[ad_1]

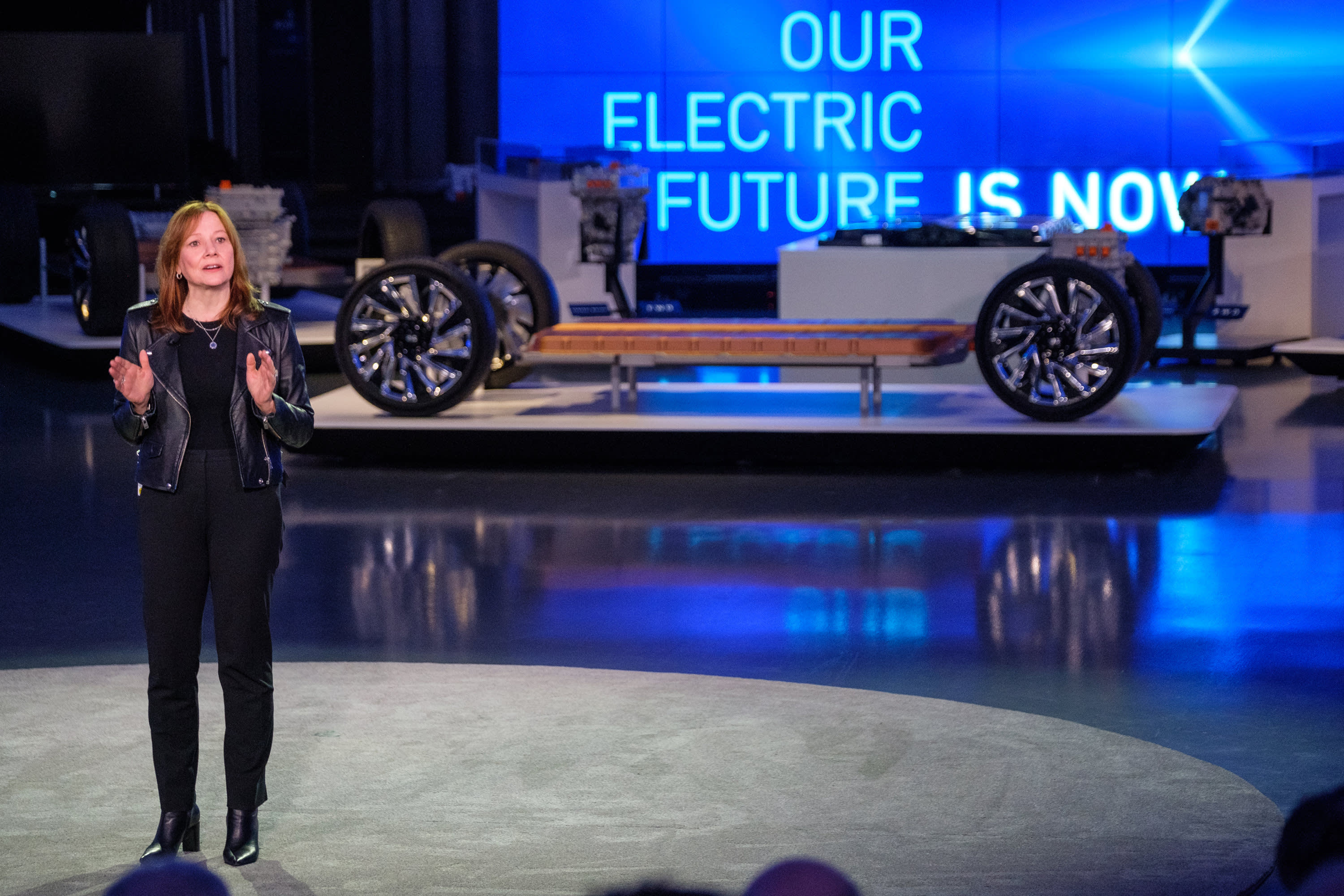

GM CEO and President Mary Barra speaks at an “EV Day” March 4, 2020 at the company’s technology and design campus in Warren, Michigan, a suburb of Detroit

DG

DETROIT – Wall Street has high expectations for General Motors’ two-day investor event that begins Wednesday afternoon – from specific revenue and profit targets to new details on its electric and autonomous vehicle operations.

But what GM investors really want is a roadmap for sustainable shareholder growth. It’s something the automaker flirted with under the leadership of Mary Barra, but was never able to keep it.

The stock rocked dramatically during Barra’s reign, from a 60% rise in the stock price to almost as big a drop since she took the helm in January 2014, according to FactSet. Prior to this year, GM shares were largely down since Barra took the reins. They are now up 36%, with almost all of that growth coming this year alone.

This kind of growth is what analysts think could continue if GM can quickly implement its plans to turn the company – at least in the eyes of investors – into a tech company more than a traditional automaker.

“With the primary focus of GM’s Investor Day focused on demonstrating the growth opportunities ahead for GM, we expect a case to be made in favor of GM’s multiple expansion… which is what we think. that it deserves, ”Credit Suisse analyst Dan Levy said in a note to investors on Friday. “We believe a clear case can be made for GM stocks north of $ 100.”

Deutsche Bank analyst Emmanuel Rosner said the event “could serve as a positive catalyst for the stock” if GM meets investor expectations, especially with regard to its electric and autonomous vehicle projects.

Morgan Stanley analyst Adam Jonas noted several key growth areas and business opportunities for GM, while questioning whether the event “will simply reinforce what many already think about GM or can it catalyze larger change. in the strategic lane? “

Like investors, Barra and her management team are hoping for the latter. Here are five ways GM will try to achieve it.

Details

Investors should expect an unprecedented amount of detail during the event, including specific targets regarding revenue, profit margins, and full market size prospects for early expanding businesses like taxis. autonomous.

This is one of two things Jonas believes will be important for GM to accomplish: “Provide transparency and disclosure to help analysts and the investment community model and assess critical business units in the business. ‘technology-driven business,’ he said in a final note to investors. the week.

GM’s revenue last year was nearly $ 122.5 billion, down 10.8% from 2019 thanks in large part to plant closures at the start of the pandemic. coronavirus. It still posted net income of $ 6.4 billion for the year while its adjusted operating income was $ 9.7 billion, or $ 4.90 per share, in 2020.

Emergency

The other important thing for GM is to leave the “investment community with a sense of urgency that the company is taking the necessary steps to attract the capital and talent needed to enable GM’s capabilities to succeed,” Jonas said. .

Barra and other GM executives such as chairman Mark Reuss and CFO Paul Jacobson are expected to discuss how the automaker is investing in electric and autonomous vehicles as quickly as possible to get technologies to market faster.

GM announced earlier this year that it would invest $ 35 billion in electric and autonomous vehicles by 2025, up 30% from plans announced late last year.

VE

As part of the investment, GM has announced that it will offer 30 new electric vehicles by 2025. The company is expected to better detail its transition from a automaker heavily reliant on internal combustion engine vehicles to an exclusive car offering. and electric trucks by 2035.

“We continue to believe that GM is delivering a compelling EV strategy, with one of the most holistic and ambitious EV strategies of historical OEMs, underpinning our positive view of GM. Having said that, now is the time to execute it, as we await data points indicating that GM can maintain market share and profitability in a world of electric vehicles, ”Levy said.

The event for investors as a whole is expected to provide a “clear strategy” to increase the valuation of the company to look more like a tech company, much like Tesla at over $ 740 billion. . GM’s market capitalization is approximately $ 79 billion.

AV

Dan Ammann, CEO of Cruise, the majority-owned autonomous vehicle subsidiary of GM, will tell investors he sees a path for his rideshare business to grow to $ 50 billion in revenue as it ramps up its operations.

It won’t detail a specific timeline for reaching such a milestone, but it should explain how they plan to build it quickly, if not faster, than other transformative companies, according to a person familiar with the plans, which were reported earlier. by Bloomberg.

GM is also expected to discuss additional details of its Super Cruise hands-free driving system, which it has promised to offer on 22 models by 2023.

Software

GM wants to increase recurring revenue and customer loyalty through a new software system developed in-house for vehicles it calls “Ultifi”.

Just as Apple or Google are building customer loyalty with their iOS and Android operating systems for personal electronics, GM will push to do the same with vehicles and Ultifi.

“It’s a goal. The more we integrate our product into their lives, the better we do with it… that’s definitely what we want to achieve. It’s not a guarantee,” Scott Miller, vice president, told reporters. from GM for software-defined vehicles last week. during a call.

The automaker aims to integrate the software platform into the digital lives of customers through custom software features, applications and services that will be regularly updated remotely. This could include paying for new services such as its hands-free highway driving system and other technologies.

– CNBC Michael bloom contributed to this report.

Source link