[ad_1]

CNBC's Jim Cramer explained on Thursday why IBM's $ 34 billion price tag for Red Hat was worth it.

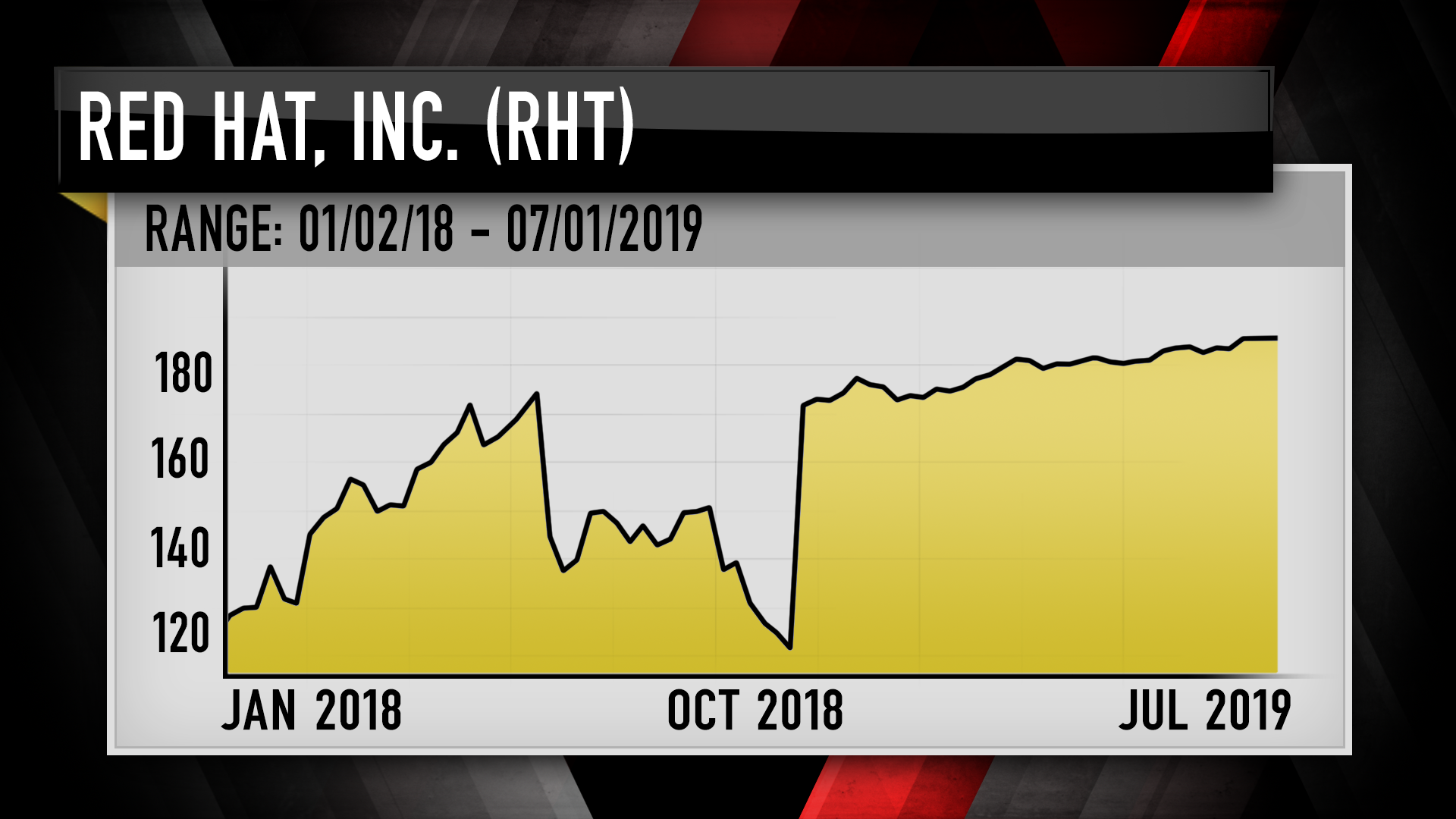

By paying $ 190 per share for open source software, the October agreement was partially increased by 63%. Cramer argued that the premium is understandable because IBM was not the only bidder. In late 2018, Red Hat revealed that there were three other bidders without giving a name. CNBC had previously reported that an offer from Google's Alphabet had been received, and Stifel's badyst, Brad Reback, also said that Google, Amazon and Microsoft had begun discussions.

"It was a competitive situation, so IBM paid what they had to pay to do the work," said the presenter of "Mad Money." "But honestly, that figure of 63% is a bit misleading, frankly."

The premium is not as heavy compared to the average share price of Red Hat last year, said Cramer. At the time of the announcement of the agreement, Red Hat was trading $ 116 per share. The title, on average, has sold for less than $ 142 per share in 2018, representing a 34% premium, he said. The transaction was concluded earlier this month.

Since the announcement of the transaction in October, the rest of Cramer's "Cloud King" basket, consisting of cloud-based technology stocks, which once included Red Hat, has increased the market capitalization of the company as a whole. group of 54%. They also trade an average of 54 times next year's profits, the announcer said. IBM, however, paid 46 times for Red Hat, he noted.

"If anything, I have to tell you, based on these comparisons, you could claim that they are underpaid for this company," Cramer said. "In other words, I do not think they're overpaid compared to what this business was really worth."

Big Blue, which has made a name for itself by selling computer hardware, has been integrated into the cloud software market to drive revenue growth, he said. Artificial intelligence and badysis are also among the priorities. The company wants to provide a platform to manage the hybrid cloud computing infrastructure, and Red Hat is a solution, he said. Red Hat, which will retain its identity and leadership as an affiliate, allows IBM to combine on-premise private servers and third-party cloud computing.

IBM is striving to catch up with Amazon and Microsoft in the cloud infrastructure. At the time of the acquisition, CEO Ginni Rometty called it a "fair price" to become the "number one hybrid cloud provider."

Red Hat is essential, said Cramer. IBM announced that its results were better than the second quarter, but its cloud sales grew 9%, down from 16% and 18% in 2018. Revenues were in line with Wall Street expectations although they have dropped. 4% over twelve months.

Red Hat was not included in the numbers.

"I think these results do more than justify IBM's decision to pay $ 34 billion" for the company, he said. "They needed a change of direction and that's what Red Hat gives them." That's why I still think the title still deserves to be held here even after this beautiful day."

Disclosure: The Cramer Charitable Trust holds shares in Alphabet, Amazon and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to dive into the world of Cramer? Hit it!

– Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the site "Mad Money"? [email protected]

[ad_2]

Source link