[ad_1]

The Chinese fintech industry has taken a terrible toll in recent months, as the government continued to reduce online lending nationwide, undermining investor confidence.

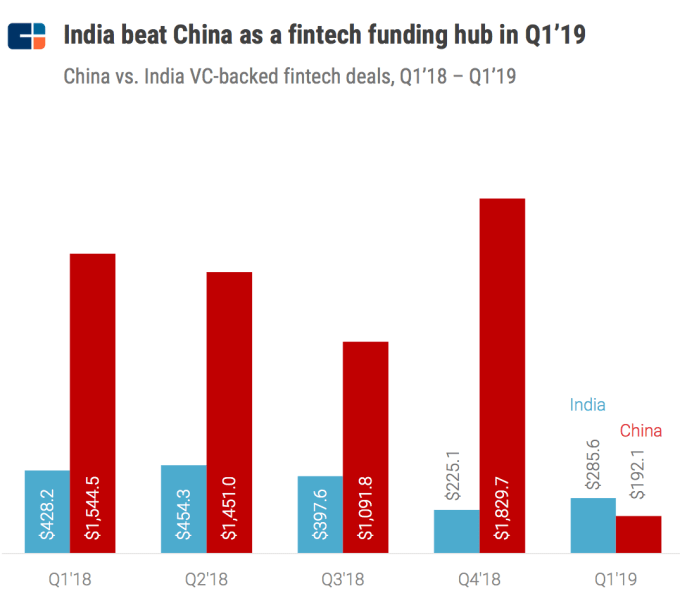

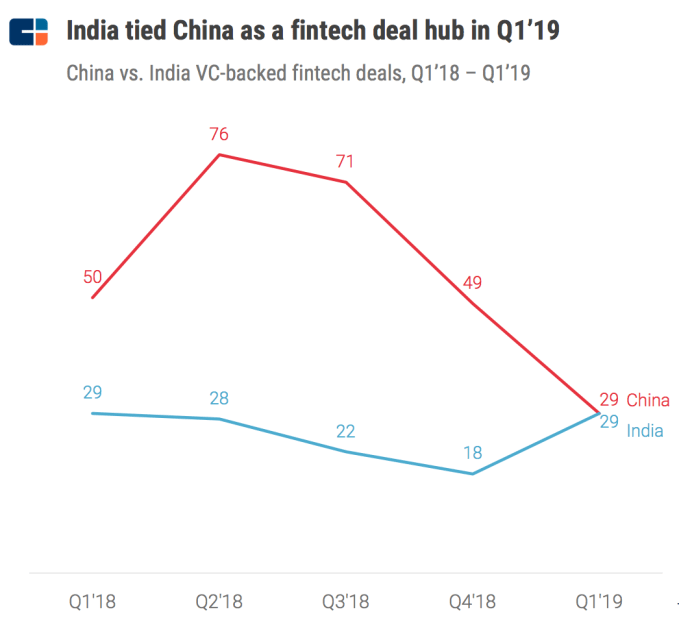

Fintech start-up financing fell 87.6% year-over-year to $ 192.1 million in the first quarter of 2019, according to a new report released by data provider CB Insights. India, which raised $ 285.6 million for new financial technology companies during this period, has surpbaded China to become the leading fundraising center for financial technology in Asia. The two countries signed 29 Fintech transactions, suggesting a climate of investor confidence in China, which peaked with 76 deals just three quarters ago.

Chart: CB Insights

According to CB Insights, the plunge in China has followed the introduction of stricter regulations for online lending . In recent years, China has stepped up measures to limit financial risks arising from its nascent e-credit sector. Interloan loans, which match an individual looking for a loan with an investor, have been the prime target of a crackdown by the government.

This type of service provides credit to unbanked people who would otherwise not be able to obtain loans in a country without a well-developed unified credit system. But a lack of surveillance has led to widespread fraud in all areas. Thousands of peer-to-peer loan sites have been closed due to increased regulation, which is expected to leave only 300 players in the market by the end of 2019, announced the Yingcai research firm, based in Shanghai.

Like China, India's enthusiasm for financial technology stems in part from the country's lack of financial infrastructure. Lending start-ups are gaining momentum as they, like their Chinese counterparts, are adapting their services to large consumers and companies in the country, who do not have banking services and whose accounts are insufficient. Technology leaders are also ready to make waves in the rest of the industry. Amazon has finally followed its rivals Paytm, Google Pay and PhonePe to start offering peer-to-peer payments in the country. Walmart is following closely how Flipkart, which she bought back last year, applies the data to the payment solution.

Chart: CB Insights

Despite the decline in online lending, a new form of consumer finance vehicle – so-called mutual aid platforms that allow patients to use crowdfunding for the treatment of serious diseases – is booming in China, CB Insights said in his report. As with peer-to-peer loans, Internet-based self-help attempts to fill the gaps in a traditional sector. Although most Chinese people participate in a public insurance system, surgical bills can easily bring down an average family.

Unsurprisingly, the two best-performing companies in the industry are on two opposing sides of the tech world in China. Shuidihuzhu, which translates as "mutual aid in water" in Chinese, considers Tencent as a major investor. Users contribute just half a penny to a cash reserve that is paid when a patient needs financial badistance. The three-year-old platform, which uses WeChat messenger, a billion Tencent users, to recruit members, claims to have attracted 78.8 million users and paid nearly 440 million yuan to 65.34 million. million yuan to more than 3,100 families.

Shuidihuzhu's rival, called Xiang Hu Bao and which stands for "mutual protection," is managed by Alibaba's Alibaba e-wallet. Launched only last September, the service announced that it had acquired more than 50 million users in April and set an ambitious goal: to reach low-income groups that can not afford it. allow premiums and advance payments related to traditional health insurance. acquire 300 million users over the next two years. This means that nearly a third of Alipay users, most of whom live in Chia. By the end of 2018, the digital portfolio had more than one billion annual users worldwide.

Source link