[ad_1]

Only two years ago, investors poured huge sums into Chinese startups sharing bikes without a dock. Now, this boom has erupted with abandoned bicycles strewn on city streets.

Meanwhile, a new race has been launched for two-wheelers equipped with engines – and one of the main players is a survivor of the craze for sharing bikes. Benefiting from the financing of the world's largest financial technology company, Ant Financial Through its Series D to F fundraisers, Hellobike provides a range of mobility services, such as shared electric bikes and electric scooters leased to its 230 million registered users.

Electric thrust

Hellobike was launched in 2016 by deploying shared bikes in smaller cities – where Ofo and Mobike were virtually absent at first – rather than in major urban centers like Beijing and Shanghai. This allowed Hellobike to largely avoid the fierce competition against Ofo and Mobike.

Ofo is currently struggling with a major financial crisis as he struggles to repay user deposits. Its rival, Mobike, has slowed its expansion since its sale to the local services giant, listed in Hong Kong, Meituan. And Hellobike, who boasts of his operational efficiency, began an electric push.

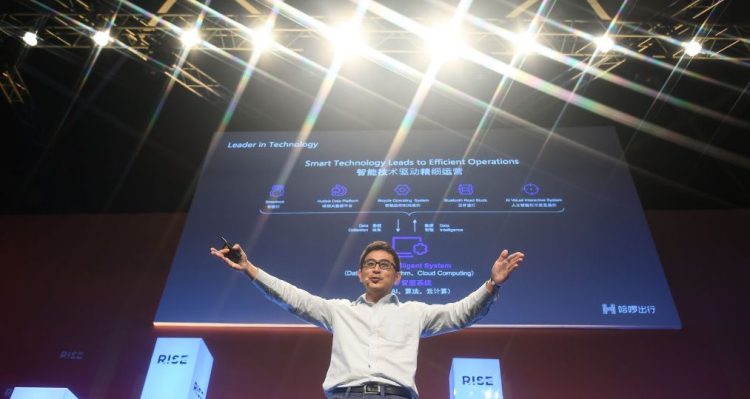

"When the two great powers were at war, none of them pursued e-bikes. They were fighting on their bicycles, "Fischer Chen, Hellobike's CFO (pictured above), referring to the quarrel between Mobike and Ofo, told TechCrunch recently at the Rise conference in Hong Kong. "As such, there was no price war for electric bikes since the beginning. The competition is rational. "

Two-wheeled electric vehicles are in high demand in the country, home to nearly 1.4 billion people. According to data collected by Hellobike, nearly 300 million trips are made daily on badog bikes in China. What many do not realize is that electric-powered e-bikes and pedalless scooters are more than double that number, generating 700 million journeys a day.

As for bicycles, there are advantages to renting than buying an electric bike in China. On the one hand, users do not have to worry about stealing their badets. Secondly – and this is specific to electric vehicles – finding a safe and convenient charging point can be a challenge in China.

That's why Hellobike installed charging stations while offering shared bicycles in 2017. In these kiosks, riders exchange their battery for a new one without having to plug in and wait. They then have the opportunity to pay with Alipay, Ant's mobile portfolio with a billion users.

Hellobike models (left and center) and e-bike (right) / Photo: Hellobike via Weibo

According to Mr. Chen, Hellobike captured 80% of the market share of all monthly sales of two-wheeled electric bicycles in China. For bike sharing, this represents 60-70%. It is difficult to verify the sharing by consulting the data compiled by third-party application tracking tools, as they usually do not divide the user number for individual features. The Hellobike app is a one-stop shop for bicycles, electric bikes, electric scooters as well as car pooling, a complementary service to its core business of two-wheelers aimed at "capturing consumers from price-sensitive small towns" , according to Chen.

Similarly, Mobike has been integrated with Meituan's all-in-one service application. What further complicates the investigation is that some of Hellobike's attractions are accessible directly on Alipay rather than on its own app.

Regarding the competition in electric two-wheelers, Chen claimed that other competitors were "relatively small" and that the acquisition of users online had become "very difficult". For Hellobike, getting existing customers to try out new features requires as much effort as "adding a new tab to their application," suggested Chen.

But other giants of the internet have also turned to trendy micromobility. Didi Chuxing, leader of carpooling and two groups Mobike have their own e-bike sharing programs. It will not be an easy game, as all candidates face the increasingly stringent rules imposed by China on electric bicycles.

Scooter rental is next

What is certain is that Hellobike has great ambitions for electric micromobility. Although shared bikes and e-bikes are for single use, Hellobike is considering renting electric scooters for longer periods, as many people may want motor vehicles for their daily trips.

The Hellobike electric scooter. Caption: "Lock by application. Smart anti-theft. Real-time tracking of the location to check the condition of the vehicle. "/ Photo: Hellobike homepage

Hellobike created a new joint venture last month to meet this demand. Along with Ant, controlled by Alibaba's founder, Jack Ma, and China's leading battery manufacturer CATL, Hellobike is launching a rental market for its electric scooters at 25km / h, intended for millions of migrant workers in Chinese cities.

"People might be able to afford an electric scooter that costs several thousand yuan. [$1 = 6.88yuan]but they could leave the city after a year, so why would they buy it? So we are entering as a third party partner with a new rental model whereby people pay about 200 yuan a month to use the scooter, "said Chen. "In doing so, we are encouraging people to buy vehicles to pay for services, to rent vehicles."

The three shareholders will also work to install additional battery exchange stations nationwide, which will not only recharge Hellobike's shared e-bikes, but also its electronic scooters, which will be manufactured by manufacturing partners.

"We operate as a platform and do not compete with traditional scooter manufacturers," suggested Chen. "They continue to use their own designs and SKUs [stock keeping units]but we'll be incorporating smart hardware into their models … so users know where their vehicles are … and can unlock the scooters with a QR code, just like they do with a shared bike or electric bike. "

Hellboke has collected at least $ 1.8 billion so far, according to public data compiled by Crunchbase. Bloomberg announced in April that it was seeking at least $ 500 million in a new round of financing. The company declined to comment on its progress in raising funds.

Regarding the financial indicators, Chen, a seasoned investment banker, declined to disclose whether, overall, Hellobike was profitable, but said the company "had a much better financial performance than its competitors." The most profitable segment, according to the executive, is that of the electric bike.

Regarding bicycles, Chen said China's leading self-service bicycle companies "are not burning money anymore" because they have been raising prices in recent times. The Hellobike bike unit has generated positive cash flow during the hottest and hottest seasons, Chen said.

Source link