[ad_1]

A crackdown on pollution in China’s rust belt is starting to weigh on the price of iron ore, the steel ingredient that is the biggest profit generator for major miners.

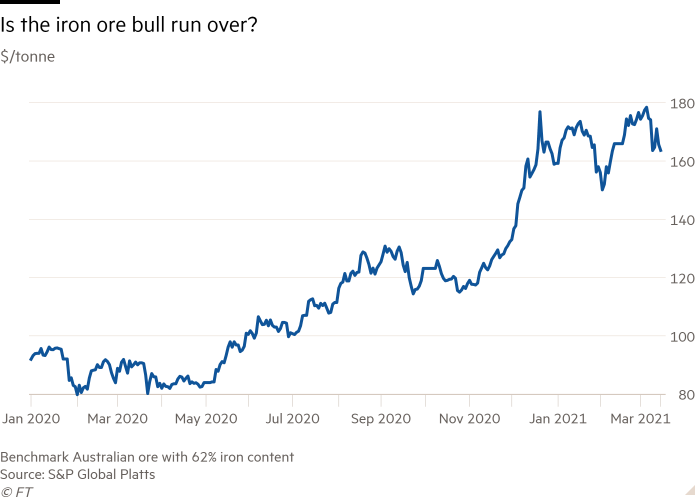

Iron ore was the top performing primary commodity last year, rising 75% to $ 160 a tonne due to strong demand from its biggest customer, China, and disruptions in supply to Australia and Brazil.

This increased the profits of large producers such as BHP Group, Rio Tinto, Fortescue Metals and Vale, who rewarded their shareholders with dividends of several billion dollars.

But after hitting a 10-year high of $ 178 this month, prices fell to $ 163.65, according to data from S&P Global Platts. The trigger for this drop is concern that Beijing – which targets peak emissions by 2030 before reaching ‘carbon neutrality’ by 2060 – is working on new policy measures to clean up its vast steel industry and fight against excess capacity.

“The Ministry of Industry and Information Technology, alongside the Ministry of Environmental Protection, is increasingly expected to announce new policy measures aimed at stabilizing emissions of here the middle of this decade, ”said Nicholas Snowdon, analyst at Goldman Sachs.

“As part of this goal, Beijing is now expected to introduce policies restricting blast furnace-based steel production and supporting scrap metal.”

The steel industry is a major source of pollution in China, with the sector estimated at around 15% of the country’s total emissions, analysts say. Senior officials have already said the country’s steel production, which exceeded 1 billion tonnes last year, is expected to drop in 2021.

A sign of how seriously Beijing is taking the problem, an inspection team led by the Minister of Ecology and Environment visited China’s largest steel city Tangshan last week, according to MySteel Global. , a Chinese price information agency, to verify supply restrictions ordered by the local government as part of an anti-pollution emergency plan.

The Tangshan government has ordered heavy industry to limit or stop production during high pollution days in order to cut emissions by 50 percent, according to media reports.

“Tangshan’s current pollution emergency regime may be temporary, but the city is also aiming for a 40% reduction in steel-related emissions by 2021 and the government is working on a steel capacity replacement plan. tighter, making headwinds for China’s steel production likely to continue, ”Morgan Stanley analyst Marius van Straaten said.

He estimates that the blast furnace utilization rate in Tangshan has fallen to 54%, from 76% at the end of February. “This translates into an impact of around 50 million tonnes per year, or 5% of China’s steel production.”

On the production side, the export market of 1.7 billion tonnes per year of iron ore had its first smooth start to the year for large miners since 2018, analysts said.

“In January and February, there were a lot of fears about the rainy weather in Brazil and the cyclone season in Australia, but it didn’t materialize,” said Erik Hedborg, senior iron ore analyst at RAW.

With Chinese demand still strong, Hedborg believes the iron ore market will remain tight for most of the year, although it will start to become more balanced as Vale increases production.

The Brazilian miner, who is recovering from a deadly dam disaster that hampered operations, recently reiterated its production forecast for 2021 of 315 to 335 million tonnes, up from 300 million in 2020, and said it was on track to reach 350 million tonnes of capacity by the end. of the year.

Goldman takes a similar point of view. For the iron ore export market, it now forecasts a supply shortfall of 9 million tonnes this year, down from 27 million tonnes previously.

“We are now seeing iron ore prices drop in the coming months,” said Snowdon, who has set a 12-month price target of $ 100 per tonne. “This reflects growing evidence that supply is shifting towards a sustained recovery and that China’s environmental policies will reinforce a spike in iron ore imports.”

Source link