[ad_1]

Replicas of "longevity" lanterns are seen in front of Qianqing Palace in the Forbidden City in Beijing, China this month. Photo: China Stringer Network / Reuters

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

China has not feared that its economy will be weakening with growth figures better than expected.

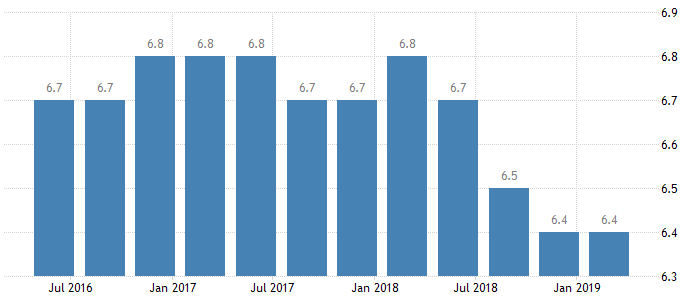

Despite the pressure of Donald Trump's trade war, the Chinese economy has grown at an annual rate of 6.4 percent in the first three months of this year, according to official figures.

This is in line with the growth rate of the previous quarter and suggests that Beijing's economic stimulus program has managed to stave off a slowdown and a potential landing.

Economists expected growth to slow to 6.3%, down from 6.8% a year ago, as a result of the US trade dispute and slowing global growth. have hit the world's second largest economy.

Darren

(@Dlefcoe)#China GDP + 6.4%

acceptable number given in the background. pic.twitter.com/fpcxOt4OCu

China's industrial heart and growing clientele were both stronger than economists had feared.

Industrial production rose 8.5% from one year to the next in March, the highest performance in four years.

Retail sales also broke expectations, up 8.7% in March from 8.2% previously.

In China, the unemployment rate went from 5.3% to 5.2% and real estate investment jumped from 11.6% to 11.8%.

The news sparked a wave of relief in the financial markets, given China's crucial role in the global economy.

As Julian Evans-Pritchard, senior economist in China to Capital saving, says it:

"It can not be denied that the Chinese economy closed the first quarter on a stronger note.

The Chinese economy will eventually collapse if it is not already done. "

Bloomberg Next China

(@Next_china)JUST IN: China's economic growth stalled unexpectedly in the first quarter, with GDP up 6.4% over the year https://t.co/zbRDV1gYYz pic.twitter.com/1NmIZNQfgU

But there is a reservation: how reliable are the Chinese data, given the pressure to continue to hit the government's goals and the size of its economy?

Stephen McDonell

(@StephenMcDonell)#China GDP figures are higher than badysts' forecasts (at 6.4%), which means that growth could be faster here than it seemed. (Do not forget that many badysts do not trust the Chinese GDP figures but …). The increase in bank loans and infrastructure spending are two factors that explain this evolution.

Also coming today

The new British inflation figures will show whether the cost of living in Britain and Europe has gone up last month.

Economists predict that the consumer price index in the UK rose 2% in March, up from 1.9% in April. Tuesday's results, which show nominal wage growth at its highest level in 10 years, would suffer.

Inflation in the euro area is expected to be lower, rising from 1.5% to 1.4% a year.

L & # 39; s calendar

- 9:30 am: BST: report on British inflation for March

- 9:30 BST: UK real estate price report for February

- BST: Euro zone inflation report for March

[ad_2]

Source link