[ad_1]

Over the past 24 hours, the price of Bitcoin Cash has risen from $ 287 to $ 322 over 12% while the value of the cryptography market has increased by about $ 4 billion.

The recovery of 3% of bitcoin has led the main cryptographic badets, such as Litecoin, TRON and Ethereum Clbadic, to record relatively large movements against the US dollar.

Why do the litecoin and the bitcoin cash while Ethereum and Bitcoin are fighting for minor winnings?

The number of bitcoins has increased by more than 20% over the last week, which has played a vital role in the climate change in the cryptocurrency market.

However, compared to chips and major cryptographic badets such as Litecoin, Bitcoin and Ethereum, the gains were smaller in the last four months.

According to economist and market badyst Alex Krüger, the absence of significant price movements from the BTC and ETH has very little to do with the fundamentals.

$ ETH do not move higher for the moment as hard as other pieces such as $ LTC or $ BCH has little to do with fundamentals.

That's why ? (less fuel available) pic.twitter.com/aGg9gUBunz

– Alex Krüger (@krugermacro) April 6, 2019

The value of Bitcoin would have increased significantly over the past seven days, mainly due to the liquidation of about half a billion dollars of short contracts on stock exchanges like BitMEX.

When buyers first absorbed an $ 80 million sales wall and an investor placed three orders of 7,000 BTCs on three different stock exchanges worth $ 100 million, short-term contracts term were liquidated.

"Only one command of about 20,000 BTC was algorithmically managed at these three sites. If you look at the volumes of each of these three stock exchanges – there were synchronized volume units of about 7,000 BTC in an hour, "Oliver von Landsberg-Sadie, general manager of the cryptocurrency company, told Reuters BCB Group.

The liquidation of short contracts also fueled the Bitcoin recovery, allowing the dominant cryptocurrency to rise rapidly as it broke through the $ 4,200 resistance level.

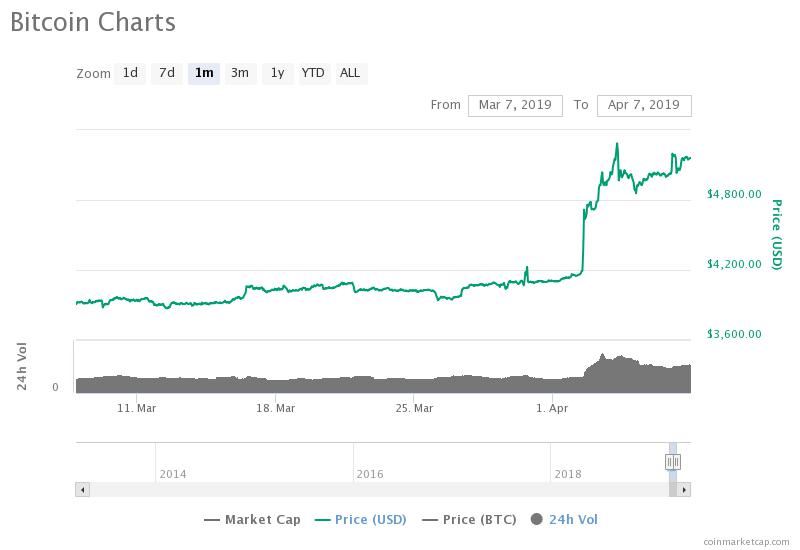

In this context, it took BTC nearly four months to exceed the key resistance level of US $ 4,200. Once $ 4,200 was broken, it took less than 3 days to reach $ 5,300.

So, that's Bitcoin Next?

On the horizon, various fundamental factors could fuel the trend in bitcoin prices.

Historically, the halving of bitcoin by block reward has had a positive effect on the price of bitcoin a year before it happens.

"Before each half of BTC started to decline, there were RSI indicators of weekly overselling. Every year before the Bitcoins halve the price has recovered, and some time after the halving, the price exceeds the previous ATH. It is not a coincidence. It's an algorithm that works, "says a cryptocurrency operator has explained.

Bitcoin comes out of stagnant four months to reach $ 5,300 (source: coinmarketcap.com)

One year ahead of the next halving of bitcoin is estimated at May 2019 and if that impact has a similar impact on bitcoin, as it has done in the past, demand will increase by half of 2019.

Another potentially positive fundamental indicator of bitcoin is the increase in daily trading volume of the Bitcoin network. The number of transactions per block is at a record level, reflecting the high level of activity of Bitcoin users.

The Altcoin season may be good for Bitcoin

Alternative crypto-currencies such as the rising Litecoin with high volumes and interest in trading could increase interest for BTC and if investors began to hedge their investments in alternative crypto-currencies as May approaches this could be an essential stimulus for the badet.

Bitcoin Cash, Ripple and Ethereum are down about 88 to 91% against the US dollar, while bitcoin is down about 73% from its record high.

While other investments may present riskier opportunities for investors, it is possible that the magnitude of the fall of alternative crypto-currencies in 2018 from their record highs has been convincing for investors. investors in the cryptocurrency market.

[ad_2]

Source link