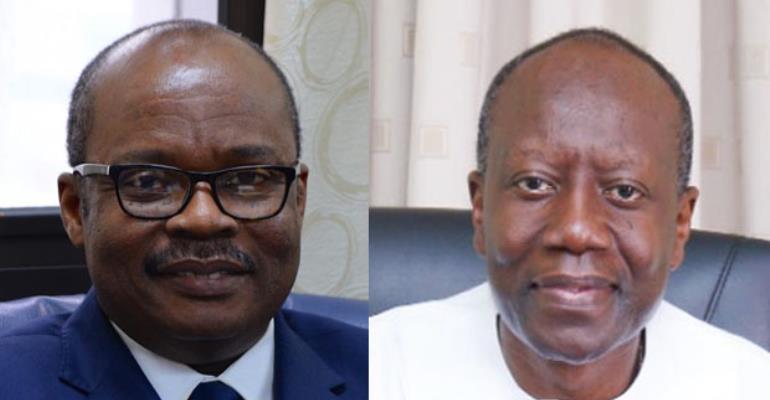

Ernest Addison, Governor of BoG, and Ken Ofori-Atta, Minister of Finance

Letter of intent

Accra, March 7, 2019

Christine Lagarde General Manager

International Monetary Fund (IMF) Washington, DC 20431

Dear Mrs. Lagarde,

1. On behalf of the Government of Ghana, we hereby transmit the enclosed Memorandum of Economic and Financial Policy (MEFP), which describes the progress made in the Expanded Credit Facility Program, which has been agreed with the authorities in April 2015.

2. Two years ago, this government took office after winning an overwhelming mandate from the people of Ghana in December 2016. The government inherited an economic program that had experienced serious macroeconomic imbalances, such as: deviating considerably from its objectives. Over the last two years, the government has requested an extension of the program and recalibrated the macroeconomic framework in order to restore macroeconomic stability. During this period, decisive and painful measures were taken to maintain fiscal consolidation and financial stability to promote growth and job creation.

3. We are pleased to report that the economy has responded positively to these measures. Growth rose from 3.4% in 2016 to 8.1% in 2017 and 6.7% in the first three quarters of 2018. Inflation increased from 15.4% to 9.0% in January 2019. The consolidation of our public finances has been successful. a significant reduction of the budget deficit from 7.3% of GDP in 2016 to 3.8% in 2018. The primary balance became positive at the end of 2017, the first time in almost a decade, and remained positive and as expected at the end of 2018.

Our efforts have been well received both nationally and internationally, resulting in the first improvement of Standard and Poor's ratings in 2018, after almost a decade, as well as the largest single issue of the euro. -bonds in 2018, which consisted of issuing the first 30-year bond and reaching the lowest rate on a 10-year bond since Ghana's first Eurobond issue in 2007. Although some structural reforms have progressed more slowly than expected, we continue to tackle unresolved vulnerabilities.

4. Given the commitment and commitment shown in the implementation of macroeconomic policies and reforms, the Government of Ghana calls on the IMF Executive Board to waive non-compliance with Performance Criteria (PCs) payroll, net international reserves of the Bank of Ghana (BoG), for the end of June and the end of December 2018, the PC on the primary balance for the end of June (although meeting by the end of December) and the PC in continued on the gross credit to the government of the Bank of Ghana (missing November 2018 as a result of the Bank of Ghana's exceptional intervention in the monetization of the bond ceded to the Consolidated Bank in Ghana as part of Financial Sector Cleansing), to complete the seventh and eighth combined Extended Credit Facility (ECF) reviews, and disburse the seventh and eighth installments for an amount equivalent to 132.8 4 million SDRs.

5. In the future, we pledge to continue to implement appropriate policies to support growth while keeping in mind the need to preserve macroeconomic stability. Ensuring the irreversibility of our policies, through the establishment of strong institutions, remains an essential strategy to enable us to achieve our goal of moving "Ghana Beyond Aid".

We have therefore put in place a legal framework to help ensure fiscal discipline. As a first step, we pbaded the 2018 Financial Accountability Act (Law 982) which caps the budget deficit at 5% of GDP and guarantees the maintenance of an annual primary surplus. We have also established and inaugurated a tax system [Responsibility] Advisory Council and an Advisory Council on Financial Stability. These frameworks and structures should ensure the irreversibility of the reforms and measures put in place to maintain macroeconomic stability and discipline and provide an anchor for medium-term policy direction.

6. The President's agenda "Ghana Beyond Aid" remains underway. This transformation program is based on the growth of the productive sectors of the economy, the mobilization of domestic revenues, the diversification of export revenues into value-added products and the positioning of Ghana as a regional hub for services. financial, transport, energy, fintech and logistics. making society aWISER of Ghana (rich, inclusive, sustainable, self-reliant and resilient). We are also confident that the resumption of collaboration with the Republic of Côte d'Ivoire in the cocoa sector will strengthen our bargaining power as we deal more locally, and that other partners in the cocoa sector will the oil sector will enable us to make the most of the many key players in the emerging sector in our market. shores.

7. In entering into and terminating this extended credit facility agreement, we express our gratitude to you, the Board of Directors and all of the Fund's staff for being our advisors of confidence. We are moving out of the ECF program on a positive note and are optimistic about our medium-term prospects of creating a prosperous society for all.

8. The Government agrees to make publicly available the contents of the IMF Staff Report, including this letter, the RFP and the attached Technical Memorandum of Understanding, as well as the Debt Sustainability Analysis. carried out by the staff of the IMF and the World Bank and, therefore, authorizes the IMF to publish these documents on its website as soon as its board of directors approves the completion of the seventh and eighth examinations in the World Bank. part of the FEC program.

Ken Ofori-Atta, Minister of Finance

Ernest Addison, Governor of the Bank of Ghana

[ad_2]

Source link