[ad_1]

Retiring as a millionaire may seem like a fantasy rather than a concrete financial goal, but this is possible with sensible monthly savings.

Achieving this goal, however, requires determination, especially if you do not start until later. Fortunately, the personal finance site, NerdWallet, has badyzed the numbers, broken down by age group, to show how much you will need to hide on a monthly basis.

First, let's see how they got the numbers. The calculation badumes that you start without money, that your investments will earn 6% a year and that you plan to retire at age 67.

Savings programs designed to help you reach this level could include your employer's 401 (k) account, which is a tax-advantaged retirement savings account, or a Roth IRA or traditional IRA. Investment options include low-cost index funds.

Now let's dive into the numbers.

If you start saving at age 20, you will need to accumulate $ 319 per month in retirement to reach your goal of $ 1 million in 47 years. This may seem like a lot to someone so young, but deferring your savings will not cost you more in the long run.

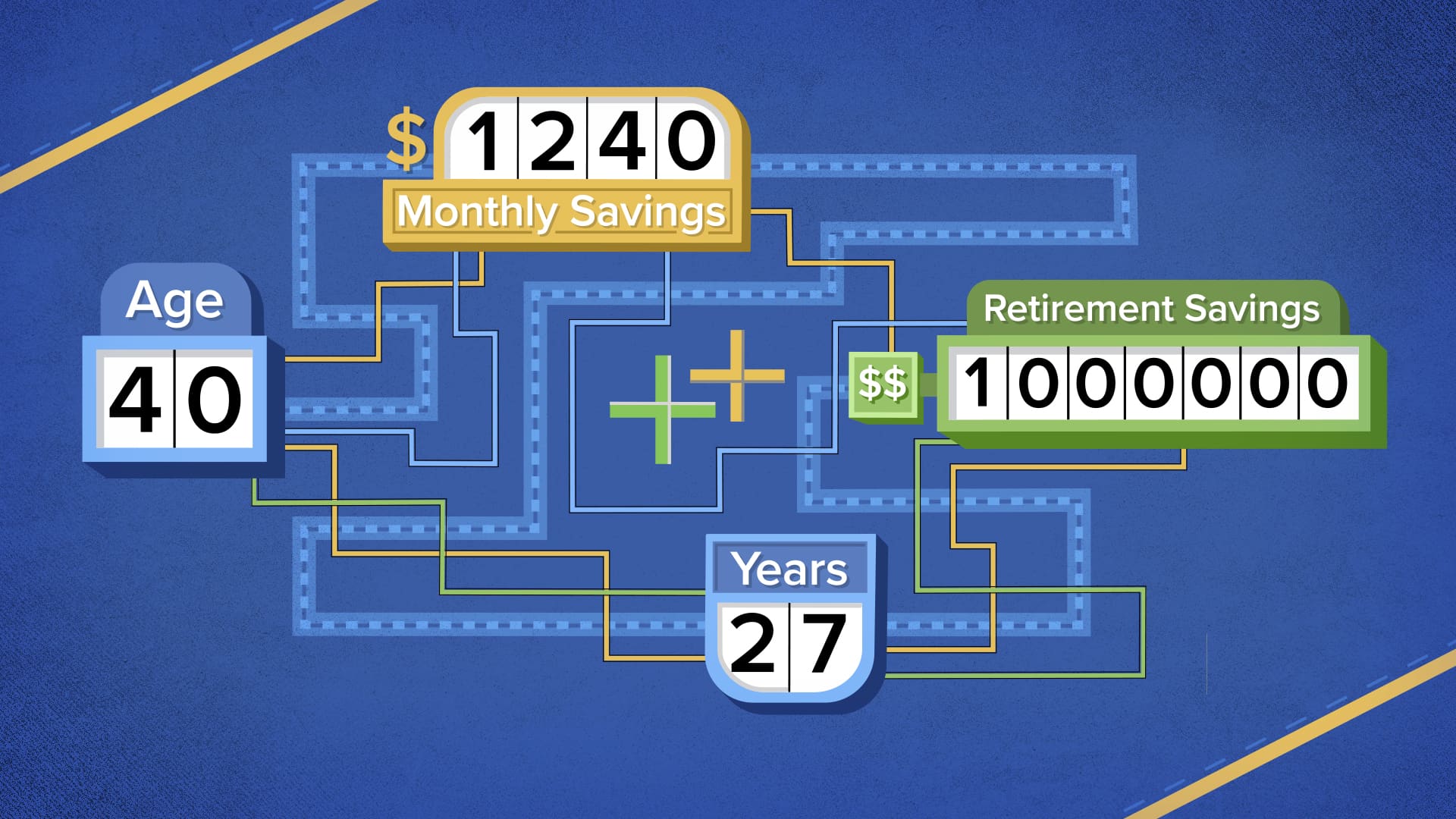

If you are 40 years old without savings, this figure rises to $ 1,240 per month directly in savings to reach one million for retirement. That's almost four times the amount if you had started saving at 20.

As you can see, the longer you wait, the more you will have to pay. Do yourself a favor and start saving early.

More Invest in You:

Josh Brown: Sometimes the best returns come from CEOs you've never heard of

The power of composition can help you double your money over and over again

Disclosure: NBCUniversal and Comcast Ventures Invest in acorns.

Source link