/cloudfront-us-east-2.images.arcpublishing.com/reuters/RMPF6H5MFNKSRL6JJDAL26P77Q.jpg)

[ad_1]

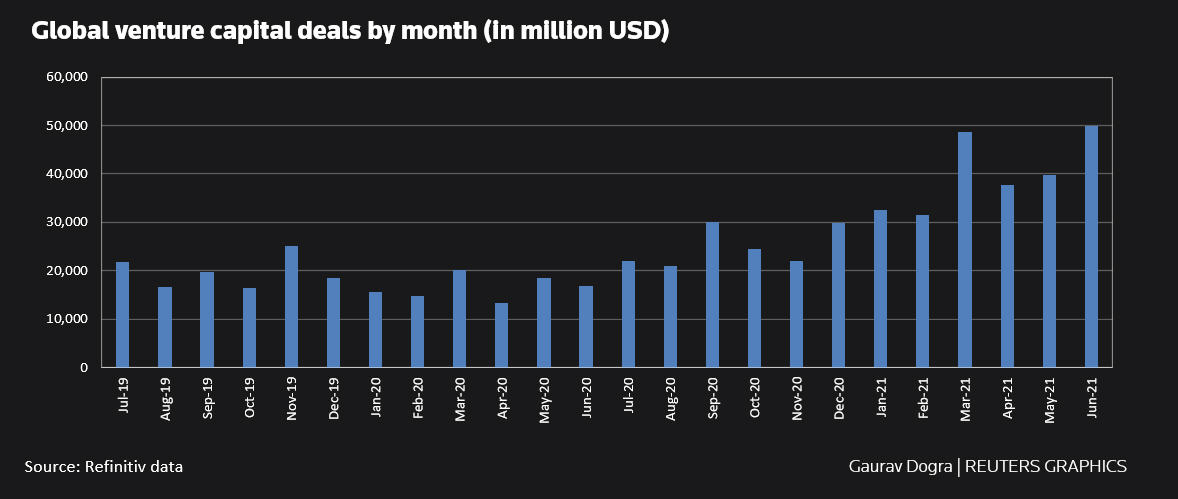

July 21 (Reuters) – Global venture capital investment is at record highs this year, boosted by rising stocks, higher liquidity and increased interest in sectors that have benefited from the coronavirus pandemic.

According to data from Refinitiv, global venture capital funds have invested $ 268.7 billion so far in 2021, far exceeding their total investments of $ 251.2 billion a year earlier.

The bulk of those deals involved software, e-commerce, digital healthcare and fintech companies, whose products and services saw high demand during the pandemic, the data showed.

“(The lockdowns) and changes in consumer behavior have fueled the growth of digital startups, in turn accelerating investor appetites,” said Jaime Moreno, COO of Secfi, a San Francisco-based vendor. equity planning tools for startup employees.

Late-stage startups attracted the lion’s share of funds, with venture capitalists injecting $ 195.3 billion, or about 73% of their total investments, while start-ups received $ 73.4 billion. of dollars.

“Venture capital continues to flow into late stage startups. This is due to the euphoria of several large later stage exits recently,” said Swati Chaturvedi, CEO of the San-based angel investment platform. Francisco, Propel X.

“Plus, venture capitalists are sitting on a lot of dry powder.”

Rock bottom interest rates, a rush to diversify their portfolios and a string of successful exits have also prompted global investors to set aside more money for venture capital funds this year.

U.S. venture capital funds raised $ 70 billion in the first half of the year, a 65% increase from the previous year, according to data from Refinitiv. Asian and European funds raised $ 16.1 billion and $ 8.2 billion, respectively, far more than in 2020.

“This record year for global venture capital funding is the result of the creative economy being a legitimate asset class and investors knowing they need to have an allocation,” said said Jeff Ransdell, managing director of Fuel Venture Capital, based in Miami, Florida.

“Businesses are just staying private longer than ever before, so much of the wealth creation is done in the private sector at the moment.”

Last month, venture capital firm Accel raised more than $ 3 billion in three new investment funds to support businesses in the United States, Europe and Israel.

Since 2019, 10 companies, in which Accel had invested, have been made public, including Slack (WORK.N), Bumble (BMBL.O), UiPath (PATH.N), CrowdStrike (CRWD.O) and Deliveroo (ROO. L).

Life sciences venture capital firm Vida Ventures raised $ 825 million last month in an oversubscribed round of funding for its third fund from existing and new leading institutional investors across the world.

Data from CB Insights showed Tiger Global and Andreessen Horowitz to lead in transaction activity in the second quarter.

Reporting by Patturaja Murugaboopathy, Gaurav Dogra and Jane Lee in San Francisco; Editing by Anil D’Silva

Our Standards: Thomson Reuters Trust Principles.

Source link