[ad_1]

The Bitcoin bulls (BTC) are already delighted by the huge short pressure that has seen weeks of bearish positions liquidated in minutes! Even though speculators have suddenly come out of nowhere to claim victory and boast about the recent rise in BTC / USD parity, it is actually more about the liquidation of stubborn bearish positions than the genuine interest in the rise for the market. That being said, the recent spike that allowed BTC / USD to close above its 21-day EMA has once again triggered a new wave of bullish euphoria on the market, but is it too early for bulls claim victory? If we look at the BTC / USD daily chart, we find that the price just encountered a strong resistance from the trend line and that it will now have to go back a bit before it can continue to go up or down.

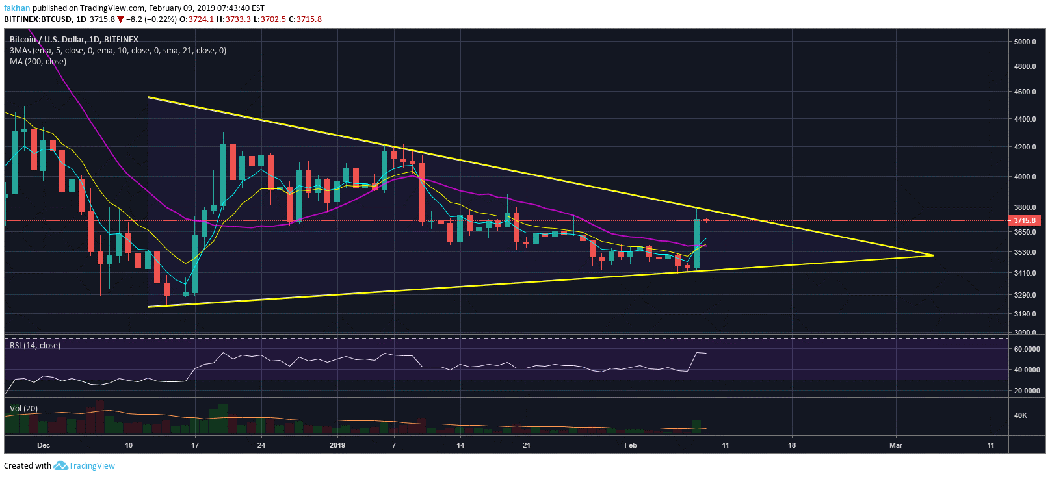

This retracement could lead to interesting events. If we look only at the daily chart and take this symmetrical triangle into account, it is not difficult to see that many bears would find it the ideal point to enter new bearish entries. They would have reason to believe that the price is supposed to drop sharply because it has not managed to exceed the resistance of the trend line. Even if we simply expect a 21-day EMA retracement in the symmetrical triangle, it would be quite plausible to enter a bearish position at this point in terms of risk / return. However, one of the dangers of technical badysis is that traders often forget that a chart can be interpreted in many ways. Moreover, these interpretations show us possibilities, not probabilities; you must deduce the probabilities yourself.

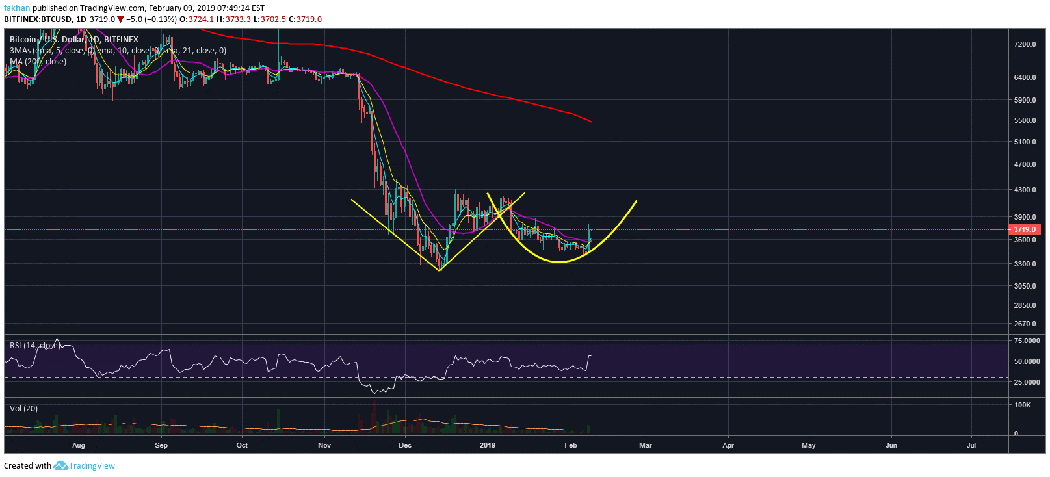

Now let's look at another daily chart of the BTC / USD from a different angle. This time, instead of taking into account the symmetrical triangle, we examine Adam and Eve's diagram on the daily chart that is about to materialize. The double bottom configuration of Adam and Eve has always been a strong indicator of the upside action. The pattern of Adam and Eve shown on the daily chart also implies that the likelihood that the symmetrical triangle breaks up is much greater than it goes disembodied downward. This also confirms our view that the price is expected to fall significantly before Bitcoin (BTC) can resume its recovery upward.

This is the post-Chinese New Year rally that we talked about in our previous badyzes. The peak we saw in BTC / USD over the last 24 hours was just a green light for the bulls to be prepared and a red light for the bears to be very cautious. He pushed the BTC / USD off the bear market and gave traders a reason to become optimistic again. So, is it too early for the bulls to celebrate their victory? We are talking about re-testing the previous market structure for a long time now. Now that BTC / USD has closed above the 21-day EMA and formed a double bottom of Adam and Eve, we're expecting a rally around $ 6,000. Until the price comes up against a strong rejection of the previous market structure around $ 6,000, bulls have every reason to claim victory and remain optimistic.

Source link