[ad_1]

MyGlamm, a direct-to-consumer beauty brand in India that sells most of its products through its own website, app and touchpoints, said on Monday it raised $ 71.3 million during a round table as the Mumbai-based company seeks to grow its business in the South Asian market.

The startup had raised $ 23.5 million in its four-fold Series C fundraising round from Amazon, Ascent Capital, Wipro in March of this year. On Monday, he said he added an additional $ 47.8 million as part of the round – which is now closed.

Accel led the investment in the new tranche while existing MyGlamm investors – Bessemer Venture Partners, L’Occitane, Ascent, Amazon, the Mankekar family, Trifecta and Strides Ventures – also participated, Darpan Sanghvi told TechCrunch, founder and CEO of MyGlamm. interview.

Sanghvi started MyGlamm in 2017 after pivoting his previous business. He recalled the struggle he had to fight to raise money for a direct-to-consumer brand, which was not as popular in the world’s second largest internet marketplace just five years ago. To make matters worse, MyGlamm was also among the last direct-to-consumer startups to launch its travels at the time.

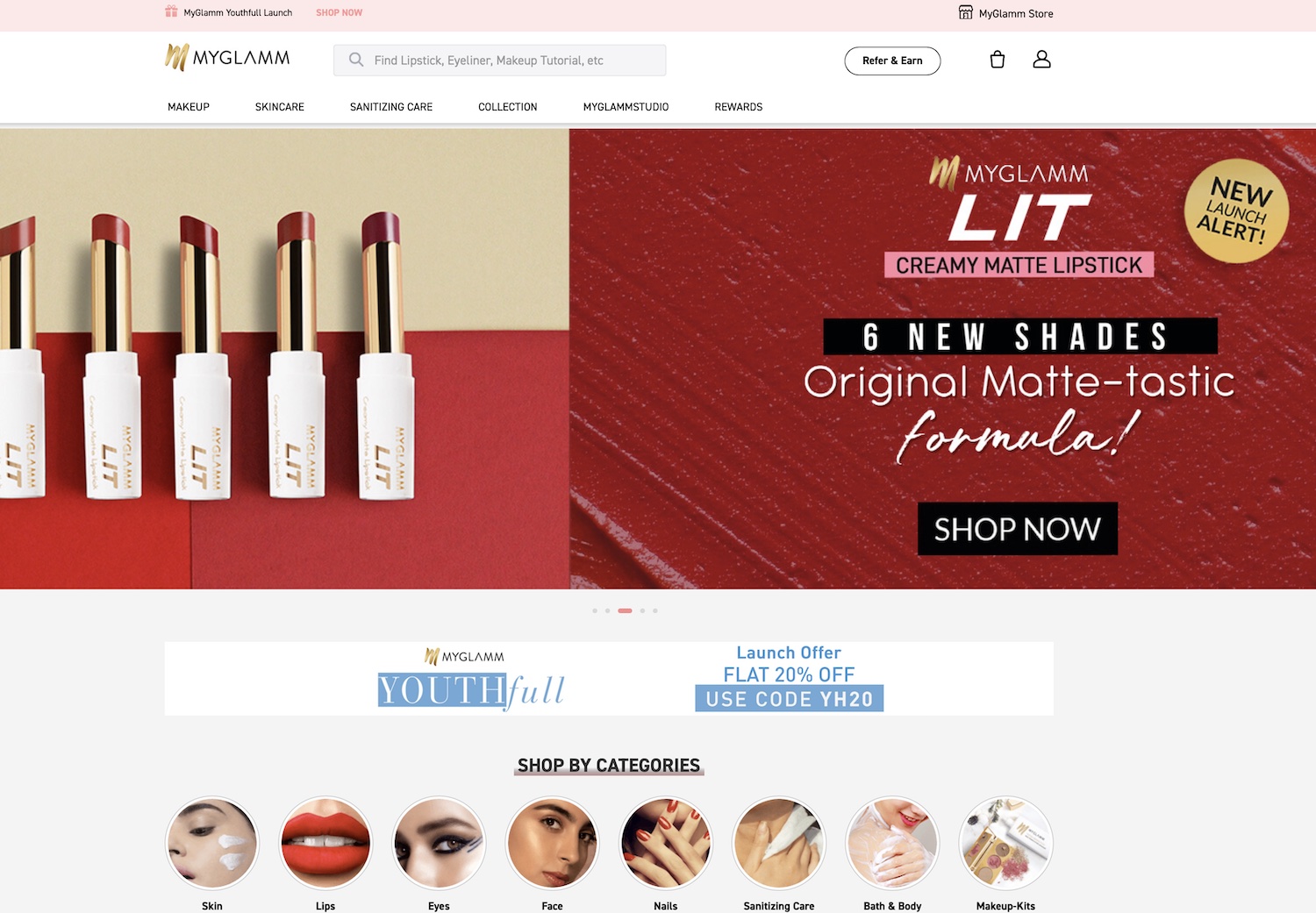

MyGlamm website

The startup operates today as a house of brands in beauty and personal care spaces. “We operate in the areas of makeup, skin care, hair, bath and body and personal care. Unlike other brands, we have managed to create a main brand in all categories, ”he said on a video call.

“The reason we’ve been able to build this is because we’re really direct with consumers. This allows us to communicate very directly with them, ”he said, adding that most other companies in the industry are too dependent on third-party markets for their sales.

He attributed the recent growth of the startup, which sells more than 800 SKUs across all categories (up from 600 in March), to its new user acquisition strategy. In August, the startup acquired POPxo, a startup that has built a community around content, influencers, and commerce and serves over 60 million monthly active users.

“The content of the commerce engine has become our biggest gap,” he said. “We’re gaining 250,000 new users every month without spending any real money.”

POPxo, which is led by Priyanka Gill, engages with nearly 300,000 users each month, collecting their feedback and ideas for new products. Gill said on a video call that “in this line of business, CAC (customer acquisition cost) is gaming and POPxo has solved that problem,” she said, adding that POPxo, which is run as a fairly independent business, is in operation. track to reach over 100 million users by March of next year.

The startup also has 15,000 point-of-sale touchpoints in the physical world across India. The physical presence, which accounts for 40% of the income it generates today, “has been crucial in expanding the country,” Sanghvi said.

“We believe the time has come to create the first brands of digital CPGs with a focus on content to commerce,” said Anand Daniel, partner at Accel, in a statement.

“COVID has only cemented this belief. The unique combination of content coupled with a compelling product line has given us the conviction to lead this round of MyGlamm. We are delighted to partner with Darpan, Priyanka and the MyGlamm team. and look forward to building the next generation CPG giant, ”he said.

The startup plans to deploy the fresh funds to expand its product development, data science and technology research teams. It is also working to expand its offline presence and expand POPxo’s digital reach.

The new investment comes at a time when Indian startups are raising record capital and a handful of mature companies are starting to explore public markets. Last week, Tribe Capital’s investment crowned BlackBuck as the 16th Indian unicorn this year, up from 11 last year and six in 2019. Food delivery start-up Zomato made a flying debut on the stock market during the week. latest and financial services firms MobiKwik and Paytm have also filed for an IPO. . Insurance aggregation service PolicyBazaar and online beauty e-commerce company Nykaa are also expected to file their IPO documents in the coming weeks.

Source link