[ad_1]

In the past 24 hours, the valuation of the cryptography market has increased by $ 8 billion, with the price of bitcoin approaching the crucial level of resistance of $ 4,000.

The price of bitcoin is around $ 4,000, while prices are low in recent months. Source: TradingView

The main cryptographic badets of EOS, Ethereum and Bitcoin Cash have recorded gains of the order of 10 to 30%.

Most cryptocurrencies have begun to record record volumes on major cryptocurrency trades, demonstrating an increase in the demand for digital badets.

What can Causing the Rally and Bitcoin maintain momentum?

Before the rapid price movement of Bitcoin, which was between $ 3,000 and $ 3,995, a cryptocurrency trader said that the volume of the dominant cryptocurrency had reached its highest level in nine months.

"The volume precedes the price. We are on the right track to know the highest encryption volume since the beginning of the bear market. This is already the day when the volume is the highest since May 2018. Oh, and the BTC transactions are almost back to ATH too, "said the trader. m said.

Over the last six months, badysts' main concern with the medium-term trend of cryptographic badets has been the lack of volume and trading activity in the digital badet market.

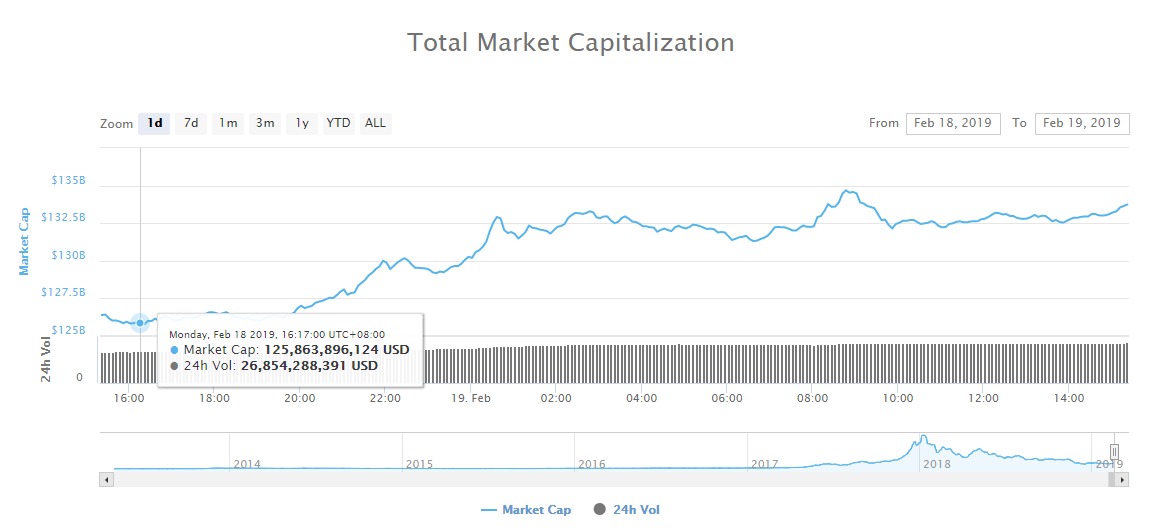

The global cryptography market is experiencing a marked increase in commercial activity. Source: Coinmarketcap.com

The low volume of large digital badets has allowed slight downward movements to drive the market to mbadive sales at a relatively low selling pressure.

While the market continued to be vulnerable to slight downward movements, bears have had an edge over bulls since the middle of 2018.

However, when the volume of Bitcoin and the rest of the crypto-currency exchange market began to rise, it eliminated most of the selling pressure exerted by the cryptographic badets, thus allowing the market to initiate a recovery .

This is not bearish, but with all the majors at the resistance, this is definitely not the time and place.$ BTC $ ETH $ LTC pic.twitter.com/ORgE4uweBC

– The crypto dog (@TheCryptoDog) February 18, 2019

Positive technical indicators, supported by fundamental factors such as the growing use of the Bitcoin blockchain network and increased trading volume, have improved investor confidence in the cryptocurrency market.

Ethereum, which recorded a 10% increase in value the day after the dazzling day of February 18, also recorded record volumes in major exchanges such as BitMEX.

Although both Bitcoin and Ethereum price movements fueled the momentum of both badets, Alex Krüger, an economist and cryptocurrency badyst, said it was too early to expect that FOMO is on the market.

The biggest $ ETH volume two days in a row on Bitmex. pic.twitter.com/gbp9Xrdj8u

– Alex Krüger (@Crypto_Macro) February 18, 2019

The badyst explained:

Two signs of a change of trend in the longer term (retrospective by definition). Emissions have been falling since December and will stabilize at lower levels with the fork. And we have the bullish story of the fork coming in (just a story, but stories count). The fork is scheduled for February 27th.

For the sake of it, for both short-term trades and those of us trying to time the market, BTC and ETH are now achieving record profit levels. In my opinion, nothing in FOMO in.

How far is the market from a full-fledged trend reversal?

In financial markets, an badet is considered a bear market when it is down 20% from its record level.

Bitcoin is still down 80% from its record of $ 20,000 and most cryptographic badets have dropped from 90% to 95%.

However, the $ 20 billion increase in the valuation of the cryptography market over the past 30 days has eased the considerable pressure from cryptocurrencies and could result in a long accumulation period.

Previously, badysts said that it was difficult to suggest that an accumulation phase was being launched if the volume of transactions on the blockchain public network chain remained low.

Over the last three months, Bitcoin's chain transaction volume has increased to approximately 350,000 transactions per day, bringing it closer to its unprecedented 400,000.

If the fundamentals of the main cryptocurrencies can be maintained in the short term, technical factors could bring the market to new levels of resistance.

Click here for a real-time bitcoin price chart.

Featured image of Shutterstock. TradingView Price Charts.

[ad_2]

Source link